Grayscale Investments, a leading provider of Bitcoin Exchange-Traded Funds (ETFs), has revealed the fees for its recently-announced subsidiary fund, the Bitcoin Mini Trust (BTC). However, despite its low-cost, analysts suggest investors not get their hopes high yet.

Grayscale Bitcoin ETF: A Strategic Shift

According to the latest filing, the Bitcoin Mini Trust is poised to become the most economical choice among the 11 approved spot Bitcoin ETFs, with its fee set at a mere 0.15%. This fee is a tenth of the 1.5% charged by its parent product, the Grayscale Bitcoin Trust (GBTC).

Grayscale’s decision to introduce the Bitcoin Mini Trust reflects a strategic shift towards catering to investor demands for lower fees in the increasingly competitive market, with other major players like Franklin Templeton and Bitwise also offering competitive fee structures.

The new trust will comprise 63,204 bitcoin, which is equivalent to around 20% of the current assets held in GBTC. These shares will be automatically issued and distributed to existing GBTC shareholders, ensuring a seamless transition for investors.

One of the significant advantages of the Bitcoin Mini Trust is its tax-efficient structure. Existing GBTC shareholders will be able to transfer to the new fund without incurring any capital gains tax, making it an attractive option for investors looking to optimize their returns.

Grayscale’s ‘Intentional’ Move

Eric Balchunas, an ETF analyst at Bloomberg, commented on the development, emphasizing the strategic significance of Grayscale’s decision. He stated:

“Grayscale’s mini Bitcoin Spot ETF will have a 15 bps fee, making it the cheapest BTC ETF on the market. While this is an estimated financial statement, it’s a notable move in response to investor demand for lower fees.”

Moreover, Balchunas called the move “pro-forma financials and as such hypothetical” and explained that although the proposed fees are subject to change before the launch, Grayscale’s decision to set the fee at 0.15% was intentional to capture investors’ attention.

“They had to pick a number for this, and they knew people would be watching,” he added.

On the other hand, renowned ETF analyst Nate Geraci explained the difference between GBTC and BTC, highlighting the different investment strategies associated with each product. GBTC, as a trading vehicle, is often used by investors looking to capitalize on short-term price movements in bitcoin. On the other hand, BTC, the buy-and-hold vehicle, is favored by investors with a long-term investment horizon, aiming to hold onto their bitcoin assets for extended periods.

GBTC’s Outflow Troubles

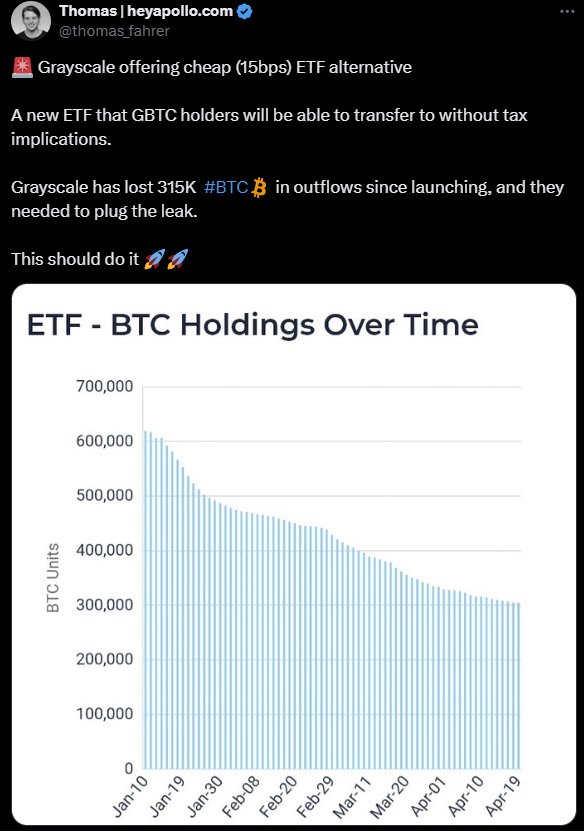

Grayscale’s move to introduce the Bitcoin Mini Trust comes at a crucial time, with investors increasingly withdrawing funds from GBTC since the launch of spot Bitcoin ETFs in January. According to recent data, GBTC has witnessed around $16.73 billion in outflows since the introduction of spot Bitcoin ETFs.

Thomas Fahrer, CEO of Apollo, a digital asset-focused reviews portal, highlighted the necessity for Grayscale to offer a cheaper alternative to GBTC fees. “Grayscale has lost 315K BTC in outflows since launching, and they needed to plug the leak,” Fahrer explained.

The launch of the Bitcoin Mini Trust is seen as a proactive measure by Grayscale to retain investors as they are preferring spot Bitcoin ETF leaders like BlackRock and Fidelity.

As the demand for regulated bitcoin investment vehicles continues to surge, Grayscale’s strategic Bitcoin Mini Trust is poised to attract a new wave of investors seeking cost-effective exposure to bitcoin.