Coinbase, a prominent digital asset exchange, has expressed confidence that the approval granted to bankrupt lending platform Genesis to sell its Grayscale Bitcoin Trust (GBTC) shares will not disrupt the market.

The exchange argues that most of the funds generated from Genesis GBTC sale will flow back into the ecosystem, resulting in a neutral impact on the market.

Genesis GBTC Sale: Approval for Liquidation

Notably, Genesis, recently granted approval by a bankruptcy judge on February 14, is authorized to liquidate around $1.6 billion worth of GBTC as part of its efforts to reimburse creditors. The ruling allows Genesis to either convert the shares of these funds into their underlying BTC, ETH, or ETC on behalf of creditors, or sell the shares outright and distribute the cash.

The confirmation hearing for Genesis’s Chapter 11 bankruptcy plan is scheduled for February 26, where the court will decide on the debt repayment plan.

This move comes in the wake of Grayscale Investments receiving approval on January 10 to convert GBTC into a spot Bitcoin Exchange-Traded Fund (ETF). However, GBTC has experienced outflows exceeding $5 billion since then, raising concerns within the industry about potential downward pressure on bitcoin price due to Genesis’s approval to sell off GBTC shares.

A Neutral Effect

Coinbase, in its weekly report, states that while it remains uncertain whether the additional GBTC outflows will enter other spot Bitcoin ETFs or directly contribute to repaying creditors, the funds are likely to remain within the ecosystem, resulting in a neutral overall effect on the market.

Despite the uncertainties and potential netting in the digital asset market due to Genesis’s GBTC sales, there is prevailing optimism. Sam Callaghan, a senior analyst at Swan Bitcoin, acknowledges the likelihood of netting but also emphasizes the uncertainty surrounding the number of creditors who will sell their bitcoin holdings. Axoni CEO Greg Schvey echoes the sentiment by stating:

“Much of the selling pressure from sale of GBTC will be absorbed by the Genesis estate’s purchasing of spot BTC.”

Spot ETFs’ Success

The attention from Wall Street suggests a notable shift, signaling a promising future for Bitcoin within traditional finance.

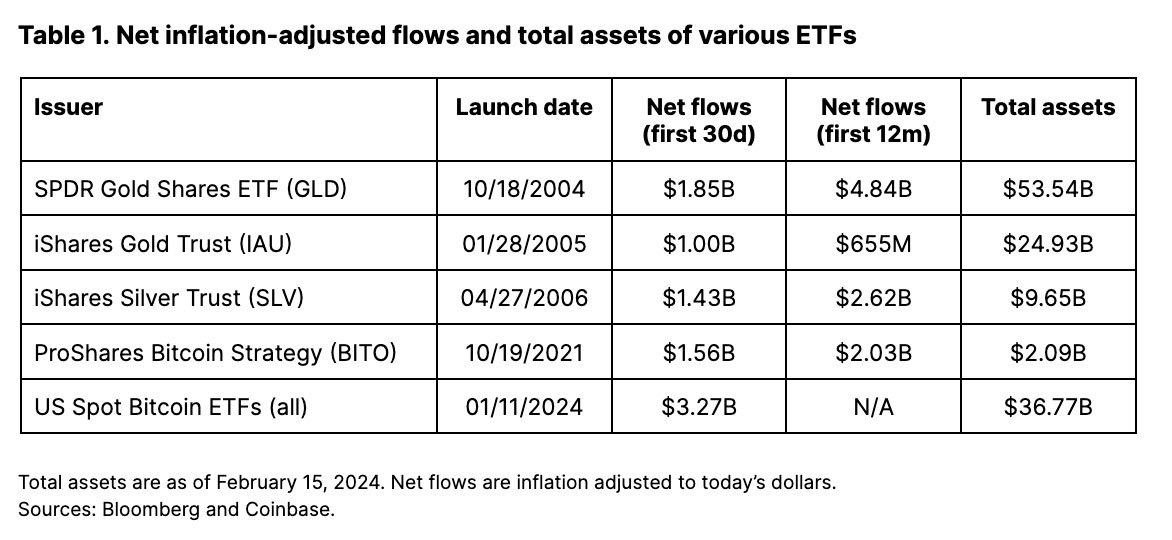

Coinbase also highlights that the net inflows for Bitcoin ETFs in their first 30 days have surpassed those of State Street’s SPDR Gold Shares ETF—historically, one of the most successful ETF launches on record—in its initial month.

Bitcoin’s positive momentum in traditional finance is further highlighted by contrasting trends in gold ETFs. Notably, 14 leading gold ETFs have experienced outflows of $2.4 billion in 2024 as of February 14.

Coinbase states:

“We believe bitcoin in particular (and crypto more generally) should remain well-supported in the next 3-6 months, as more institutional players adjust to the new ETF reality alongside the ongoing global narrative of monetary reflation.”

In contrast, preliminary data indicates that ten approved spot Bitcoin ETFs have attracted aggregate inflows of around $4 billion this year, reaching record volumes. This data reflects a growing preference for Bitcoin over traditional gold investments.