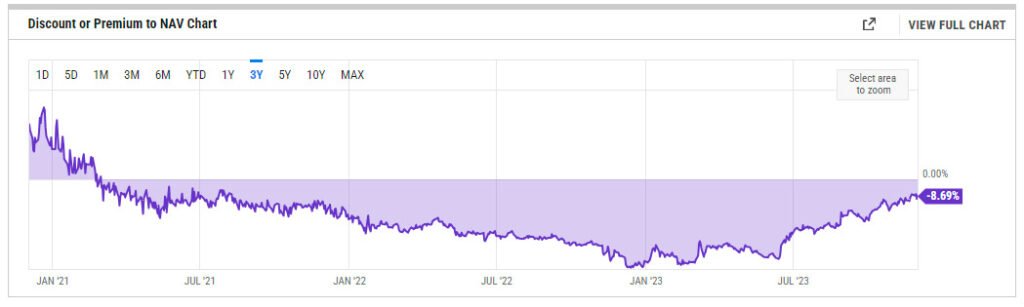

The discount on Grayscale Bitcoin Trust (GBTC) shares has narrowed to its lowest point in over two years, sitting at -8.69% at the moment of writing. This reduction in GBTC discount comes amid growing expectations that the U.S. Securities and Exchange Commission (SEC) will approve the conversion of GBTC into a Spot Bitcoin Exchange Traded Fund (ETF).

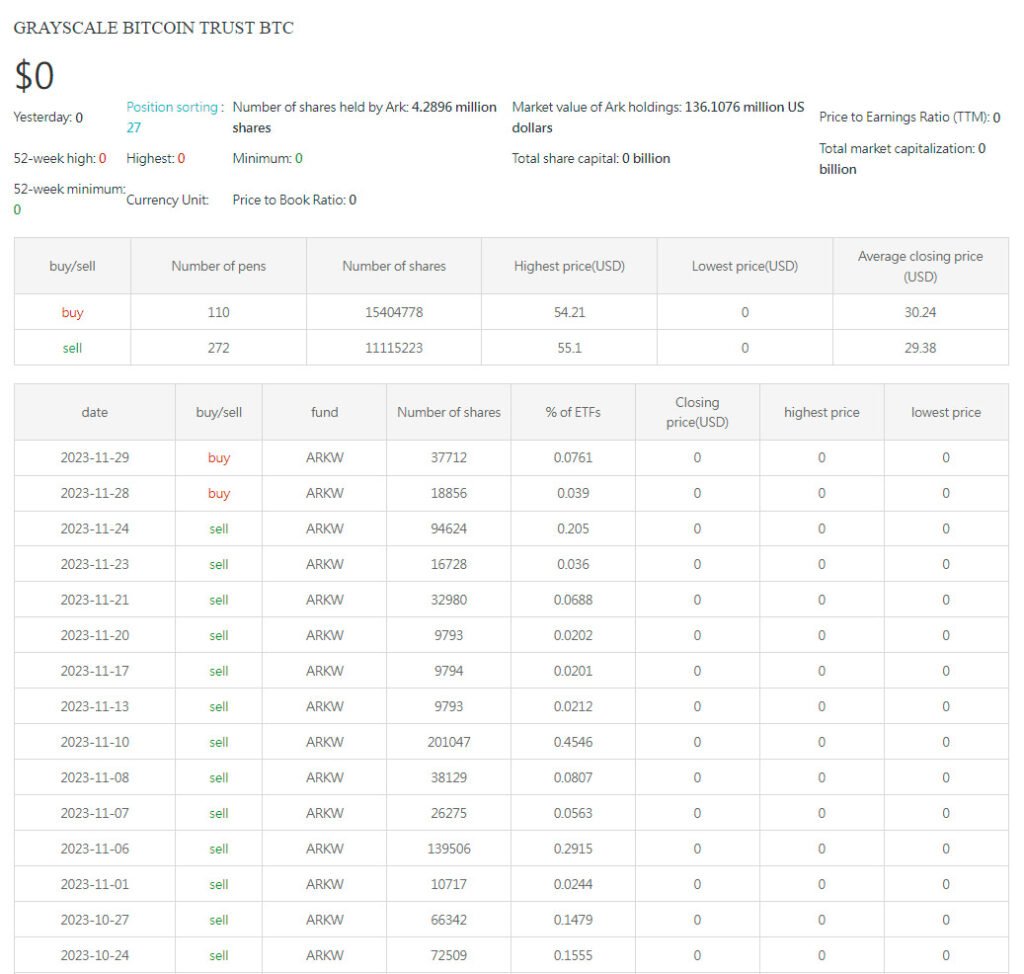

Despite Ark Invest’s important recent sell-off of GBTC shares, Grayscale Bitcoin Trust continues its relentless climb towards breakeven at net asset value (NAV).

What is Grayscale Bitcoin Trust?

The Grayscale Bitcoin Trust (GBTC) is a digital asset investment product that provides a convenient and traditional way for individual and institutional investors to gain exposure to Bitcoin. As opposed to a direct investment in Bitcoin, which requires dealing with digital asset exchanges and understanding blockchain technology, GBTC offers a more accessible investment structure to the general public in the form of shares.

Understanding GBTC Discount and Premium

GBTC operates as a closed-end fund, issuing a fixed number of shares to investors and using the proceeds to purchase Bitcoin. The trust’s value is derived from the Bitcoin it holds, but its share price often deviates from this underlying value, resulting in a premium or discount to its Net Asset Value (NAV).

GBTC investment trust is exclusively invested in Bitcoin and owns over 3% of all current circulating supply. As of October 2023, the trust managed $17.4 billion in assets and held 692.37 million shares outstanding, with an annual management fee of 2%.

Brief History of GBTC

Launched in September 2013, Grayscale Bitcoin Trust (GBTC) is a private, closed-ended trust that provides investors with exposure to Bitcoin. In 2015, GBTC received FINRA approval to trade publicly, allowing investors to buy and sell shares under the ticker “GBTC”.

In October 2021, NYSE Arca submitted a Form 19b-4 application with the SEC to convert GBTC into a Spot Bitcoin ETF.

In June 2022, the SEC denied Grayscale’s application “to protect investors and the public interest” as it wasn’t allegedly clear how it was “designed to prevent fraudulent and manipulative acts and practices.”

Related reading: Grayscale Threatens SEC with Legal Action if Bitcoin ETF is Rejected

In response to the SEC’s denial, Grayscale Senior Legal Strategist and former U.S. Solicitor General Donald B. Verrilli, Jr. filed a petition for review with the U.S. Court of Appeals for the District of Columbia Circuit, challenging the SEC’s decision on its proposal to convert GBTC into a Spot Bitcoin ETF.

On Aug. 29, in a major blow to the SEC, a U.S. Court of Appeals Circuit Judge ordered the reinstatement of Grayscale’s petition to convert GBTC into a Spot Bitcoin ETF. The court ruled that the SEC’s denial of the application was not adequately explained. However, this decision does not guarantee the eventual approval of a Spot Bitcoin ETF.

Related reading: Grayscale’s ETF Hopes Prevail as SEC Opts for No Appeal

This event has been perceived as a victory not only for Grayscale but for the entire Bitcoin industry. The community is eager to see Bitcoin making inroads into traditional finance as a legitimate asset class and definitive alternative to gold and other traditional assets as a store of value.

Grayscale’s victory against the SEC has given the Bitcoin sentiment a noticeable tailwind, adding growing credibility to the prospect of SEC approval of Spot Bitcoin ETFs. Many believe this will not only include Grayscale’s ETF application, but also from other asset management giants such as Blackrock , Fidelity, Invesco & Galaxy and others….

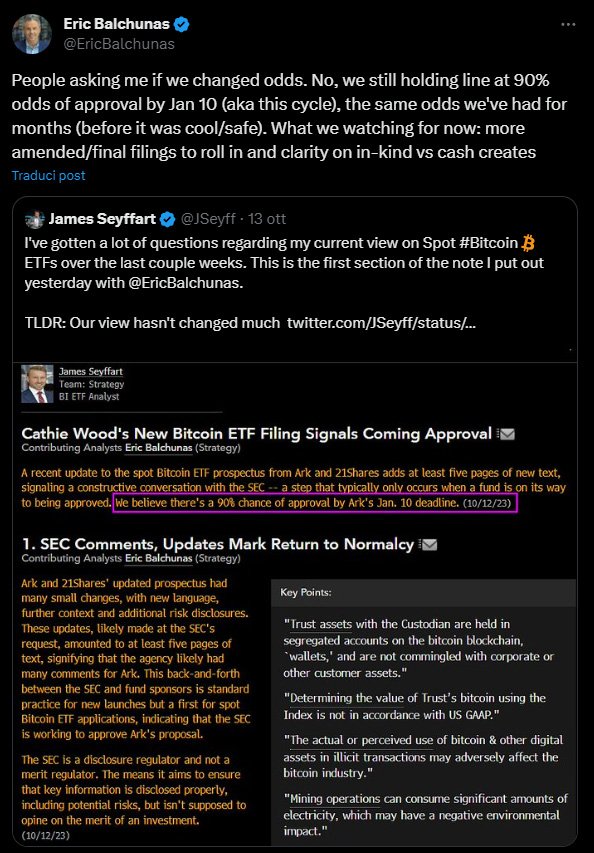

Bloomberg analyst Eric Balchunas recently reiterated Bloomberg’s stance on the odds of SEC’s approval of a Spot Bitcoin ETF by January 10, 2024, predicting a 90% chance of approval. This means that there is a very high likelihood that an ETF will be approved by the SEC in the next two months.

An ETF would be a significant development for the bitcoin industry, as it would provide investors with a more regulated and convenient way to invest in Bitcoin. It would also likely lead to increased institutional adoption of Bitcoin.

What Will Change in GBTC After Conversion to a Spot Bitcoin ETF?

One of the biggest criticisms of GBTC is that investors have often found themselves trading at a discount or a premium. These fluctuations arise primarily from regulatory uncertainty and the fact that GBTC operates as a closed-end fund, without the ability to create or withdraw shares depending on market demand.

On the other hand, Bitcoin ETFs can create and redeem shares, allowing them to closely track the price performance.

Talking about the implications of the conversion to an ETF for current GBTC costumers, Grayscale CLO Craig Salm and CFO Edward McGee stated in a recent interview:

“GBTC investors do not have to take any action. When investors look at their GBTC holdings following the uplisting to NYSE Arca, they will simply see the shares listed on NYSE Arca instead of being quoted on OTCQX. GBTC will retain the same ticker symbol (GBTC) and the same CUSIP, and investors will continue to be able to buy and sell shares of GBTC at open-market prices.”