Invesco and Galaxy Asset Management recently made headlines in the Bitcoin Exchange-Traded Funds (ETFs) market, as they strategically cut fees to attract investors in a competitive market.

Invesco Galaxy’s BTCO Fee Reduction Strategy

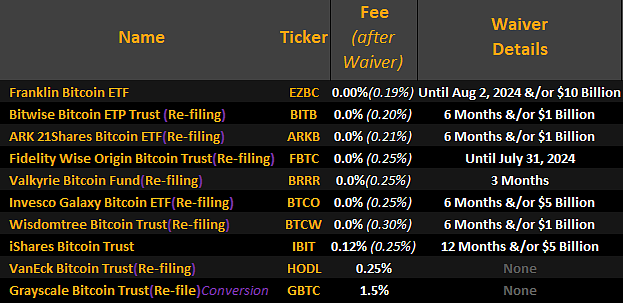

In a bid to stay competitive, Invesco Galaxy has significantly lowered the fees for their Bitcoin ETF, BTCO. The sponsor fee, initially at 0.39%, has been slashed to 0.25%, bringing it in line with industry heavyweights like BlackRock, Fidelity, and others.

Competitive Fee Landscape

The move follows a broader trend in the industry, where issuers have been racing to lower fees even before the official approval of spot Bitcoin ETFs by the Securities and Exchange Commission (SEC). The fee war is intense, with companies aiming to distinguish themselves in a crowded market.

Before the ETFs’ official launch this month, Nate Geraci, The ETF Store president, emphasized investors as the “clear winners” in the bitcoin ETF competition. In early January, he highlighted the abundance of low-fee issuers as “how brutally competitive this category will be.”

Despite being one of the first traditional finance institutions to launch a Bitcoin ETF, Invesco’s BTCO has faced a slower start compared to peers. With approximately $283 million in assets, it sits in the middle of the pack. However, the recent fee reduction is a strategic move to attract more investors and increase its assets under management.

Waived Fees for Initial Months

To sweeten the deal, Invesco is waiving fees for the first six months or until the fund reaches $5 billion in assets. This flexibility aims to entice investors and boost the fund’s appeal in a highly competitive landscape.

The Invesco Galaxy press release reads:

“Invesco continues to waive BTCO’s entire fee on assets up to $5 billion for BTCO’s first six months of operations, effectively bringing the total expense ratio of BTCO to 0 basis points, with the discretion to extend the fee waiver further.”

Bloomberg Intelligence analyst James Seyffart highlighted this event, stating:

“We have @InvescoUS & @galaxyhq cutting the long term fee on their #Bitcoin ETF from 39 bps to 25 bps. (Yes they have the fee waiver to 0% for first 6 months or $5 billion in assets).”

Industry-Wide Fee Adjustments

In a broader context, other players in the Bitcoin ETF arena, such as Franklin Templeton, have also adjusted their fees. Franklin Templeton’s ETF, trading under the ticker EZBC, boasts the lowest fee in the group at 0.19%, with a waiver in place until August 2, 2024, or $10 billion in assets.

The fee adjustments have triggered a shake-up in the market, with investors closely monitoring these changes. Grayscale’s Bitcoin ETF, for instance, has experienced significant outflows, prompting analysts to speculate on a potential shift in investor sentiment.

Market Shifts

As the fee war rages on, Invesco’s strategic fee reduction aims to position BTCO as a more attractive option for investors seeking regulated exposure to bitcoin. Lower fees often translate to higher returns over time, and Invesco is counting on this to drive long-term investor interest.

In a market where every basis point counts, the battle for supremacy among Bitcoin ETFs continues, with fees emerging as a key battleground for investor attention and market share.