In recent reports, Grayscale’s Bitcoin ETF, GBTC, has been experiencing significant outflows, amounting to over $12 billion since January. This trend has sparked discussions about the high fees associated with the fund compared to its competitors. Grayscale’s CEO, Michael Sonnenshein, has addressed these concerns, promising a gradual reduction in GBTC fees over time.

High GBTC Fees and Outflows

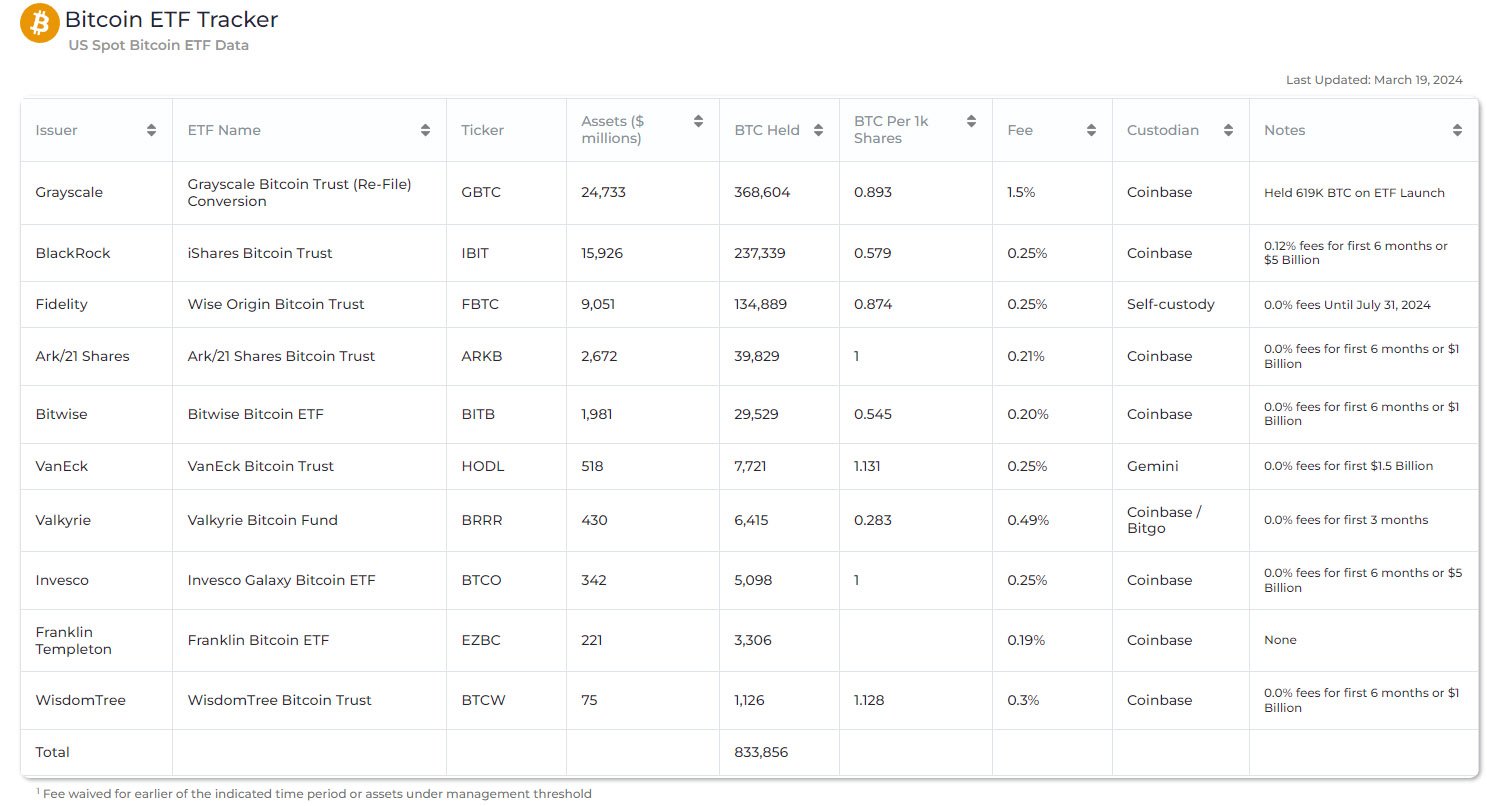

Grayscale’s GBTC has faced scrutiny due to its comparatively high management fees, standing at 1.5%, significantly above industry standards. This has led to substantial outflows from the fund, reaching a staggering $12 billion. Sonnenshein acknowledges this trend, stating, “Of course, we anticipated having outflows. Investors have been wanting to either take gains on their portfolio, or arbitragers coming out of the fund, or people unwinding positions that were part of bankruptcies through forced liquidation.”

He added:

“None of that came as a surprise […] What we’ve seen is GBTC continue to trade liquidly with tight spreads, and across a very diversified shareholder base. So we kind of think we’re between the first and the second inning of this.”

Sonnenshein described the current state of a market using a baseball metaphor. He likened the current situation to the end of the first inning, where the initial surge in demand for buying and selling has been fulfilled. Now, he believes the market is transitioning into the second and third innings, indicating that there is still untapped potential as more of the market begins to utilize the products available.

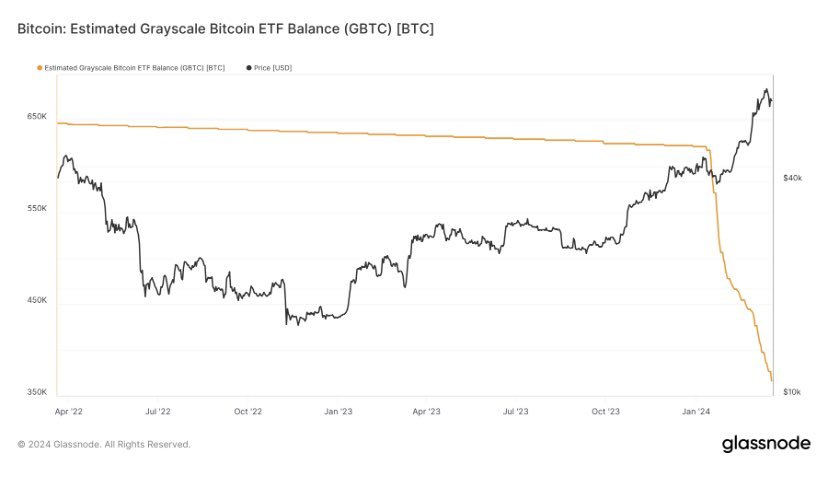

Notably, Since January 11, GBTC has witnessed a reduction in its assets under management, dropping from an initial 619,000 BTC to nearly half that amount, currently holding 368,000 BTC, according to data from Apollo.

Sonnenshein’s Commitment to Fee Reduction

In response to concerns raised by investors and market analysts, Grayscale’s CEO, Michael Sonnenshein, has affirmed the company’s commitment to reducing fees. Notably, he had previously stated that he believes most of the current Bitcoin ETFs won’t survive because they charging very low fees.

He reassured stakeholders that fees on GBTC would gradually decrease as the market matures. Sonnenshein emphasized:

“I’ll happily confirm that, over time, as this market matures, the fees on GBTC will come down. We have seen this in countless other exposures, countless other markets, you name it, where typically when products are earlier in their lifecycle, when they’re new to be introduced, these [fees] tend to be higher. And, as those markets mature, and as those funds grow, those fees tend to come down, and we expect the same to be true of GBTC.”

Sonnenshein justified Grayscale’s higher fees for GBTC, citing its liquidity and track record. He noted that ETFs with lower fees often lack track records, using incentives to attract investors. He added:

“I think from our standpoint, it may at times call into question their long-term commitment to the asset class […] all of these new issuers really came into the market to compete with us.”

Impact of Outflows and FTX Bankruptcy

The significant outflows from GBTC have been attributed in part to the bankruptcy of digital asset giant FTX, a major holder of GBTC shares. This development has influenced investor sentiment and contributed to the fund’s declining value. Vetle Lunde, a senior analyst at K33 research, commented on the situation, stating, “Going to stabilize eventually, there are def. idle holders not aware of the massive fee premium compared to other issuers.”

Grayscale’s Strategic Response

In response to market dynamics and investor demands, Grayscale has outlined plans to introduce a lower-fee version of its flagship product, the Grayscale Bitcoin Mini Trust. This initiative aims to provide investors with more cost-effective options for accessing Bitcoin ETFs. However, specific details regarding the launch timeframe remain undisclosed.

Grayscale is currently awaiting approval from the U.S. Securities and Exchange Commission (SEC) for its Bitcoin Mini Trust ETF.

Conclusion

As Grayscale’s GBTC continues to face significant outflows and scrutiny over its fee structure, CEO Michael Sonnenshein’s commitment to reducing fees offers a ray of hope for investors. With the promise of gradual fee reductions and strategic initiatives such as the introduction of a lower-fee Bitcoin Mini Trust, Grayscale aims to navigate the evolving landscape of the Bitcoin market while addressing investor concerns.

However, regulatory approval and market stability will play crucial roles in shaping the future trajectory of Grayscale’s ETF offerings.