Renowned digital asset manager Grayscale has taken a notable step in its pursuit of a Bitcoin Exchange-Traded Fund (ETF) by filing an amended application with the United States Securities and Exchange Commission (SEC).

However, this latest Grayscale Bitcoin ETF filing has raised eyebrows as it omits key details, particularly the names of authorized participants. This move comes amidst an ongoing race among several companies seeking to launch the first U.S. Spot Bitcoin ETF.

Grayscale Bitcoin ETF Amendment

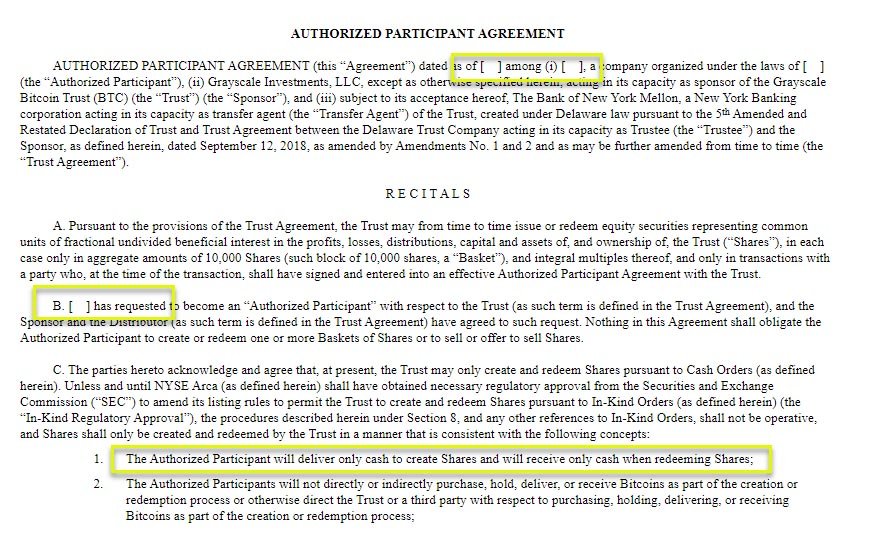

Bloomberg’s senior ETF analyst, James Seyffart, brought attention to Grayscale’s amended filing on X, highlighting a crucial change in the application. The firm clarified that authorized participants in its proposed ETF would only transact in cash for shares.

Surprisingly, the asset manager left the section identifying its authorized participants entirely blank. This omission is notable, as the SEC typically requires this information for evaluation. Balchunas stated:

“Not sure why since the SEC wants to see it and they have been pretty cocksure about having one. Also, nothing on fee (that I could see). That’s a big open q too.”

Grayscale Leaves the Community Confused

Balchunas expressed uncertainty about Grayscale’s decision to omit such crucial details, especially when other firms, including Fidelity, WisdomTree, and Invesco Galaxy, provided this information in their recent filings.

Particularly, investment giant BlackRock recently named JPMorgan Chase and Jane Street as authorized participants in the fifth amendment for its Spot Bitcoin ETF. The move has led to major criticism due to JPMorgan’s CEO Jamie Dimon’s stance on digital assets.

On the other hand, Invesco Galaxy listed Virtu and JPMorgan as its authorized participants, while WisdomTree and Fidelity chose Jane Street Capital.

Authorized participants play a critical role in ETFs as financial institutions or companies capable of creating and redeeming shares. It is important to note that Grayscale had previously indicated in June 2022 that it intended to list Jane Street and Virtu Financial as its authorized participants while transitioning its Grayscale Bitcoin Trust into an ETF. Balchunas questioned the rationale behind this decision:

“Yes, and they even tweeted that of course they have one, but alls I know (in philly accent) it isn’t in doc yet (which SEC wants) and until we see we aren’t counting any horse as official. Also, BlackRock, Fidelity et al did it, so why not be done w it?”

Notably, Grayscale submitted the amended S-3 filing on December 27, coinciding with the announcement of Barry Silbert’s resignation from Grayscale’s board of directors. Silbert is the CEO of Digital Currency Group, the parent company of Grayscale.

Deadline and Industry Expectations

As his company files for the amendment for its Spot Bitcoin ETF application, Grayscale CEO Michael Sonnenshein posted on X, stating, “Big work week.”

Notably, the SEC’s deadline to deliver its verdict on the latest Bitcoin ETF filings is set for January 10, with industry experts speculating that responses may be issued by the end of the first week of 2024.

As the Bitcoin ETF approval deadline approaches, the Bitcoin community remains watchful for developments that could shape the future landscape of Bitcoin investment products in the United States.