Despite having a lower market valuation of $364 billion and a price in the $20,000 range, bitcoin has outperformed gold over the past ten years. Gold vs Bitcoin is one of the oldest debates among hard money advocates.

Given that gold prices are expected to reach $3,000 to $5,000 per ounce in the next five years, and its current $12 trillion market cap, one would wonder,

Should you buy gold, or bitcoin?

Gold vs Bitcoin as Store of Value

Hard assets, which move in the opposite way of soft assets and inflation, have historically been thought of as long-term assets for storing wealth (the fruits of your effort), such as rai stones, gold, real estate, diamonds, fine art, bitcoin, etc.

Gold has underperformed as a store of value when measured against bitcoin since 2013. The preceding utilities of gold (transportation, divisibility, etc.) were replaced by gold ETFs (paper gold). Gold ETFs offered investors advantages such increased liquidity, transparency, tax efficiency, affordability, simplicity, and safety. On the other hand, Gold ETFs artificially boosted the market’s supply of gold, which caused the price to decline. Furthermore, if gold is ever demonetized, it will revert to the status of an industrial metal and lose around 80% of its value.

Even though bitcoin proved to be a better store of value, in the last decade it was much more volatile. However, the volatility of emergent technologies (internet (dot.com bubble), Amazon, Google, Apple, Tesla etc.) is an overstatement. Early technological adoption is characterized by volatility. Emergent technologies’ volatility decreases as they develop and gain wider acceptance. You will lose out on significant appreciation, if you wait until the assets volatility completely disappears. In his commencement speech, Michael Burry noted,

Volatility does not define risk.

Michael Burry

Bitcoin vs. Gold as Money Technology

Since digital revolution has made communication completely free, nobody wants to go back to the printing press, pigeon post, etc. The same holds true with gold, its predecessor utilities are now its own death. Gold’s features are a strong evidence of gold’s aging in the digital era;

- transportation,

- storage,

- authenticity,

- scarcity,

- security, and

- adoption are all factors to consider.

However, bitcoin overcomes all of the outdated problems with gold.

1. Transportation

The slow and expensive transportation of gold makes it difficult to move during times of peace or war. Germany’s effort to move its WWII gold cost €7.6 million in 2015 and took four years to complete. On the other hand, transporting gold privately might be a burden due to the many logistics required. In addition, gold is bulky and difficult to handle or divide into smaller pieces.

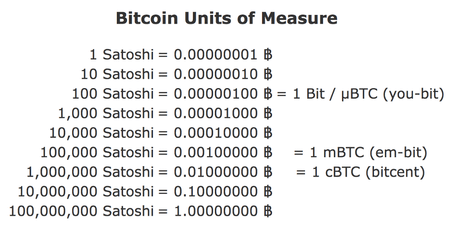

In contrast, bitcoin is simple to split into little bits (satoshis), unlike gold. As a result, it is considerably simpler to divide bitcoin into smaller quantity.

In contrast to gold, bitcoin is significantly simpler, less expensive, and faster to transmit because to its divisibility and network.

2. Storage

Gold’s inability to be safely stored is another out-of-date trait in the digital age. According to a CNBC story,

Owning gold is one thing, storing it is quite another.

CNBC

The best option is to store it in a bank safe if you don’t want to expose yourself to attack by digging a hole in your backyard. However, by doing so, you effectively become an owner of the IOU and lose physical access to your gold.

On the other hand, bitcoin can be secured with a seed phrase and kept in a hardware wallet. Additionally, you can store your bitcoin inside your head (i.e., Brainwallet) or set up multi-signature wallet, and protect yourself from a $5 wrench attack. Bitcoin is a lot more effective and convenient way to store your money.

3. Authenticity

The procedure of gold assaying is both time intensive and out of reach for the average person. Buying gold is also excruciatingly difficult due to paperwork, fees, and price markups. Gold bar counterfeiting is a common occurrence, and it poses a risk to a new customer. The inability to verify gold’s authenticity has made it an undesirable asset to purchase and deposit your riches.

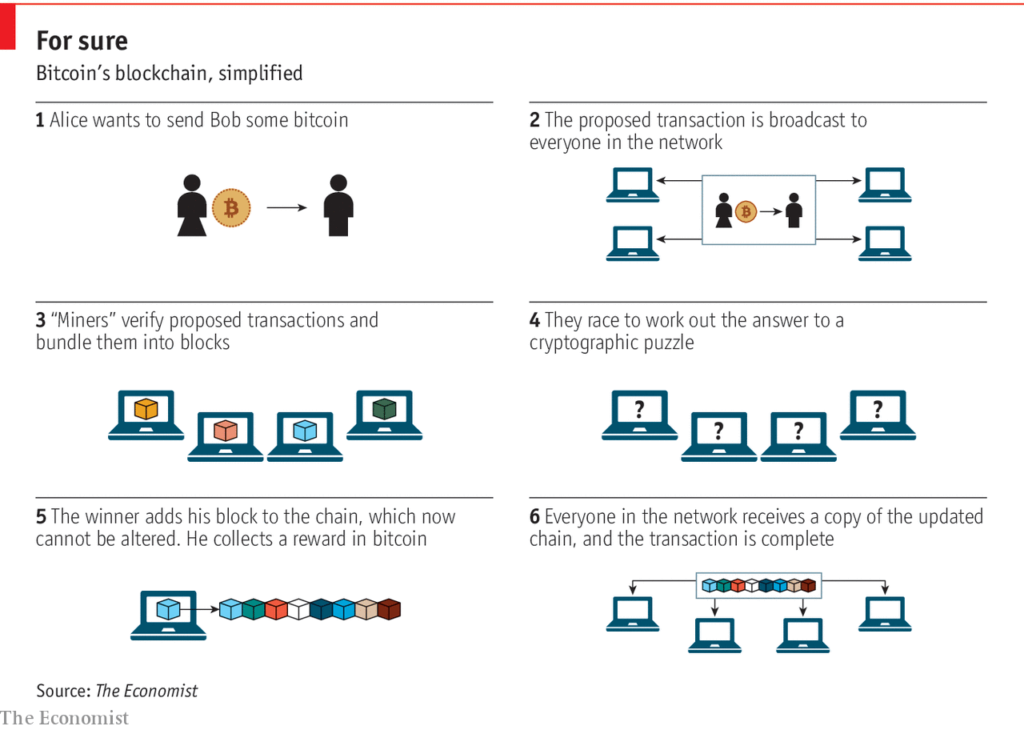

Bitcoin’s authenticity is done trough its network. It is verified by miners and nodes, ensuring the bitcoin’s authenticity. There is no third-party necessity, and there is no way to get a fake bitcoin. The blockchain removes any need for an intermediary to guarantee or verify the transaction.

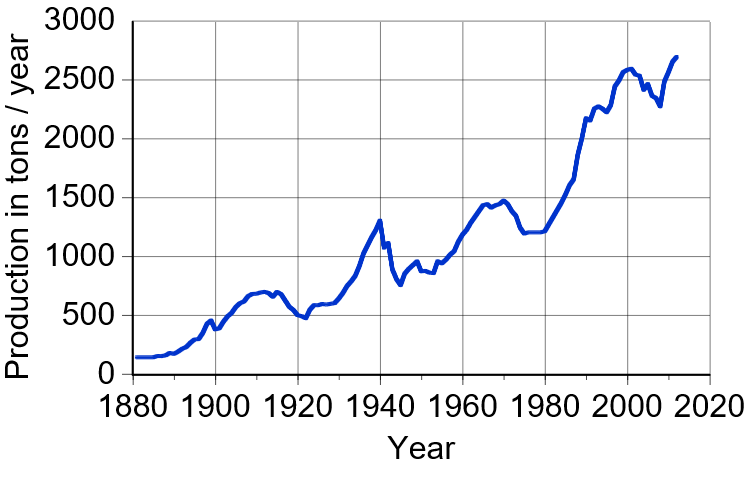

4. Mining

The cumulative effects of gold mining on local economies and ecosystems around the world, are frequently linked to,

- violence, as every major gold rush has meant death and devastation for local people at the hands of fortune-seekers,

- various poisonous chemicals, such as cyanide and mercury, which cause major public-health problems for miners and communities, and

- damages to Earth, such as those to water and land,

Despite what many people believe, mining bitcoin does not harm the environment. Miners are urged to use renewable energy sources (geothermal, hydroelectric, natural gas, etc.) due to the fierce rivalry in the Bitcoin mining sector.

5. Scarcity

The difficulty of mining gold has only added the perception of gold as a valuable commodity. If the supply would rise, due to extraction of gold from deep oceans or from asteroids, scarcity of gold would disappear. Granted, the technology and cost-effectiveness for these extractions are not there yet, but in the foreseeable future they might be.

Even though gold has a high stock-to-flow ratio, it is challenging to determine the precise amount that is now in use, casting doubt on its scarcity. Additionally, there is a chance that gold miners will deliberately and artificially alter the supply of gold.

However, as anyone can examine the real number of newly-created Bitcoins on the network, Bitcoin, on the other hand, has demonstrable scarcity. Due to the halving of Bitcoin, its stock-to-flow increases every four years. Furthermore, the network adapts to stress and is resistant to an influx or outlaw of miners (e.g. China’s miners ban in 2021).

6. Adoption

Millennials and Gen Z (i.e. Zoomers), for example, do not have an emotional attachment to gold as Boomers or Gen X. Consumers in Generation Z are less inclined to invest in gold for the long term, while Millennials do not buy gold at all. Cash bills and physical coins are falling behind as we move farther into the digital age, owing to their inconvenient and outmoded characteristics. Demographic trends will continue to wreak havoc on gold prices for many years to come, and might just transition to a better store of wealth — bitcoin.

7. Security

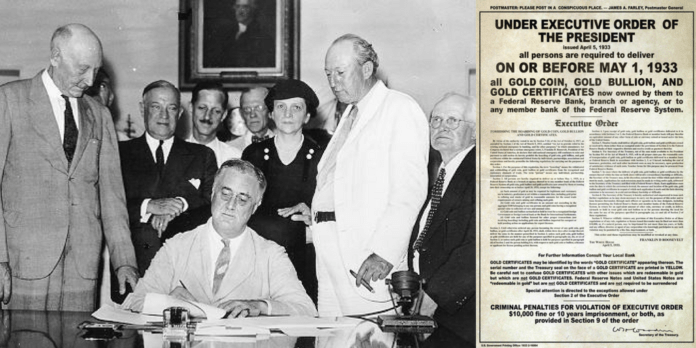

President Franklin D. Roosevelt of the United States signed Executive Order 6102 in 1933, prohibiting individual ownership of gold coins, gold bullion, and gold certificates in the United States. Without your knowledge or ability to object, the gold treasure was stolen and converted for paper money.

Due to the 1933 passage of a law prohibiting private ownership of gold, which gave the government ultimate control over whether or not you can keep your gold, the security of keeping your wealth in gold disappeared.

As already noted, Bitcoin can be secured with a seed phrase and kept in a hardware wallet. Additionally, anyone can transact with bitcoin thanks to its neutrality, censorship resistance, and decentralized network. As Venezuela discovered with its gold and as Afghanistan and Russia discovered with its foreign exchange reserves,

Not Your Keys, Not Your Coins

It’s That Simple

Bitcoin vs. Gold, Conclusion?

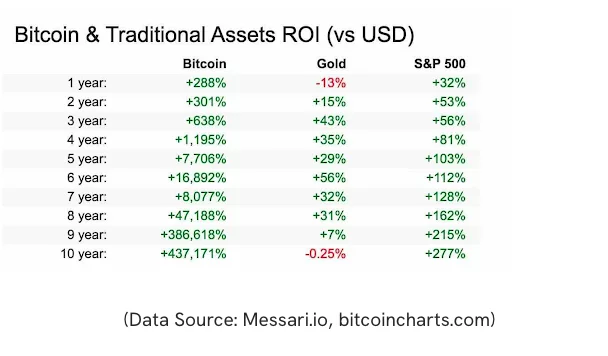

In recent decades, gold has underperformed as an inflation hedge, a store of value, and an asset investment. When compared to bitcoin and S&P 500 Index, gold has had the worst return on investment since 2012.

In summary, it is clear to say that bitcoin is taking the place of gold as a store of wealth and asset investment given the outdated nature of gold as a money technology in the digital age — which its poor performance since 2012 confirms. The price of bitcoin would be around $500,000, representing a 25X return as of today, when it achieves a $12 trillion market cap of gold. Therefore, one shouldn’t wonder anymore if,

you should buy gold, or bitcoin.