Bitcoin (BTC) has reached a new milestone, breaking the all-time high in the bitcoin-to-gold ratio.

The ratio, which measures the purchasing power of bitcoin against gold, has hit 40 ounces of gold per BTC. This is a big deal for bitcoin as a modern store of value, often referred to as “digital gold”.

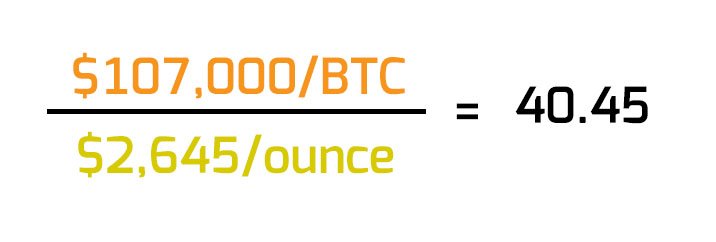

This comes as bitcoin’s price just passed $106,000 and gold is stuck at $2,650 per ounce.

Related: Digital Gold | Understanding Bitcoin’s Parallel to the Timeless Asset

Peter Brandt, a veteran trader who follows the metric, said:

“The next stop will be 89 to 1—it will require 89 ounces of gold to buy a single bitcoin.”

He’s not being shy about the fact that Bitcoin is going to surpass gold as the ultimate inflation hedge.

The bitcoin-to-gold ratio is calculated by dividing bitcoin’s price by the spot price of gold per ounce. This simple metric shows how many ounces of gold can be bought with 1 bitcoin. For example, at the current high, 1 BTC can buy 40.45 ounces of gold.

This ratio is not just a number; it’s a measure of investor sentiment and preference between these two assets. Gold has been a store of value for 3,500 years, while Bitcoin is the new kid on the block.

The all-time high in the bitcoin-to-gold ratio is due to several factors: institutional adoption, limited supply and it’s being seen as an inflation hedge.

Jerome Powell, Chairman of the U.S. Federal Reserve, called bitcoin a “digital version of gold” earlier this year and that boosted investor confidence. Cathie Wood, founder of ARK Invest, said Bitcoin can capture a big chunk of gold’s $15 trillion market.

Bitcoin’s fixed supply of 21 million, unlike gold’s ongoing supply, makes it a more attractive store of value due to its programmed scarcity.

Another reason for bitcoin’s rise is the influx of institutional money. The approval of U.S.-based Bitcoin ETFs earlier this year has opened the floodgates. Global Bitcoin ETF assets under management (AUM) are now at $123 billion and closing in on gold ETFs which have $274 billion.

Nate Geraci, President of The ETF Store, thinks the overtake will eventually happen. He said Bitcoin ETFs will surpass gold ETFs in AUM in the next 2 years. Bitcoin being added to institutional portfolios is a stamp of approval.

Bitcoin’s scarcity is one of its best features. The total supply is 21 million and the halvings reduce the rate at which new bitcoin is being created. Gold is still being mined and the supply is increasing.

And on top of that, Bitcoin’s mining difficulty just hit an all time high of 105 trillion. That’s how secure the network is and how much demand there is for bitcoin.

Peter Brandt believes bitcoin is now a serious competitor to gold, not just an alternative asset.

The comparison between bitcoin and gold has investors debating. Gold has always been the safe haven asset during economic uncertainty because of its stability and 20% annual volatility.

Bitcoin, on the other hand, offers higher returns but with more price swings—around 50% annual volatility.

QCP Capital, a Singapore based digital asset firm said:

“Bitcoin is solidifying its status as ‘digital gold’ and is increasingly favored as a store of value over traditional gold.”

There also is increasing evidence that governments have started to adopt bitcoin as a strategic reserve asset. MicroStrategy’s Michael Saylor, a big Bitcoin advocate, recently told the U.S. government to sell its gold and buy bitcoin instead.

“Dump your gold, sell all the U.S. gold, and buy bitcoin because you can buy 5 million bitcoin for the cost of the gold,” Saylor said, pointing out Bitcoin’s potential as a future-proof national reserve asset.

As Bitcoin goes up, everyone will be watching to see if it hits 89 ounces of gold per BTC. Whether it replaces gold or coexists as an additional asset, one thing is for sure; Bitcoin is rewriting the financial rules as we know it.

At the time of writing, bitcoin has retraced back to $104,950, building momentum toward new milestones in the near future.