Digital assets, notably Bitcoin, are assuming an increasingly pivotal role, especially as major central banks grapple with challenges amid inflation 2024 outlook. Against the backdrop of the Federal Reserve, the European Central Bank (ECB), and the Bank of Japan (BoJ) navigating economic storms, the focus has shifted to Bitcoin’s potential resilience.

Spot Bitcoin ETF Approval Impact

Interestingly, a mere week after the United States Securities and Exchange Commission (SEC) approved 11 spot Bitcoin Exchange-Traded Funds (ETFs) by major financial giants, the landscape witnessed a shift in BTC investor demand, marking a crucial inflection point.

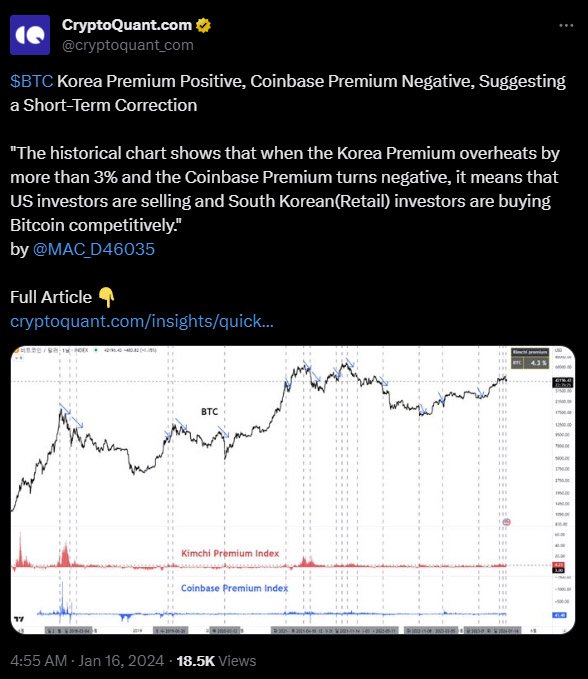

A weekly report from market intelligence platform CryptoQuant unveils a nuanced perspective, indicating weakened demand among U.S. investors, particularly evident in Coinbase’s premium turning negative for the first time in 2024.

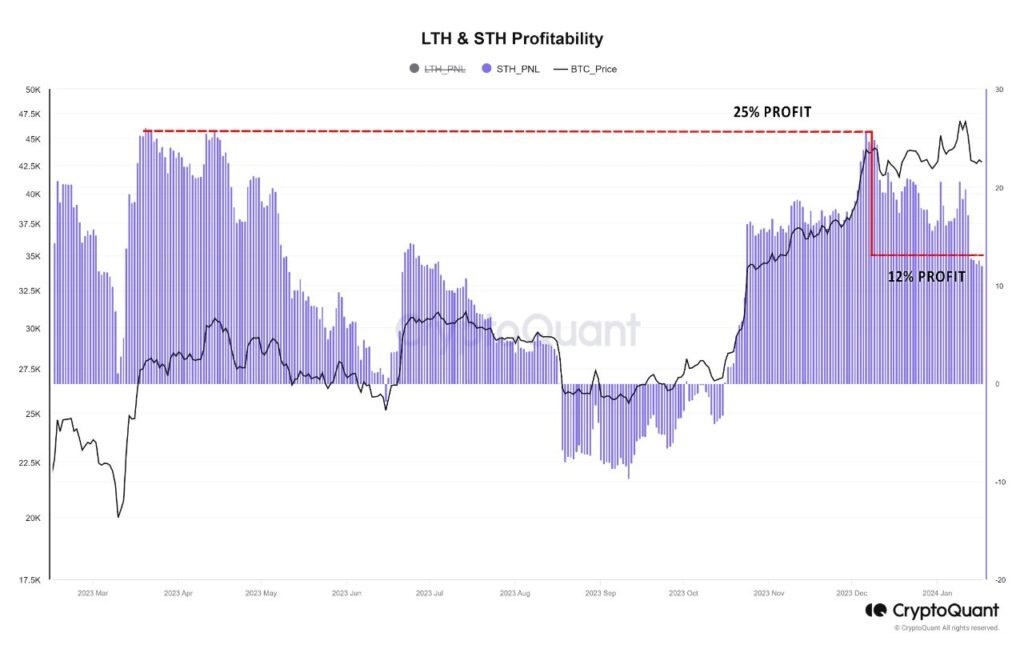

This coincides with heightened selling activity among short-term holders, bringing about downward pressure on BTC prices.

According to the report, the approval of spot Bitcoin ETFs, anticipated with enthusiasm, turned out to be a “sell-the-news” event. The event led to high over-the-counter transfer volumes running into billions of dollars on Coinbase.

The ensuing negative premium and record volumes triggered a downward price pressure, causing BTC to lose around 15% of its value, dropping from $49,000 to $41,500.

Presently, the market shows signs of cautious sentiment, with short-term investors and significant BTC holders adopting a “risk-off” attitude. CryptoQuant interprets this as a signal that investors’ BTC flow to derivative exchanges is stagnant at the moment, indicating an inclination toward potential price corrections.

Despite the recent BTC price dip, unrealized profit margins remain notably high, suggesting that the Bitcoin market may not have reached a price bottom. CryptoQuant’s prediction suggests a possible downturn to $32,000, the short-term holder’s realized price, influenced by traders who paid substantial amounts to open long positions before the ETF approval.

Inflation 2024: Upcoming Economic Indicators

As the market navigates these dynamics, the upcoming week holds critical economic indicators in the United States, Europe, and Asia, potentially influencing Bitcoin’s trajectory.

In the U.S., private sector Purchasing Managers’ Indexes (PMIs), core durable goods orders, Q4 GDP, and unemployment claims will be closely monitored, with potential ramifications for the likelihood of a March Fed rate cut.

Simultaneously, in Europe, preliminary private sector PMIs for France, Germany, and the Eurozone will be influential, guiding discussions within the European Central Bank (ECB). The bank can explore interest rate reductions if it sees a decrease in input costs and service sector activity.

On the other hand, the United Kingdom’s focus on services sector PMI figures could impact deliberations on a potential interest rate reduction by the Bank of England.

Potential Impact on Bitcoin

Drawing from historical data, it is observed that the initial phases of a Federal Reserve rate cut cycle, intended to stimulate the economy, often coincide with the nation teetering on the brink of a recession.

A recession, defined by a prolonged economic downturn and a surge in unemployment, tends to erode investors’ risk appetite. This leads to a deflation of asset prices when left to market forces. To counteract these effects, central banks frequently resort to monetary stimulus measures.

During this period, a brief yet significant rally occurs in the U.S. dollar, which, being a prominent global reserve currency, plays a substantial role in global trade and international debt. When the value of the dollar experiences a surge, people who borrowed money in dollars have to pay more to cover their debts.

This uptick in expenses tightens financial conditions, prompting investors to curtail their exposure to risky assets like bitcoin.

As Bitcoin confronts headwinds and investor caution persists, its resilience amid macroeconomic uncertainties remains a focal point, shaping the ongoing narrative of digital assets in the broader financial landscape.