In the realm of investments, a new contestant has risen to power. The battle has been getting fierce between the two titans: gold, the age-old safe haven, and Bitcoin, the new kid on the block. Recent developments in the Exchange-Traded Fund (ETF) market shed light on a significant shift in investor sentiment, with Bitcoin challenging gold’s historical dominance.

Gold ETFs Lose Luster Amid Bitcoin Surge

Gold-backed ETFs, once the go-to for investors seeking stability, are experiencing a downturn. According to reports from Bloomberg analysts and BitMEX Research, leading gold ETFs have witnessed substantial outflows totaling billions of dollars since the start of 2024. BlackRock’s iShares Gold Trust, for instance, has seen approximately $423 million flee its coffers, highlighting a general trend of disinterest in gold funds.

Bitcoin ETFs Gain Momentum

Contrastingly, Bitcoin spot ETFs are riding a wave of popularity, with massive inflows of capital flooding into these investment vehicles. BlackRock’s Bitcoin ETF, for instance, has attracted over $6 billion since its inception, signaling a fervent interest among investors. The allure of Bitcoin as a modern alternative to traditional safe-haven assets is undeniable, as evidenced by the significant investments pouring into these funds.

On the flip side, Jameson Lopp, a prominent figure in the Bitcoin community, posted a chart that compared the performance of the two ETFs. He humorously suggested someone should “check on” Peter Schiff, a well-known advocate for gold and critic of Bitcoin.

Notably, newly released information from CryptoQuant indicates a change in Grayscale Bitcoin Trust outflows, indicating a noticeable reduction in outflows.

Analysts Weigh In

Experts offer insights into the dynamics driving this shift in investment preferences. Eric Balchunas, an ETF analyst at Bloomberg, attributes the outflows from gold ETFs to a broader trend of Fear of Missing Out (FOMO) in the US equity market, rather than a direct reallocation to Bitcoin ETFs. Balchunas emphasizes the remarkable growth rate of Bitcoin spot ETFs compared to established gold ETFs, indicating a changing landscape in the investment sphere.

Similarly, Matt Hougan, who serves as the Chief Investment Officer at Bitwise, has highlighted the remarkable performance of Bitcoin ETFs in attracting early investments when compared to gold ETFs.

He stated:

Historical context: It’s really unusual for new ETFs to have inflows every day. Here’s the daily fund flows for GLD (the first gold ETF) after its launch (h/t@etfcom). It’s one of the most successful ETF launches of all time.

[Gold ETFs] In month 1, it had: * 8 days of positive flows * 1 day of negative flows * 11 days with zero flows

The sustained demand we’re seeing in bitcoin ETFs is remarkable.

Performance Disparity

The performance gap between gold and bitcoin further underscores this shift. While gold prices have seen a decline of approximately 3.9% since the beginning of 2024, Bitcoin has surged to new heights, surpassing $52,000 per coin. This stark difference in performance is driving investor attention towards bitcoin as a lucrative investment opportunity, leaving traditional safe-haven assets in the shadows.

Impact on Gold Market

The exodus from gold ETFs has implications for the broader gold market. With leading ETFs experiencing heavy outflows, the demand for gold as a store of value appears to be waning. This trend could potentially impact gold prices and reshape the dynamics of the precious metal market in the long run.

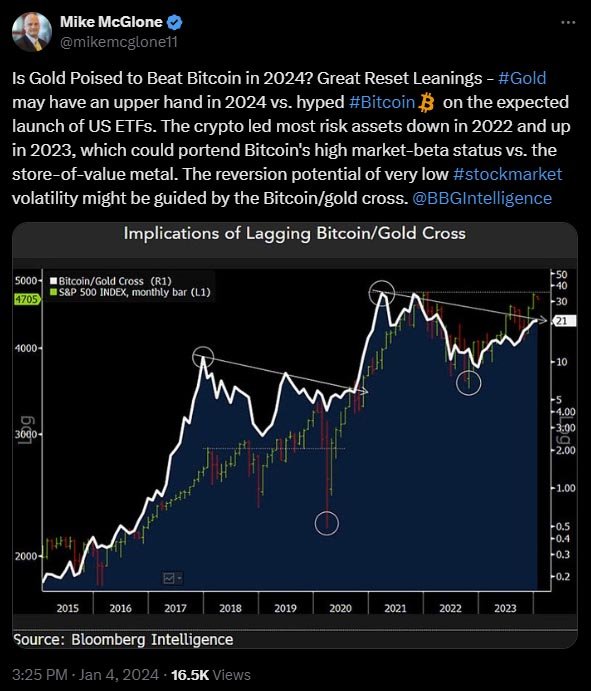

These developments go against the forecast made by Bloomberg’s senior commodity strategist, Mike McGlone, who had predicted that gold would perform better than Bitcoin in 2024.

Bitcoin as an Alternative Asset Class

Bitcoin’s ascent as an alternative asset class is gaining traction, with investors increasingly viewing it as a viable hedge against economic uncertainty. The influx of capital into Bitcoin spot ETFs underscores its growing acceptance among institutional and retail investors alike, positioning it as a formidable competitor to traditional safe-haven assets like gold.

David LaValle, global head of ETFs at Grayscale Investments noted the excellent performance of Bitcoin ETFs in an interview with CNBC, stating:

“The tracking has been really remarkable. We’ve seen the Bitcoin ETFs do an excellent job of holding very firmly along the net asset value and we’ve observed a liquidity profile indicative of what we had anticipated.”

Future Outlook

The rise of Bitcoin spot ETFs and the decline of gold-backed ETFs signify a monumental shift in investor sentiment. As Bitcoin challenges gold’s supremacy as a safe-haven asset, the financial world is witnessing a paradigm shift in investment preferences. Whether Bitcoin will emerge victorious or gold will retain its age-old allure remains uncertain, but one thing is clear: the battle between these two asset classes is far from over. Investors must carefully navigate these changing tides to secure their financial futures in an ever-evolving market landscape.