In a world where uncertainty seems to be the only certainty, Kalshi has emerged as a groundbreaking force in financial markets.

As the first CFTC-regulated exchange dedicated to event contracts, Kalshi isn’t just another trading platform—it’s reimagining how people predict and hedge against future events.

The company was founded in 2018 by Tarek Mansour and Luana Lopes Lara, two graduates of MIT.

Kalshi was born from a simple yet powerful observation: while working at financial giants like Goldman Sachs, Bridgewater, and Citadel, they noticed that many complex trading strategies essentially boiled down to betting on future events.

Why not create a straightforward way to trade directly on these outcomes?

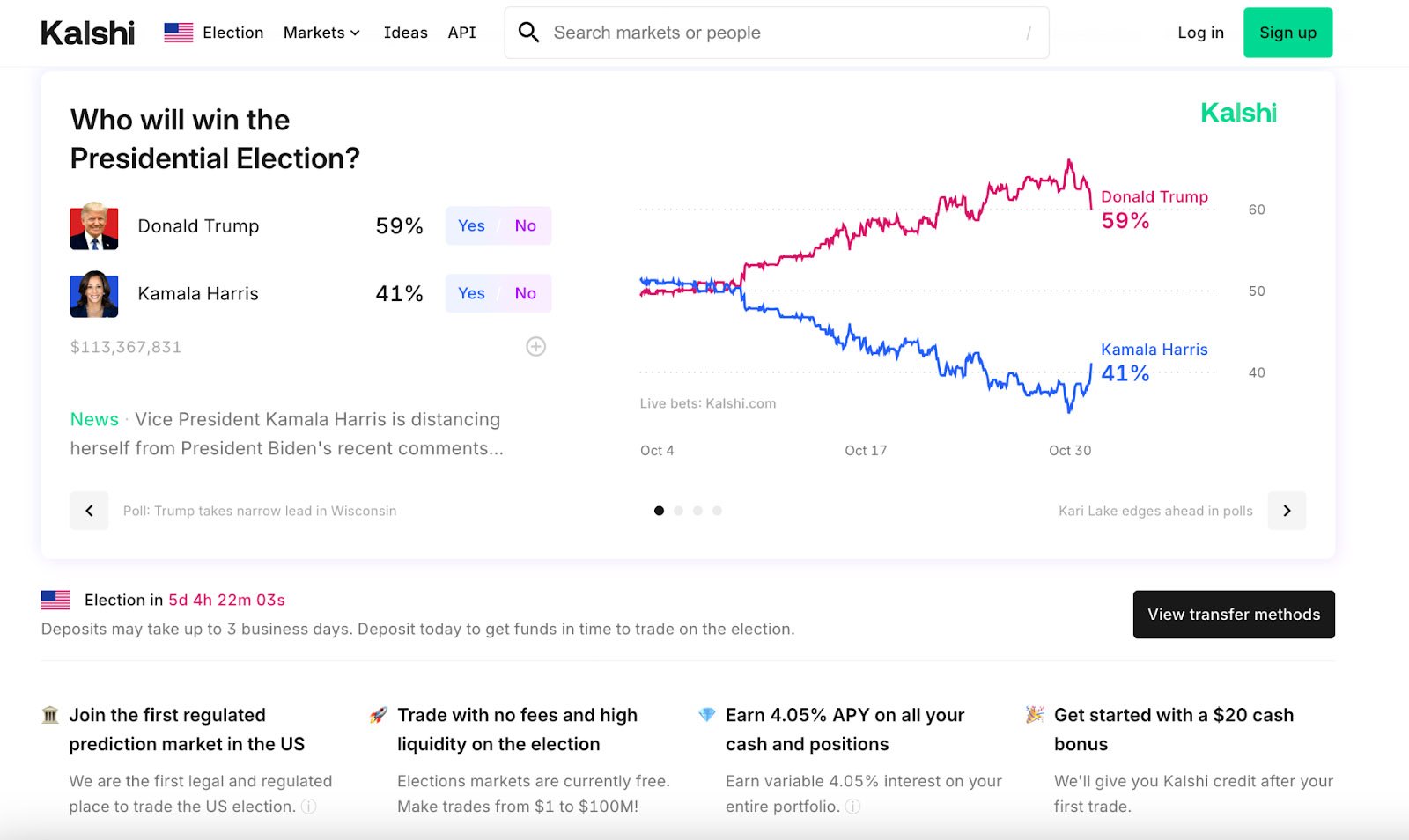

Unlike offshore prediction markets that operate in regulatory gray areas, Kalshi stands as the first legal and regulated platform for US election-related trading.

The platform has already processed over $100 million in trades for the upcoming presidential election, demonstrating robust market interest in regulated prediction trading.

Digital-First Architecture

Embracing modern financial infrastructure, Kalshi accepts USDC stablecoin deposits alongside traditional funding methods.

This integration of digital assets reflects the platform’s commitment to accessibility and efficiency. Combined with features like 4.05% APY on cash holdings and positions, Kalshi creates a compelling environment for both active traders and those seeking passive yields.

Kalshi’s event contracts span a diverse range of categories:

– Economic indicators (inflation, unemployment)

– Political events (elections, government shutdowns)

– Weather patterns

– Scientific advancements

– Traditional market indices

– They even have an ideas page for people to propose bets

What sets these contracts apart is their elegant simplicity: each represents a clear yes-or-no proposition, with prices reflecting the market’s assessment of probability.

Much like Bitcoin’s hotly debated power law models attempt to predict future price movements, prediction markets serve as forecasting tools—imperfect yet invaluable.

As Bitcoiners often jest, “past performance doesn’t guarantee future results, but it sure makes for interesting charts!” Similarly, Kalshi’s markets don’t promise perfect foresight, but they aggregate collective wisdom in fascinating ways.

Kalshi’s markets have shown remarkable predictive power. Their inflation and federal rate forecasts have consistently outperformed traditional economists and pundits over the past year.

This success highlights a fundamental truth about prediction markets: when people put real money behind their opinions, the resulting price signals often prove more accurate than conventional forecasting methods.

Risk and Reward

However, like any trading platform, Kalshi comes with inherent risks. While CFTC regulation provides important protections, it doesn’t guarantee profits or eliminate the possibility of losses.

The platform’s transparency about these risks—combined with features like small minimum trade sizes ($1) and new user bonuses ($20 credit)—creates an environment where participants can responsibly explore prediction markets.

Kalshi’s vision has attracted impressive backing from financial luminaries, including Sequoia Capital, Charles “Chuck” Schwab, and Henry Kravis. This support, combined with Y Combinator’s early backing, signals strong confidence in regulated prediction markets’ future.

Looking Ahead

As society grapples with increasing uncertainty—from global conflict to political upheaval—tools that help us understand and hedge against future events become increasingly valuable. Kalshi’s platform is a window into collective intelligence about tomorrow’s possibilities.

Kalshi stands at the intersection of traditional finance and innovative prediction markets, offering a glimpse into how we might better understand and prepare for future events.

While no crystal ball is perfect—just ask any bitcoin price predictor—Kalshi’s regulated approach to event contracts provides a valuable new tool for both retail and institutional traders seeking to navigate an uncertain future.

Whether you’re looking to hedge against personal risks, capitalize on your insights, or simply explore the fascinating world of prediction markets, Kalshi offers a regulated, accessible platform to engage with tomorrow’s possibilities.

After all, in a world where the only constant is change, having a stake in future outcomes makes things more interesting.

Note: Trading in prediction markets involves risk. Past performance of predictive models does not guarantee future results. While many seek to predict future outcomes, success typically requires both risk tolerance and a long-term perspective. Always conduct thorough research and consider your risk tolerance before trading.