Bitcoin’s rapid evolution as a financial instrument continues to gain momentum, with a wave of institutional interest, innovative derivatives, and record-setting activity.

Recent developments in Bitcoin Exchange-Traded Funds (ETFs) and their associated options markets are reshaping how investors engage with the world’s largest digital asset.

The launch of options trading for BlackRock’s iShares Bitcoin Trust (IBIT) marked a significant milestone in bitcoin’s integration into traditional finance.

Within the first 60 minutes of trading on the Nasdaq, IBIT options saw an impressive 73,000 contracts exchanged, a performance that landed it among the top 20 most active non-index options.

By the end of the day, the notional exposure exceeded $1.9 billion—a record-breaking debut for any ETF options product. Eric Balchunas, Bloomberg’s senior ETF analyst highlighted this event, stating:

“$1.9 billion is unheard of for day one. For context, $BITO did $363m and that’s been around for four years. And also this is with 25,000 contract position limits. That said, $1.9b isn’t quite big dog level yet tho, eg $GLD did $5b today, but give it a few more days/weeks.”

The activity underscores the growing interest in Bitcoin among institutional investors, who now have more sophisticated tools to manage the scarce digital asset’s notorious volatility.

Other analysts agreed with Balchunas, highlighting the impressive level of engagement on the first day of options trading for IBIT.

Bloomberg ETF analyst James Seyffart stated, “Final tally of IBIT’s first day of options is just shy of $1.9 billion in notional exposure traded via 354,000 contracts. These options were almost certainly part of the move to the new Bitcoin all-time highs today.”

Ran Neuner, a former host on CNBC Africa, attributed today’s market surge to the introduction of IBIT options. “As traders buy these options, market makers buy the spot ETF to hedge the trade.”

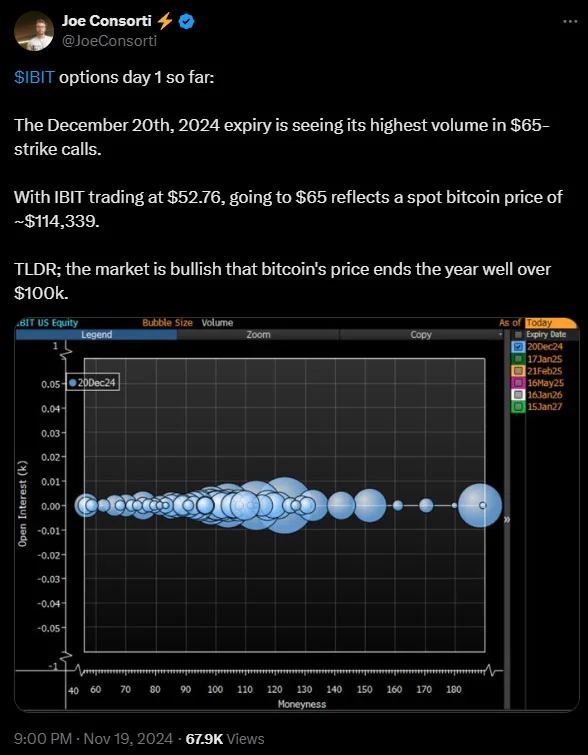

Joe Consorti, Head of Growth at Theya, a bitcoin self-custody app, highlighted on November 19 that the contracts are significant, as spot BTC ETFs “opens the doors to the largest and deepest liquidity pools on the planet.” He mentioned, “The market is bullish that Bitcoin’s price ends the year well over $100k.”

BRN lead analyst Valentin Fournier explained:

“The introduction of IBIT options is a watershed moment. It provides institutions with sophisticated tools for hedging and speculative strategies, which is key for sustaining Bitcoin’s upward trajectory. Liquidity is the lifeblood of any mature asset class, and these options are injecting exactly that into the market.”

He argues that bitcoin’s positive outlook is supported by strong fundamentals, including ETF-related inflows and the launch of the options market, signaling a shift from accumulation to a potential breakout.

If momentum continues, he believes bitcoin could reach $120,000 by early 2025. The bitcoin options market is still developing, but early signs indicate it could have a transformative impact.

Fournier added that as adoption increases, options data will become crucial for understanding market sentiment and guiding investment decisions. The next step, in his views, is integrating these tools into broader portfolios, solidifying bitcoin as a key asset class.

Analysts at QCP Capital view this development as a gateway for more institutions to enter the bitcoin market. “This is poised to attract a new wave of institutional investors who face restrictions on accessing native crypto options markets like Deribit,” the Singapore-based trading firm stated.

Bitcoin ETFs provide a simplified and regulated way for traditional investors to gain exposure to bitcoin without holding the asset directly. Now, the introduction of ETF options expands these opportunities, enabling strategies like hedging and yield generation.

Nasdaq’s debut of IBIT options is not just a one-off event.

Grayscale Investments, another major player in the Bitcoin ETF space, is quickly following suit. Grayscale announced plans to launch options for its Bitcoin Trust (GBTC) and Bitcoin Mini Trust (BTC), employing strategies like covered calls to generate income.

Bitcoin’s recent price stability above $90,000 and hitting a new peak of $98,361, has set the stage for further optimism. Analysts point to the December $100,000 strike options holding the “highest concentration of open interest,” signaling market confidence in bitcoin’s continued growth.

Meanwhile, traditional financial giants like Vanguard have significantly increased their stakes in bitcoin-related assets. Recent filings revealed that Vanguard boosted its holdings in MicroStrategy—one of the largest institutional bitcoin holders—by an astonishing 1,000% during Q3.

Beyond trading volume, the new wave of Bitcoin ETF options is expected to mature the overall market and bring more stability.

Economist Noelle Acheson highlighted the recent debut, noting that while bitcoin has an active derivatives market, its U.S. presence is small and mainly involves institutional investors.

Expanding this market domestically could enhance market sophistication, bolster investor confidence, and attract more participants. He argued that this growth would also enable diverse investment strategies, potentially reducing bitcoin’s volatility and downside risks over time.

Derivatives markets often grow to exceed the size of their underlying assets, as highlighted by QCP Capital. They anticipate that bitcoin’s derivatives market could scale similarly, expanding investment opportunities and liquidity.

The surge of activity in Bitcoin ETFs and their options is part of a larger trend of institutionalization in the bitcoin market. As bitcoin continues to break price records and gain acceptance in traditional financial markets, its role as a legitimate investment asset is becoming increasingly clear.

With bitcoin’s price nearing $100,000 and derivatives markets gaining traction, the digital asset is entering uncharted territory. The next phase of growth will likely be driven by this fusion of traditional finance tools with the innovative, decentralized potential of Bitcoin.

This recent wave of developments signals that bitcoin is no longer just a speculative asset—it’s becoming a fundamental part of the global financial system. From institutional investments to groundbreaking ETF options, Bitcoin’s journey is only beginning.