Digital asset management firm Grayscale is reportedly in talks with prominent American banking institutions, JPMorgan and Goldman Sachs, for a role as authorized participants in its proposed Spot Bitcoin Exchange-Traded Fund (ETF).

APs in Grayscale Bitcoin ETF

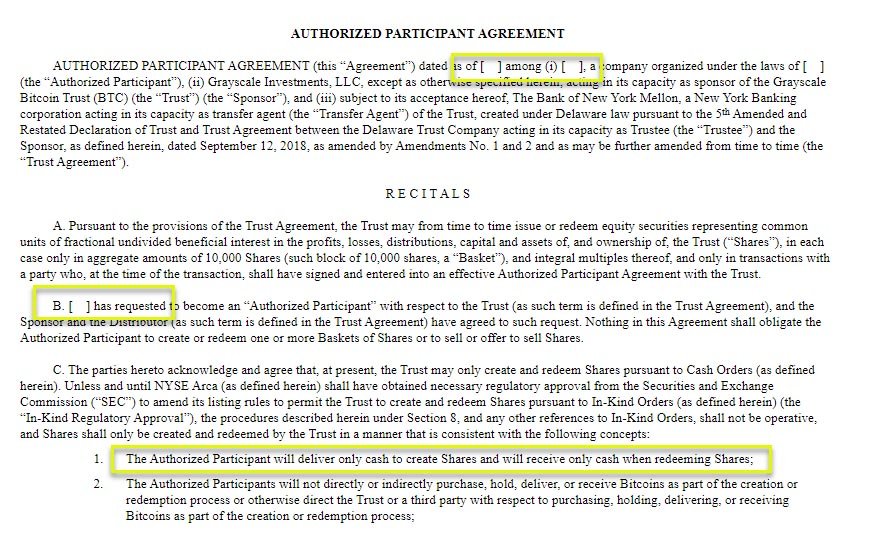

As per a Bloomberg report published on January 4, both the banking institutions are currently under consideration to serve as authorized participants—enterprises endowed with the power to generate and redeem shares of the Spot Bitcoin ETF, as disclosed by an anonymous source familiar with the discussions between the three firms.

The authorized participants play a pivotal role, as they are instrumental in aligning the ETF share price with the underlying assets of the fund and serve as a primary source of liquidity. Representatives of the involved firms have chosen not to provide comments on the matter, the report added.

Notably, an asset manager can name multiple firms as its authorized participants, but applicants are not required to name them in their S-1 or S-3 filings.

Goldman Sachs has also been in talks with BlackRock, the world’s largest asset management firm, regarding a potential role as an authorized participant in its ETF. JPMorgan, on the other hand, has already been named as an authorized participant in various Spot Bitcoin ETF applications.

If finalized, Goldman Sachs would join the ranks of other Wall Street firms like Cantor Fitzgerald and Jane Street, who are named as authorized participants in different ETF applications.

In late December, Goldman’s head of digital assets, Matthew McDermott, noted that the approval of a Spot Bitcoin ETF would make the digital asset space more mature and also attract investments from institutions that are currently hesitant to expose their balance sheets to Bitcoin.

Grayscale’s S-3 Application

It is crucial to note that the news comes less than a week after Grayscale filed an updated S-3 application with the United States Securities and Exchange Commission (SEC) without listing any authorized participants. Bloomberg analyst Eric Balchunas noted in an X post that Grayscale left the names of its authorized participants blank in the updated filing while adding:

“Not sure why since SEC wants to see it and they have been pretty cocksure about having one. Also, nothing on fee (that I could see). That’s big open [question] too.”

Exit of Grayscale Executives

On the same day that Grayscale filed the amended S-3 filing with the SEC, Barry Silbert and Mark Murphy, the chief executive and president of the firm’s parent company, Digital Currency Group (DCG), respectively, announced their resignation from the board of directors.

Some people from the digital asset community pointed out that Silbert’s departure will have a positive impact on the approval of Grayscale’s Spot Bitcoin ETF application.

“Effective January 1, 2024, the board consists of Mr. Shifke, Mr. Kummell, Michael Sonnenshein, and Mr. McGee, who also retain the authority granted to them as officers under the limited liability company agreement of the sponsor,” read the firm’s announcement.

As the industry anticipates regulatory developments, Bloomberg ETF analyst James Seyffart suggests a 90% chance that all Spot Bitcoin ETF applications could receive approval from the SEC before January 10.