Italy is set to increase its capital gains tax on Bitcoin and other digital assets from 26% to 42%, a move that has sent shockwaves through both local and international bitcoin markets.

The announcement, made by Deputy Finance Minister Maurizio Leo during an October 16 conference, forms part of a larger budget plan aimed at raising additional revenue for public services and curbing the country’s fiscal deficit.

The decision has ignited strong reactions from bitcoin investors and industry leaders, many of whom are worried about its potential consequences on Italy’s digital economy.

Currently, Italy imposes a 26% tax on capital gains on revenues made from bitcoin trades and investments. However, under the new proposal, the tax would be raised to 42%.

This sharp increase targets larger investors and high-value transactions as part of Italy’s broader fiscal strategy.

The Digital Services Tax (DST) now targets companies with annual global revenues of at least 750 million euros ($817 million) and at least 5.5 million euros ($5.9 million) in income from digital services provided in Italy. Leo explained during his announcement:

“As this phenomenon (Bitcoin) is spreading, we expect the withholding tax to increase from 26% to 42%.”

The government justifies the decision by pointing to the increasing popularity of Bitcoin among Italian investors.

With more people turning to digital assets, Italy sees this as an opportunity to generate additional tax revenue to fund public services such as healthcare and support for the most vulnerable populations.

The proposed tax hike has sparked concern among Italy’s Bitcoin community and broader market observers. Many worry that the 42% tax rate will make Italy one of the most heavily taxed countries in Europe for bitcoin investments.

Bitcoin users have expressed fears that this increase could stifle growth in the sector and push investors to move their assets to other countries with more favorable tax policies.

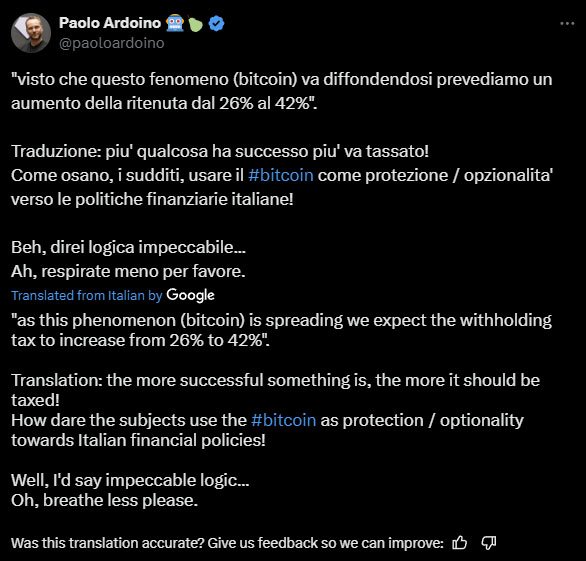

The CEO of Tether, Paolo Ardoino, was particularly vocal about the potential consequences of the tax increase. He shared his criticism on social media with a hint of sarcasm, suggesting that many bitcoin investors would consider leaving Italy for countries with friendlier tax environments.

“How dare [Italians] use Bitcoin as protection or a hedge against Italian financial policies,” Ardoino commented sarcastically, hinting at the frustration many in the Bitcoin space feel.

There is concern that this tax increase could lead to an exodus of bitcoin investors from Italy. Similar tax hikes in other countries, such as India, have resulted in significant drops in trading volumes as investors turned to offshore platforms to avoid the high tax burdens.

The proposed tax hike comes at a time when the European Union is preparing to implement the Markets in Crypto-Assets Regulation (MiCA), a set of rules aimed at creating a unified regulatory framework for digital assets across the EU.

Italy’s decision to raise its capital gains tax on Bitcoin aligns with the broader trend of increased regulation in this space.

While MiCA focuses on improving transparency and consumer protection in the market, Italy’s new tax policy targets high-value investors and large-scale Bitcoin transactions.

The Italian government hopes that these measures will help boost the country’s revenue while aligning with European standards for regulating digital assets.

While the tax hike is aimed at raising revenue for the government, there are concerns about its potential impact on Italy’s digital economy.

Critics argue that the 42% tax rate may discourage new investors from entering the market and prompt existing ones to move their operations to countries with lower tax rates.

If bitcoin investors seek out more favorable jurisdictions, Italy could lose a significant amount of capital and innovation in the digital space.

According to industry observers, Italy’s decision could influence other European countries as they consider how to tax digital assets. Should Italy’s approach prove successful in generating revenue, other nations may follow suit with similar tax policies.

However, some countries may opt to take the opposite route, promoting more favorable tax environments to attract bitcoin investors.

One key concern is that the increased tax load will make Italy less competitive compared to other European countries with more lenient tax policies. This could lead to a “brain drain,” with both talent and investment leaving Italy for more Bitcoin-friendly nations.

Related: El Salvador Removes Tax for Foreign Investments and Money Transfers

The announcement followed the Italian government’s approval of a €30 billion ($33 billion) budget for 2025, which will be partially financed by a tax on Italian banks and insurance companies.

Prime Minister Giorgia Meloni has previously reassured citizens that there would be no widespread tax hikes under her leadership. However, the new Bitcoin tax plan has drawn criticism from some, who feel it contradicts her earlier promises.

Despite this, the government appears committed to its broader fiscal goals, which include raising 3.5 billion euros from banks and insurance companies to support public services.

In an X post on October 15, Meloni reiterated her government’s focus on directing funds towards healthcare and vulnerable citizens, highlighted her government’s commitment to not raising taxes for citizens.

As Italy moves forward with its plan to increase the capital gains tax on Bitcoin, the effects of this decision will likely be felt across the European Bitcoin landscape. Whether Italy’s tax strategy succeeds in raising the intended revenue without driving away investors remains to be seen.

For now, the proposal has left many Bitcoin enthusiasts and investors reconsidering their options.