Hong Kong has taken a significant step in embracing the world of digital assets by granting conditional approvals for the launch of spot Bitcoin Exchange-Traded Funds (ETFs). This move marks a milestone in the region’s efforts to establish itself as a global digital asset hub.

Hong Kong Bitcoin ETFs: Conditional Approvals Pave the Way

The Hong Kong Securities and Futures Commission (SFC) has granted conditional approvals to several asset managers, including Harvest Global Investments, HashKey Capital, Bosera Asset Management, and China Asset Management, to launch spot Bitcoin ETF. The approvals come after a dedicated regulatory regime was rolled out last year, signaling Hong Kong’s commitment to embracing digital assets. Hong Kong based digital asset platform, OSL, was named the “first virtual asset trading and sub-custodian partner” for China Asset Management’s future ETFs.

The Securities and Futures Commission (SFC) stated that it grants a conditional authorization letter to an ETF application if it meets their criteria, with conditions like fee payments, document filings, and approval from the Hong Kong Stock Exchange (HKEX).

OSL mentioned:

“In this collaboration, OSL leverages its robust infrastructure to provide a secure trading environment essential for the ETF’s operation, managing the underlying assets with precision and reliability.”

Spot ETFs: A Game-Changer for Hong Kong

Unlike its neighboring mainland China, which has implemented a broader crackdown on digital assets trading and mining, Hong Kong has welcomed such firms with open arms. Bosera Asset Management expressed:

“The introduction of the virtual asset spot ETFs not only provides investors with new asset allocation opportunities but also reinforces Hong Kong’s status as an international financial centre and a hub for virtual assets.”

One notable aspect of Hong Kong’s spot ETFs is the adoption of the in-kind creation model. This model allows new ETF shares to be issued using bitcoin directly, enhancing market liquidity and facilitating uninterrupted trading flows. Patrick Pan, CEO of OSL Digital Securities, highlighted the significance of this mechanism, stating:

“The in-kind subscription model for the spot BTC and ETH ETFs in Hong Kong represents a substantial innovation, this mechanism enhances market liquidity by allowing the direct exchange of the asset for ETF shares, reducing reliance on cash settlements and facilitating uninterrupted trading flows, this principle is essential for ensuring market stability and is consistent with practices in both digital and traditional asset ETFs.

He mentioned that while the exact dates haven’t been finalized yet, everyone involved is working hard to speed up the launch process. Pan anticipate that once these ETFs are introduced, there will be a notable increase in investment flowing into the digital asset market in Hong Kong.

Market Reaction and Institutional Demand

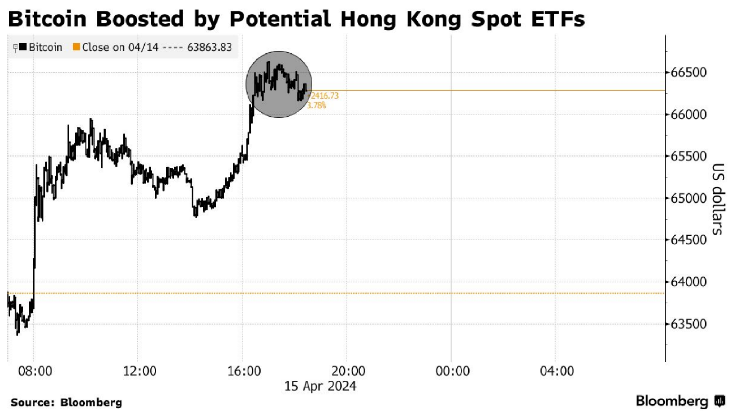

The news of Hong Kong’s approval of spot Bitcoin ETFs has had a positive impact on the market as bitcoin price rose by as much as 4.3%. The anticipation of institutional demand during Asia trading hours has also fueled optimism among market participants. QCP Capital, a Singapore-based digital assets trading house, believes that the ETFs, when approved, will unlock institutional demand and provide investors with an Asia-based alternative for exposure to digital assets.

QCP noted:

“Participants who wanted exposure have always been limited to US hours, but this now gives institutional investors an Asia-based alternative […] We believe this will be bullish short term, but there are more important narratives and drivers such as macro events.”

Hong Kong’s Ambitious Goals

Hong Kong’s ambition to become a global digital asset hub is evident in its efforts to attract digital asset firms and investors. With the granting of licenses to platforms like HashKey and OSL, Hong Kong is positioning itself as a leading destination for Bitcoin-related activities. The approval of spot ETFs further solidifies Hong Kong’s reputation as a modern financial hub and demonstrates its commitment to innovation and growth in the digital asset space.

The approval of spot Bitcoin ETFs in Hong Kong marks a significant milestone in the region’s journey towards embracing the digital asset. With conditional approvals granted to leading asset managers, Hong Kong is poised to become Asia’s first major financial center to accept bitcoin as a mainstream investment tool. The move not only reinforces Hong Kong’s status as an international financial hub but also underscores its commitment to fostering innovation and growth in the digital asset industry.