The Bitcoin market has been facing significant volatility recently, following a series of substantial bitcoin (BTC) transfers by the German government.

Over the past few weeks, the German government has been steadily offloading its bitcoin holdings, causing notable fluctuations in the asset’s price and raising concerns among investors and market analysts.

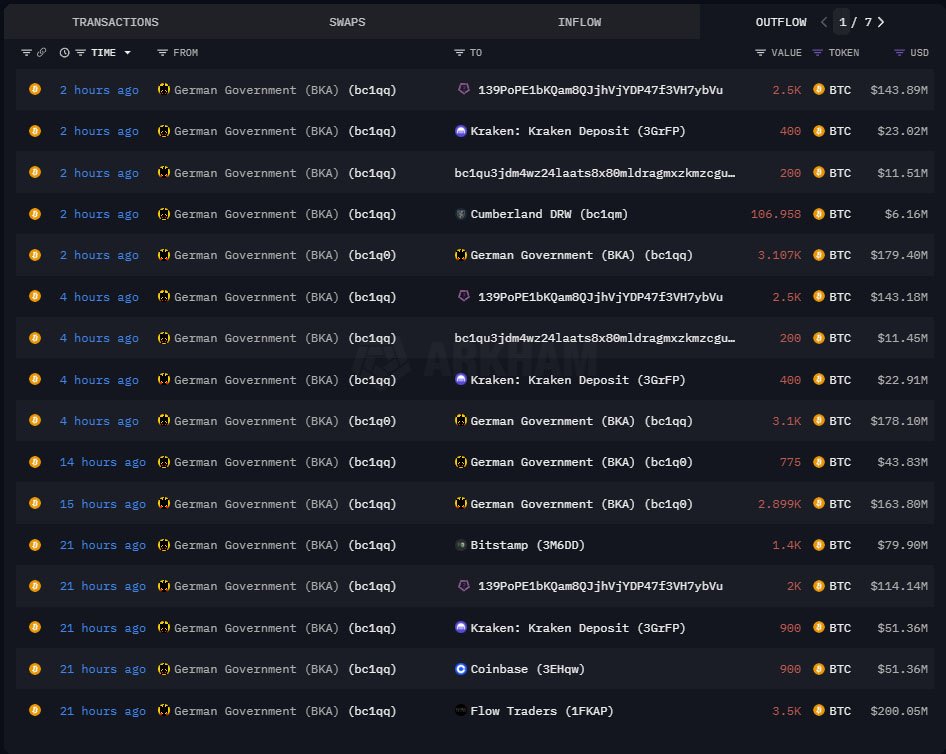

In a recent development on July 8, the German Federal Criminal Police Office (BKA) unloaded a huge batch of bitcoin into centralized exchanges.

The BKA transferred more than 16,000 BTC worth approximately $900 million to several destinations yesterday, including major exchanges like Coinbase, Bitstamp, and Kraken, as well as an address belonging to Flow Traders, a proprietary trading firm and market maker.

There have also been instances of movement of funds to unlabeled addresses.

This move is part of a broader trend of large-scale bitcoin transfers by the government that has significantly influenced market sentiment and prices.

Arkham Intelligence, an on-chain data analysis platform, revealed that during the July 8 transactions the German government transferred 2,350 BTC to Bitstamp, 2,050 BTC to Coinbase, and 1,050 BTC to Kraken.

Another 5,200 BTC was sent to addresses belonging to Flow Traders.

There have also been amounts sent to multiple addresses that Arkham Intelligence has not labeled yet. These addresses are speculated to belong to over-the-counter (OTC) services or other centralized exchanges.

Despite these sales, the German government still holds a substantial amount of bitcoin.

According to Arkham Intelligence, the government’s current bitcoin holdings stand at around 22,846 BTC, valued at approximately $1.3 billion. This is a significant reduction from the 45,000 BTC it held as recently as June.

The continuous sell-off has had a noticeable impact on bitcoin’s prices. At one point, bitcoin’s value dropped below $55,000, sparking a wave of bearish sentiment in the market. However, it has since rebounded to trade within the $55,000 to $57,000 range.

Justin Sun has been vocal about the impact of these sales on the market. In response to the government’s sell-offs, Sun has offered to purchase bitcoin from the German government off-market to mitigate the negative effects on spot prices.

Sun mentioned that he is ready to buy all the available bitcoin through private transactions to lessen the significant market disruption caused by the ongoing sales.

The German government’s actions have not gone unnoticed, with various stakeholders in the Bitcoin community expressing concern.

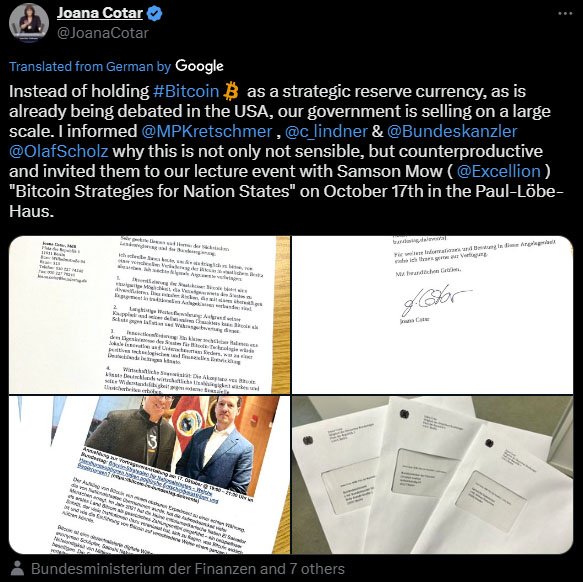

Joana Cotar, a member of the German Bundestag, criticized the government’s strategy, arguing that selling off bitcoin holdings in such a manner is “counterproductive” and “not sensible.”

Cotar emphasized the potential of bitcoin as a strategic reserve currency and suggested that the government should consider holding onto its digital assets rather than liquidating them hastily.

Her criticism highlights a broader debate within the German government regarding the handling of its bitcoin assets.

The German government’s bitcoin holdings stem from various sources, including confiscations from illegal activities.

The German Federal Criminal Police Office (BKA) seized over 49,857 BTC from the Movie2k.to piracy website in 2013. The current sales are believed to be part of efforts to liquidate some of these seized assets and increase cash reserves.

While the exact reasons behind the ongoing sell-off remain unclear, it is evident that these actions have contributed to heightened market volatility.

The large-scale transfers by the German government have had a profound impact on market sentiment. Investors have been spooked by the continuous movement of coins from the government’s coffers to exchanges, leading to a shift towards a more fearful outlook.

The fear of further sell-offs has added to the market’s anxiety, especially with the recent repayment announcements to Mt. Gox creditors, which also contributed to the market downturn.

Amid the German government’s bitcoin sales, other market activities have also influenced the price of bitcoin. Japan-based Metaplanet recently acquired 42.466 BTC for ¥400 million ($2.48 million), bringing its total holdings to 203.734 BTC, valued at $12.7 million.

Metaplanet’s consistent acquisition strategy aligns with its new focus on bitcoin as a primary reserve asset, which has positively impacted its stock performance on the Tokyo Stock Exchange.

In contrast, the German government’s decision to liquidate its bitcoin holdings has been viewed as a strategic misstep by some observers. The contrasting approaches of these two entities highlight the differing strategies within the market and their varying impacts on bitcoin’s price.

Looking ahead, the market remains on edge regarding the German government’s future actions. If the government continues to sell off its remaining bitcoin reserves, the market may face further price corrections.

The uncertainty surrounding these potential sales has added to the market’s volatility, with investors closely monitoring the government’s moves.