Bitcoin, the world’s leading digital asset, has been a subject of intense speculation regarding its potential market cap growth. Fidelity Investments, a prominent financial firm, has weighed in on this debate, suggesting that Bitcoin could achieve a market capitalization of $6 trillion. The analysis provided by Fidelity’s Director of Global Macro, Jurrien Timmer, explores the factors driving this bold prediction.

Jurrien Timmer Comparing Bitcoin to Monetary Gold

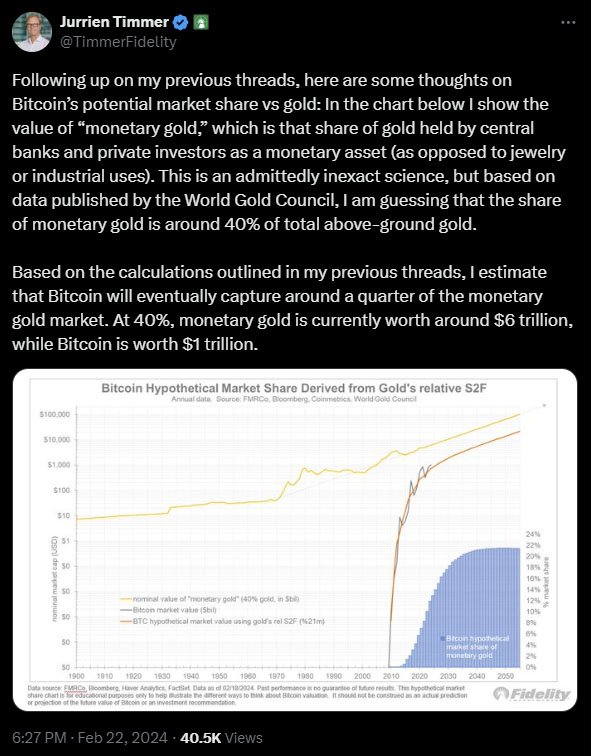

Timmer’s analysis draws parallels between Bitcoin and the “monetary gold” market, which encompasses gold held by central banks and private investors for monetary purposes. Currently valued at around $6 trillion, this market represents a significant portion of the global wealth. Timmer suggests that Bitcoin, with its finite supply and growing acceptance as a store of value, could capture a quarter of this market.

He stated:

“I estimate that Bitcoin will eventually capture around a quarter of the monetary gold market. At 40%, monetary gold is currently worth around $6 trillion, while Bitcoin is worth $1 trillion.”

Current Market Values and Potential Growth

Bitcoin’s current market capitalization stands at approximately $1 trillion, a fraction of the monetary gold market. However, Timmer believes that Bitcoin’s valuation could soar five-fold to reach the $6 trillion mark. This growth potential is fueled by the increasing recognition of Bitcoin’s role as a hedge against economic instability and currency devaluation.

Timmer also considers the impact of Bitcoin halving events on its price trajectory. Historically, these events, which reduce the rate of new bitcoin issuance, have led to significant price increases. However, Timmer suggests that the diminishing returns from future halvings could temper Bitcoin’s growth rate over time.

Related reading: Fidelity Exec. Jurrien Timmer: Bitcoin is “Exponential Gold”

Price Projections and Market Dynamics

To project Bitcoin’s future price, Timmer introduces a modified Stock-to-Flow (S2F) model that accounts for diminishing halving effects. This model aligns Bitcoin’s supply dynamics more closely with those of gold, leading to hypothetical price projections of approximately $100,000 by the end of 2024. However, Timmer acknowledges the inherent uncertainties in the bitcoin market, including regulatory changes and competition from other digital assets.

Strengths and Weaknesses of the Analysis

Timmer’s analysis highlights Bitcoin’s potential to reshape the global wealth distribution and emerge as a significant asset class. Factors such as scarcity, increasing adoption, and institutional interest support the bullish outlook for Bitcoin. However, there are also challenges and uncertainties, including market volatility and the evolving landscape of digital assets, which could impact Bitcoin’s journey to a $6 trillion market cap.

An X user stated that is outlook is bearish, highlighting Bitcoin’s “bottom-up” growth. He stated:

“Thes seems overly bearish. Demand for gold is globally on nation state level, however Bitcoin demand is growing from ‘bottom up’, people were first to adopt is not nations,”

Conclusion

Fidelity’s analysis underscores the transformative potential of Bitcoin in the financial landscape. While reaching a $6 trillion market cap would be a remarkable feat, Timmer’s insights provide valuable perspectives on Bitcoin’s trajectory. As the digital asset continues to gain traction as a digital store of value, its market cap growth remains a topic of keen interest and speculation among investors and analysts alike.

In summary, Fidelity’s analysis offers a compelling case for Bitcoin’s potential to reach a $6 trillion market cap, driven by its unique characteristics and growing acceptance in mainstream finance.