Euro zone producer prices surged more than expected in March as energy prices more than doubled year-on-year, data showed today. Eurostat, the European Union’s statistics office revealed prices at factory gates within the eurozone jumped 5.3% month-on-month for a 36.8% year-on-year surge.

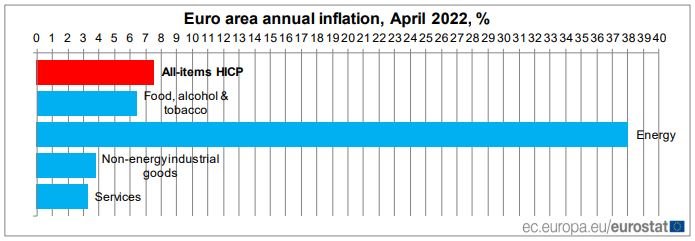

With this in increase that has never been recorded before, inflation levels continue to soar in Europe placing increased pressure on the European Central Bank to raise interest rates. Annual inflation hit 7.5% in April setting a record all-time high.

The effects of such a possible emergency rate hike are discussed by economists around the world as it could introduce a time of economic cleansing and usher into recession.

Energy crisis cuts supply

Bloomberg quoted European Central Bank Vice President Luis de Guindos as saying, “Price increases will most likely remain high over the coming months, mainly because of the sharp rise in energy costs.” According to Eurostat, energy reached a 38% increase. Western European response to Russia’s involvement in Ukraine is resulting in instability in the energy markets.

Fear continues to rise with natural gas being cut off to Bulgaria and Poland. Fuel shortages combined with unpredictable food supply and continued pandemic recovery raise uncertainty in the euro region.

The Netherlands inflation numbers appear particularly alarming at 11.2%; however, this is partly a result of how the Dutch utility data is calculated.

While fear and uncertainty continue to rise, people will likely continue to seek stability to secure their future. Bitcoin will certainly be a strong consideration for many as to where to store wealth in times of record-breaking inflation. High inflation can be a good reason for people to investigate hard money. Countries that experienced hyperinflation recently such as Venezuela or Argentina have been on the forefront of adoption as people are looking for alternatives.

Real estate prices have indicated inflation too. The comparison of European member states show that house prices went up over 20% in most countries, and over 100% in Lithuania, Austria, Czech Republic and Latvia. Are people trying to protect their money by buying real estate?

Skeptics of the Euro and fractional reserve banking have predicted the final fiat currency crisis in the EU for many years. “Solving the problems caused by printing money by printing more money doesn’t work”, so the anti-money-printing wisdom. But central bankers such as Christine Lagarde have shown that they can print money for a long time. And we all remember the famous announcement made by Mario Draghi “whatever it takes”. There is no magic. The show must go on and the only way to keep it going is by printing money. The european central bank discusses “going full zimbabwe” openly in a working paper with the title “Whatever it takes: what’s the impact of a major nonconventional monetary policy intervention?”

Meanwhile, the ECB’s balance sheet equals to 82% of Eurozone GDP.. The balance sheet of the Bank of Japan equals 137% of the GDP. Is the ECB on the way to the 100-140% range?

Consumers are the ones to bear the cost for the largest financial experiment in recent history. Their governments use taxpayer’s money to service debt. Debt that voters may never agreed to. But voters are now expected to deal with higher prices.

Bitcoiners are warning about the risks of paper currency since the birth of bitcoin. With bitcoin, they believe, a fair monetary system can be built. And they seek protection from the wealth transfer that inflation causes.