The liquidity growth in Iran broke a 50-year record in the past year amid rampant inflation.

The “Mehr” news agency, in its report on this news, cited the rapid growth of liquidity as a significant factor contributing to worsening of inflation and the shrinking of people’s purchasing power and stated that its management should be a top priority for the thirteenth government.

According to Mehr news agency’s reporter, one of the most important indicators for measuring the size of an economy for economic policymaking is the liquidity available in the country. This concept, which refers to the total volume of banknotes and credits held by individuals in banks, has, with its unprecedented growth, created unstable conditions for the Iranian economy.

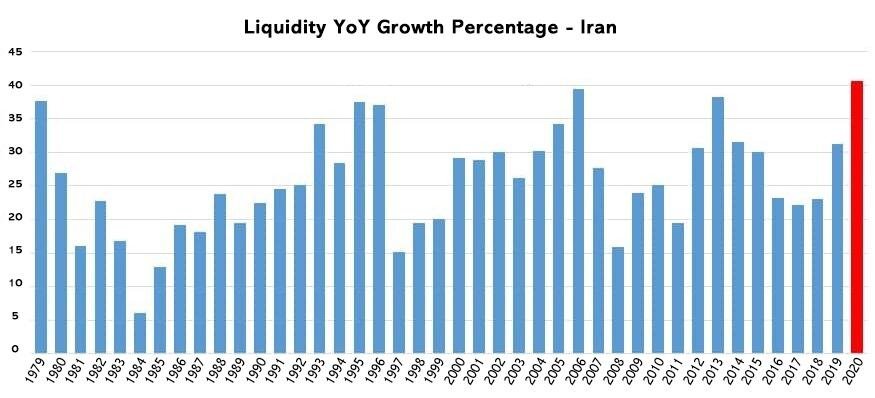

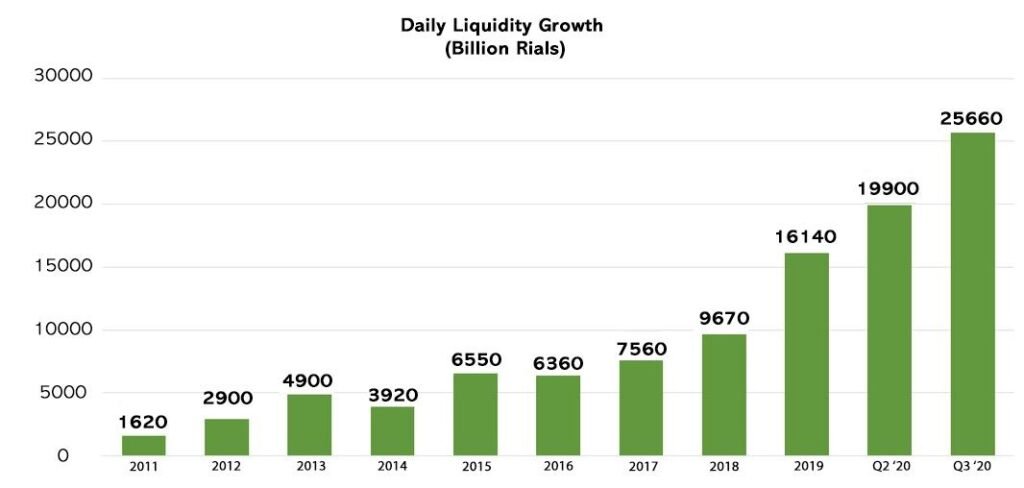

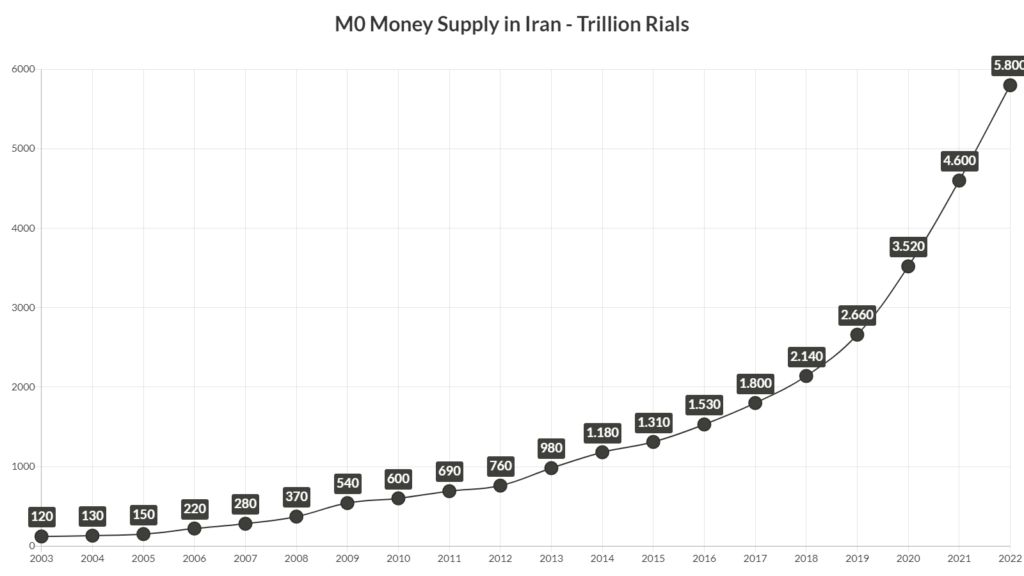

After the Islamic Republic’s revolution in Iran, liquidity in the economy has increased by an average of about 25% annually, and in the year 2020, liquidity growth broke the records by jumping 40% in a year. According to the latest published statistics, the total liquidity volume in the country was estimated to be around 35,000 trillion Rials at the end of 2020, which is an unprecedented record compared to previous governments.

During the eight years of Rouhani’s presidency (2013 – 2021), the liquidity figure increased from 4600 trillion Rials to 34,210 trillion Rials by the end of 2020, marking the highest rate of liquidity increase in the past fifty years.

What is Liquidity Growth ?

The article explains that liquidity in a country is typically created by banks and the monetary base is a part of it. In other words, when banks provide loans to individuals, companies, or institutions, they create obligations that require the creation of new money to fulfill.

The report states that this new money, however, is not in the form of physical banknotes but rather in the form of various credits and facilities provided to individuals. And since the central bank has not exerted effective supervision over banks, the creation of money in banks has accelerated significantly.

Related reading : Is Leveraging Legacy Assets To Buy Bitcoin A Good Strategy?

Furthermore, according to the country’s formal law, the central bank is not an independent entity but operates under the government’s supervision. This situation turns the central bank into a powerful and secure financial source for government expenditures.

These circumstances have led to a significant portion of credits and securities in the economy being allocated to unsustainable projects or used to cover the government’s outstanding expenses.

The liquidity volume, on its own, doesn’t convey any specific meaning unless we examine it alongside other economic indicators. One of the indicators that has a direct relationship with this monetary variable is the inflation rate.

Inflation in Iran

According to the latest statistics announced by the Central Bank of Iran, Iran’s inflation rate in the past year stood at 46.5%, which is 0.3% higher than the previous year’s inflation rate. Iran also experienced high inflation in the year 2020, with a rate of around 47.1%.

However, in the second year of the current government’s activity, the inflation rate broke the records of previous years and still remains above the 40% range. President Raeisi, the head of the thirteenth government in Iran, had promised to reduce the inflation rate. It is important to note that in the official statistics provided by government authorities, a 20% reduction in the inflation rate has also been mentioned several times.

In recent years, inflation has become one of the most significant economic crises in Iran. Iran is experiencing one of the highest inflation rates in the world.

Although the inflation rate in 2022 has been estimated at 46.5%, the Chamber of Commerce has emphasized in an extensive report that, based on the latest data from the Statistical Center of Iran and taking into account a monthly inflation rate of 6% for February 2020, the inflation rate for the entire year of 2021 for Iranian households, is estimated to be around fifty percent. That is higher than the Central Bank’s figure, and it also indicates a 10 percentage point increase compared to the inflation rate in 2021.

The highest recorded inflation rate since the Islamic Revolution in 1979 has been 49.4%. Although analyses show that inflation has been in single digits only in four years during the past 44 years, the current period of inflation is one of the most peculiar inflationary periods in the last four decades.

During this period, two governments have been in charge. Iran’s inflation rate has been on rapid rise since 2019 and has experienced rates exceeding forty percent. The simple average inflation rate over the forty-five years studied, from 1978 to the end of 2022, is 21.1%, and the highest frequency of inflation rates between 10% and 20% occurred during the last twenty years.

In other words, for four consecutive years, from 2019 to the end of the past year of 2022, the inflation rate has remained above forty percent, marking the longest duration of inflation within this range.

According to many Iranian economic experts, the most significant cause of inflation in recent decades is the budget deficit and the increase in liquidity to cover partial deficits.

Additionally, the structural increase and escalation of government expenses have not only failed to reduce the government’s borrowing from the central bank but also contributed to its continued growth.