Genesis, a prominent player in the digital asset lending space, has made headlines with its recent $2.1 billion bitcoin investment. This significant move comes amid the company’s bankruptcy proceedings and has sparked discussions about its impact on the broader digital assets market.

Genesis Bankruptcy: Bitcoin Acquisition Strategy

In light of its bankruptcy situation, Genesis opted to sell off 36 million shares of the Grayscale Bitcoin Trust (GBTC) shares. This move was aimed at settling debts with creditors and navigating through the challenging financial landscape.

According to reports, Genesis liquidated the GBTC shares, yielding $2.1 billion, which was promptly used to purchase 32,041 BTC. This strategic allocation of funds underscores Genesis’ commitment to repaying its obligations while reinforcing its position in the Bitcoin space.

Coinbase, a leading exchange, weighed in on the matter, assuring the community that the sell-off and subsequent bitcoin acquisition by Genesis were unlikely to have a significant impact on the market. Coinbase stated:

“Our view is that much of these funds will likely remain within the crypto ecosystem, contributing to a neutral overall effect in the market.”

Analyst Insights

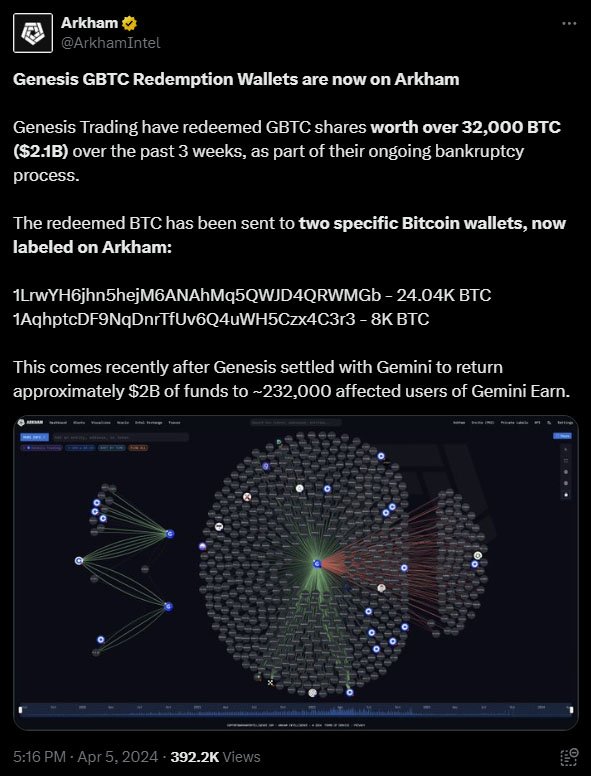

Industry analysts have been closely monitoring Genesis’ actions, particularly in relation to the broader market dynamics. Arkham Intelligence highlighted the connection between Grayscale GBTC’s outflows and Genesis’ bankruptcy proceedings. The liquidation of GBTC shares, coupled with Genesis’ bitcoin purchases, has led to significant market movements, impacting both bitcoin’s price and the broader altcoin market.

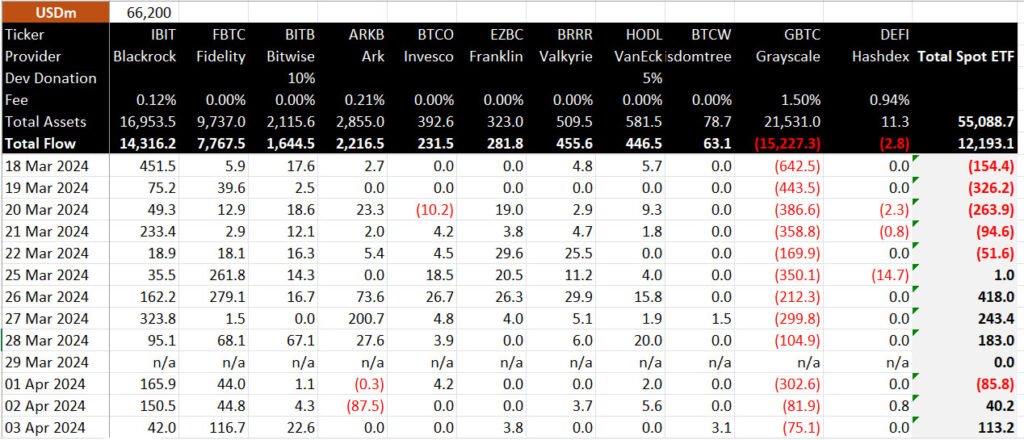

GBTC saw significant outflows, hitting a peak of $642 million on March 18, per BitMEX Research. The trend persisted until April 3, with outflows around $75 million.

Navigating Bankruptcy and Repayment Strategies

Genesis’ decision to reinvest in Bitcoin amidst bankruptcy proceedings raises questions about its repayment strategies. The company’s move to convert GBTC shares into bitcoin aligns with its efforts to address financial obligations. However, the effectiveness of this strategy in meeting creditors’ demands remains to be seen.

The Genesis saga underscores the complexities and volatility inherent in the digital assets landscape. While Genesis’ bitcoin investment signals confidence in the asset’s long-term prospects, its impact on market dynamics warrants close observation. The potential correlation between GBTC outflows and bitcoin’s price fluctuations highlights the interconnected nature of the market.

Conclusion

Genesis’ $2.1 billion bitcoin investment amidst bankruptcy proceedings has stirred conversations within the community. As the company navigates through financial challenges, its strategic moves shed light on the evolving relationship between digital assets and traditional finance. Moving forward, all eyes will be on Genesis as it continues to navigate the turbulent waters of the market.

Genesis’ bold investment serves as a testament to the resilience of the Bitcoin ecosystem, showcasing its ability to adapt and thrive in the face of adversity.