According to a recent report published by Bybit, institutional traders‘ behaviors in the digital assets market have been changing throughout 2023. The report concludes that many traders have massively shifted their investments from altcoins towards Bitcoin.

The study, focuses on 3 different classes of traders: Institutional traders (INS), individual traders with a capital of $50,000 or more(VIP), and the rest of the traders (Retail Traders). It also divides the assets into 4 categories: Bitcoin, Ethereum, Stablecoins and altcoins.

Institutional Traders: Bitcoin Dominance and Altcoin Skepticism

According to Bybit Research, institutional traders have been heavily favoring Bitcoin throughout 2023, nearly doubling their BTC holdings in the first three quarters of the year.

This surge was driven by positive market sentiment and anticipation of the Securities and Exchange Commission (SEC) approving a Spot Bitcoin Exchange-Traded Fund (ETF) in the U.S. Institutions maintained about half of their assets in BTC, contrasting sharply with retail traders who held lower BTC amounts, possibly due to higher leverage levels.

Ethereum’s Rollercoaster Ride: Institutional Interest on Decline

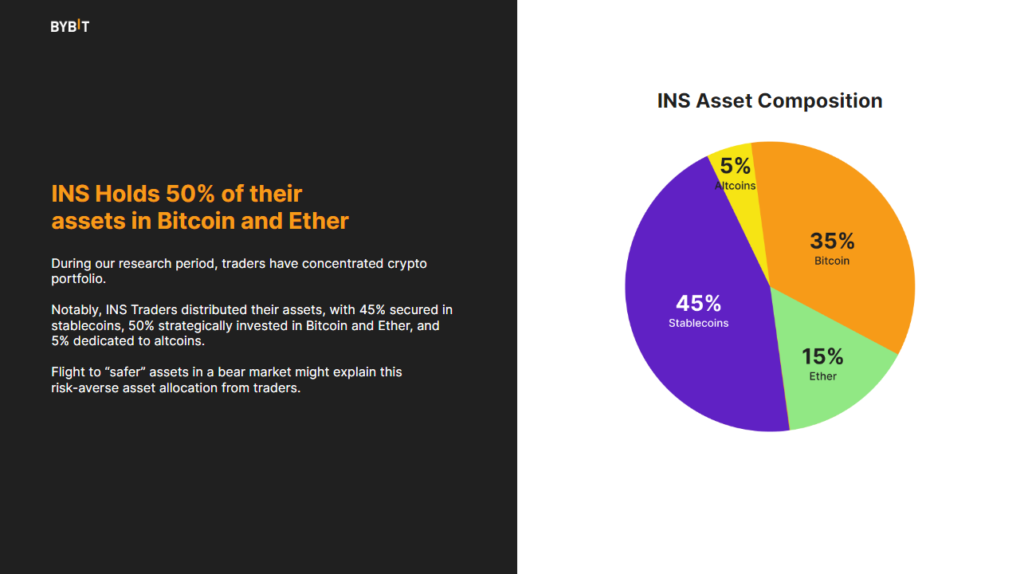

Institutions currently maintain a portfolio consisting of stablecoins, Bitcoin, Ethereum, reflecting a focus on liquidity and strategic diversification. Notably, their BTC holdings have nearly doubled in the first three quarters of 2023.

Related reading: Could BlackRock Bitcoin ETF be Affected by Stablecoins?

While there has been a decline in institutional interest in Ethereum, the potential launch of a BlackRock Spot Ethereum ETF and other market developments might reverse this trend. According to the report, some institutions have recently begun allocating funds to Ethereum since September 2023.

Some analysts believe that this rise in interest in Ethereum after its decline, could possibly be driven by a general positive sentiment toward “crypto”, contrasting with the reduced interest from VIP and retail traders following the Ethereum Network’s Shapella upgrade.

Related reading: FED probes Stablecoin issuer Tether in 86-Page Denial Order

Institutions Skeptic About Altcoins

Bybit’s data revealed a cautious stance among institutions and whales towards altcoins. There was a consistent decline in altcoin holdings among traders, with a notable decrease starting in August, indicating a broader trend of skepticism among institutions toward these more volatile assets.

Institutions demonstrated a lack of interest in altcoins and a stronger allocation toward BTC, accounting for half of their asset portfolios in September, according to Bybit’s recent research. The positive market sentiment towards Bitcoin, fueled by potential ETF approvals and favorable lawsuit outcomes, contributed to this focused investment strategy.

Shifting Strategies and Allocation Patterns

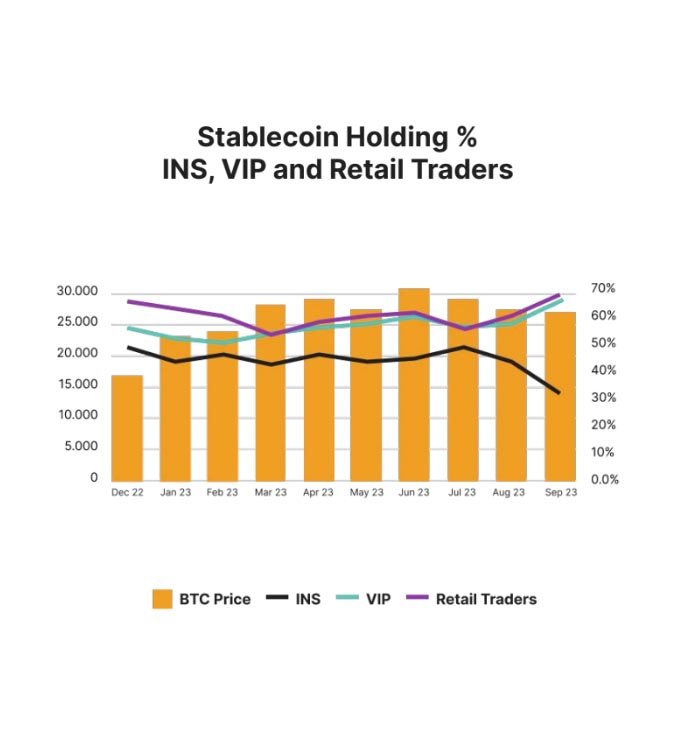

Bybit’s comprehensive analysis highlighted how different trader cohorts adjusted their strategies in response to market fluctuations. Institutional traders predominantly held 45% in stablecoins, with 35% in BTC and 15% in ETH. This approach emphasized liquidity management strategies, highlighting institutional investors comfort with stablecoins, possibly because of Bitcoin’s volatility. Although the trend in stablecoins preference seem to be on the decline too.

The fact that 35% of the funds is allocated to BTC, shows investors desire to be exposed to bitcoin’s high gains.

Nevertheless, retail traders were observed to be more cautious, maintaining higher proportions of their portfolios in stablecoins compared to institutions. They exhibited a more conservative approach to risk, whereas institutions showcased a dynamic strategy, optimizing their allocations based on market trends.

The Digital Asset Landscape is Changing

The digital asset market’s dynamics have evolved significantly throughout 2023, witnessing institutional traders doubling down on Bitcoin while exercising caution with altcoins. Ethereum experienced fluctuations in institutional interest, and stablecoins played a crucial role in risk management strategies for both retail and institutional traders.

In summary, institutional investment behavior in this realm has been dynamic and strategic, shaped by regulatory developments, market sentiment, and asset performance. As we head into 2024, these trends provide valuable insights into how institutional players navigate and adapt within this ever-evolving market.