Goldman Sachs, one of the largest and most influential investment banks in the world, has recently made waves by disclosing its substantial investments in Bitcoin exchange-traded funds (ETFs).

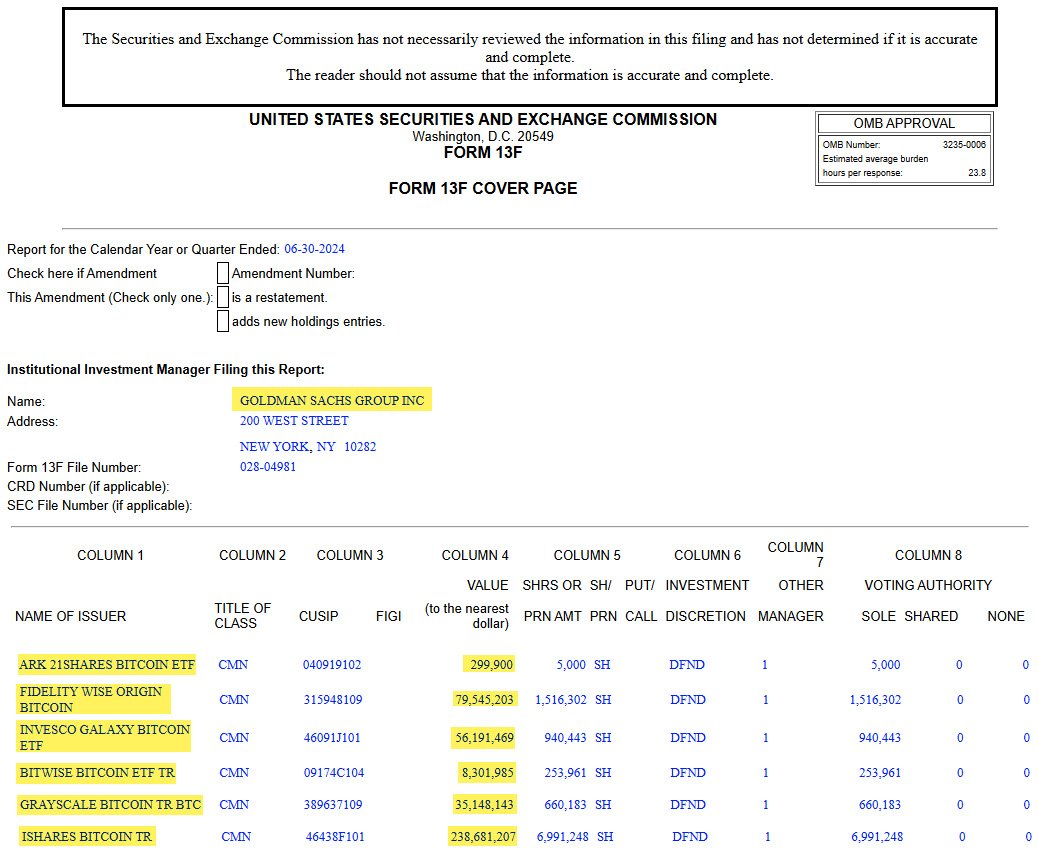

This move represents a significant shift for a company that has historically been skeptical of Bitcoin. As of June 30, 2024, reported Goldman Sachs Bitcoin ETF holdings were above $400 million, according to its latest 13F filing with the U.S. Securities and Exchange Commission (SEC).

In its quarterly 13F filing, Goldman Sachs revealed that it holds positions in seven different Bitcoin ETFs available in the U.S. market. The bank’s largest holding is in BlackRock’s iShares Bitcoin Trust (IBIT), with nearly 7 million shares valued at approximately $238 million.

This makes Goldman Sachs the third-largest holder of the IBIT fund, trailing only behind Millennium Management and Capula Management Ltd.

The bank has also invested in several other Bitcoin ETFs. Notably, Goldman Sachs holds 1.51 million shares of Fidelity’s Bitcoin ETF (FBTC), worth around $79.5 million.

Additionally, the bank disclosed holdings of $56.1 million in Invesco Galaxy’s Bitcoin ETF, $35.1 million in Grayscale’s Bitcoin Trust (GBTC), and smaller positions in ETFs from Bitwise, WisdomTree, and ARK 21Shares.

These investments collectively amount to more than $400 million, marking a significant exposure to bitcoin through these regulated financial products.

Mathew McDermott, Goldman Sachs’ global head of digital assets, highlighted the importance of Bitcoin ETFs, stating that the approval of spot Bitcoin products in the U.S. was a “big psychological turning point” for the industry.

He added that this development has opened the door for more institutional investors to enter the market, noting that Bitcoin ETFs are “an astonishing success.”

Goldman Sachs’ significant investment in Bitcoin ETFs is part of a broader trend of institutional adoption of Bitcoin.

Related: Bitwise CIO Foresees Big Institutional Move into Bitcoin ETFs in Q2

For years, the financial giant expressed skepticism about digital assets.

Sharmin Mossavar-Rahmani, the chief investment officer of Goldman Sachs’ Wealth Management unit, had stated, “We do not think it is an investment asset class. We’re not believers in crypto.”

However, the landscape has changed dramatically. The approval of Bitcoin ETFs has provided a more regulated and familiar way for institutional investors to gain exposure to bitcoin without directly owning the asset itself.

ETFs offer liquidity, security, and ease of access, making them an attractive option for large financial institutions.

Goldman Sachs’ embrace of Bitcoin ETFs reflects this shift in sentiment. The bank’s substantial holdings in these funds indicate a growing recognition of Bitcoin’s potential as an asset class. McDermott highlighted:

“Institutions like ours actually see the potential in how it can transform where parts of the financial system can operate in a much more efficient way.”

The popularity of Bitcoin ETFs has surged in 2024, with Goldman Sachs and other institutional investors pouring billions of dollars into these products.

BlackRock’s IBIT has been particularly successful, attracting around $20.5 billion in cumulative net inflows this year alone. This makes it one of the most successful ETF launches in recent history, far outpacing other new ETFs that have come to market.

BTC ETF flows continued in the green during the U.S. Tuesday trading day with $39 million in daily inflow recorded, according to data from Farside Investors.

Nate Geraci, President of The ETF Store, highlighted this success, stating, “Numbers are comical at this point,” referring to the vast difference in inflows between Bitcoin ETFs and other types of ETFs launched this year.

The next closest non-Bitcoin ETF has attracted just $1.3 billion in inflows, underscoring the dominance of Bitcoin-related products.

This growing interest in Bitcoin ETFs is not limited to Goldman Sachs. Other major financial players, such as Capula Investment Management, have also disclosed significant positions in these funds.

Capula, one of Europe’s largest hedge funds, revealed that it holds $464 million in spot Bitcoin ETFs, with its largest holdings in BlackRock’s IBIT and Fidelity’s Bitcoin ETF.

The increasing involvement of institutions like Goldman Sachs in Bitcoin ETFs has broader implications for the Bitcoin market.

As more institutional money flows into bitcoin through these regulated products, it could lead to greater price stability and increased legitimacy for Bitcoin as an asset class.