Bitcoin faced significant market turmoil recently, driven by a series of outflows from Bitcoin exchange-traded funds (ETFs). In the past week, these outflows totaled over $600 million, signaling a shift in investor sentiment.

This decline comes amid a broader downturn in the digital assets market, influenced by the hawkish Fed decision to maintain current interest rates.

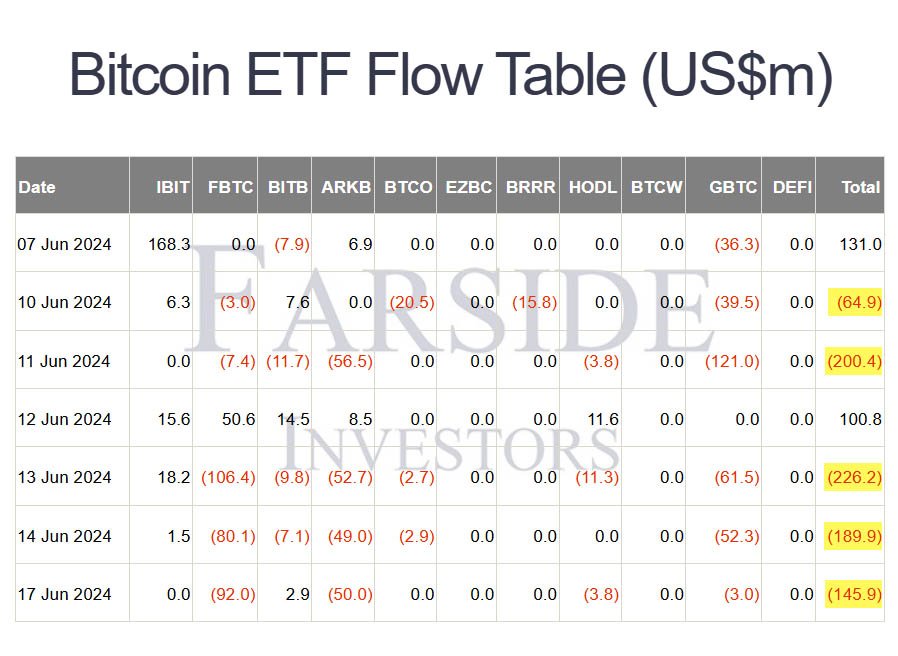

Recent outflows from U.S. Bitcoin ETFs contributed to a significant drop in the total assets under management (AUM). On June 17 alone, Bitcoin ETFs saw net outflows of $145.9 million, marking the third consecutive trading day of such declines.

Fidelity’s FBTC ETF experienced the largest outflow, losing $92 million. Ark Invest’s ARKB followed with $50 million in outflows. Grayscale’s GBTC and VanEck’s HODL saw smaller outflows of $3 million and $3.8 million, respectively.

According to data from CoinShares and Farside Investors, these outflows continued throughout the week, culminating in a total of $621 million pulled from these bitcoin investment products.

This marked the end of a four-week streak of net inflows that had previously brought in roughly $4 billion. The cumulative impact reduced the total net inflows in U.S. spot Bitcoin ETFs to just under $15 billion.

The Federal Reserve’s recent decision to keep interest rates steady between 5.25% and 5.50% has had a profound impact on the market.

Investors were expecting rate cuts, but the Fed’s hawkish stance, influenced by a strong jobs market and persistent inflation, led to the opposite decision.

Related: The Fed Still Undecided, Rate Remains Unchanged

This decision has prompted many investors to scale back their exposure to riskier assets like bitcoin. James Butterfill from CoinShares noted:

“These outflows and the recent price sell-off saw total assets under management fall from above $100 billion to $94 billion over the week.”

The Federal Open Market Committee (FOMC) meeting’s outcome was a significant factor in this shift. CoinShares’ report highlighted that the hawkish tone of the meeting surprised many investors, leading to a significant reduction in their exposure to Bitcoin ETFs.

The market’s reaction was immediate. Bitcoin’s price fell to $64,600, its lowest point since mid-May, reflecting an 11% decline from its recent highs.

This drop in price was accompanied by a rise in bitcoin’s dominance in the broader digital asset market, reaching 56.2%, the second-highest level of the year.

Despite the overall bearish sentiment, some funds like BlackRock’s IBIT managed to maintain their position without any inflows or outflows.

Another factor contributing to the outflows was the increased sell-off by Bitcoin miners. The recent Bitcoin halving, which reduced block rewards from 6.25 to 3.125 BTC, has forced miners to optimize their operations.

Matteo Greco, a research analyst at Fineqia International, explained:

“This event forces miners to optimize their capital efficiency to maintain profitability, initially causing a significant decrease in profitability as rewards are halved from one block to the next.”

As miners sold more heavily to bolster their cash reserves, the selling pressure increased, contributing to bitcoin’s price decline. This, combined with ETF outflows, created a challenging market environment.

The recent developments underscore the volatile nature of the digital assets market and its sensitivity to macroeconomic factors.

Despite the current market challenges, there are signs of growing adoption in other regions. Australia, for instance, continues to see the expansion of Bitcoin Spot ETFs.

VanEck recently obtained approval to list a BTC Spot ETF on the Australian Securities Exchange (ASX), indicating increasing acceptance among traditional finance investors.

The recent outflows from Bitcoin ETFs highlight a significant shift in investor sentiment. The anticipation of interest rate changes by the Federal Reserve plays a crucial role in this dynamic.

Market analysts now expect only one rate cut by the end of 2024, a stark contrast to earlier predictions of multiple cuts this year.

This cautious approach by investors is reflected in the overall market performance.

As traditional financial instruments like ETFs continue to integrate bitcoin, the interplay between regulatory decisions, market sentiment, and technological advancements will shape the future of digital assets.

For investors, staying informed about these developments is crucial. The ongoing expansion of BTC Spot ETFs in markets like Australia and Hong Kong highlight the growing acceptance and integration of Bitcoin into mainstream finance.