The Bitcoin market has been buzzing with speculation following significant transactions by the German and U.S. governments.

Both countries have moved substantial amounts of bitcoin (BTC), raising questions about potential impacts on the market and the intentions behind these moves.

The German government has been particularly active, making several notable transactions.

On July 1, the German Federal Criminal Police Office (BKA) transferred 1,500 BTC, worth approximately $94.7 million, to multiple exchanges, including Bitstamp, Coinbase, and Kraken.

These transactions are part of a broader trend of bitcoin sell-offs by the German authorities, which began in earnest on June 19.

According to Arkham Intelligence, these recent moves are just the latest in a series of transactions by the German government. Since mid-June, Germany has transferred over 2,700 BTC to various exchanges.

Despite these sell-offs, Germany still holds a significant amount of bitcoin—around 44,692 BTC, valued at roughly $2.82 billion.

This substantial holding comes from a large-scale seizure in 2013, when the BKA confiscated nearly 50,000 BTC from the operators of the now-defunct piracy website Movie2k.to.

Across the Atlantic, the U.S. government has also been active in the Bitcoin market.

On June 30, the U.S. government moved 11.84 BTC, valued at around $743,000. The funds were moved from an address holding assets seized from Estonian digital asset entrepreneurs Sergei Potapenko and Ivan Turogin.

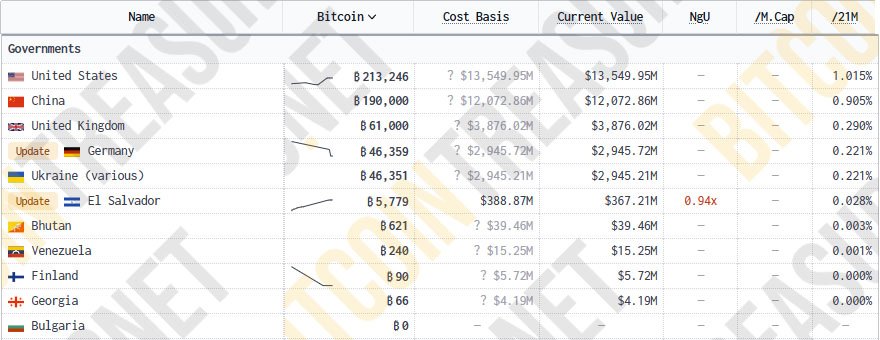

Currently, U.S. government wallets hold about 213,534 BTC, worth $13.42 billion. These significant holdings make the U.S. government one of the largest known state holders of bitcoin, followed by countries like China, the UK, Germany, and Ukraine.

These governmental moves have sparked considerable discussion and speculation within the Bitcoin community. Investors and analysts are trying to decipher the potential market impacts of these large-scale transactions.

Edo Farina, a digital assets analyst, speculated, “The Government surely knows something.” This sentiment reflects a broader curiosity about whether these transactions are driven by insider knowledge or broader strategic considerations.

The price of bitcoin, which has shown resilience despite these sell-offs, has been closely watched. On the day of the German government’s latest transaction, bitcoin’s price surged above $62,000, reflecting its robust market position.

However, Vijay Pravin, CEO of BitsCrunch, highlighted a cautious note, stating:

“I think it is the market waking up to potential downside risk. There’s caution in the air among investors that large-scale disposals by the German and U.S. governments could potentially trigger a more pronounced downturn in bitcoin’s price.”

Historically, July has been a month of recovery for bitcoin following typical declines in June.

Data from Coinglass supports this trend, showing that bitcoin has traditionally bounced back in July with significant gains. Despite the recent sell-offs by the German and U.S. governments, there is a sense of optimism within the community that bitcoin might continue this historical pattern.

However, the ongoing Mt. Gox saga adds another layer of complexity.

The announcement that Mt. Gox would start bitcoin and Bitcoin Cash (BCH) repayments in July 2024 has led to concerns about a potential sell-off, which could impact market prices.

Digital assets influencer Ajay Kashyap remarked, “Bitcoin tends toward strong performance in July, but Mt. Gox is weighing on hopes of a rebound.”

The recent actions by the German and U.S. governments also highlight the evolving regulatory landscape for digital asset.

Germany’s movements, for instance, come as the European Union’s Markets in Crypto-Assets Regulation (MiCA) is set to take effect.

This regulation aims to provide a comprehensive framework for digital assets and services within the EU, potentially impacting how governments manage and liquidate their holdings.

Similarly, the U.S. government’s transfers of seized bitcoin reflect ongoing regulatory and enforcement efforts.

The funds involved in these transactions were seized from individuals involved in fraudulent activities, indicating the U.S. government’s proactive stance in handling illicitly obtained digital assets.

Despite the uncertainty, bitcoin’s market performance has shown resilience. At the time of reporting, bitcoin’s price stood at around $63,456, with a 2.5% increase over the past 24 hours.

These price movements suggest that while government sell-offs might introduce volatility, the market’s fundamental strength remains intact.