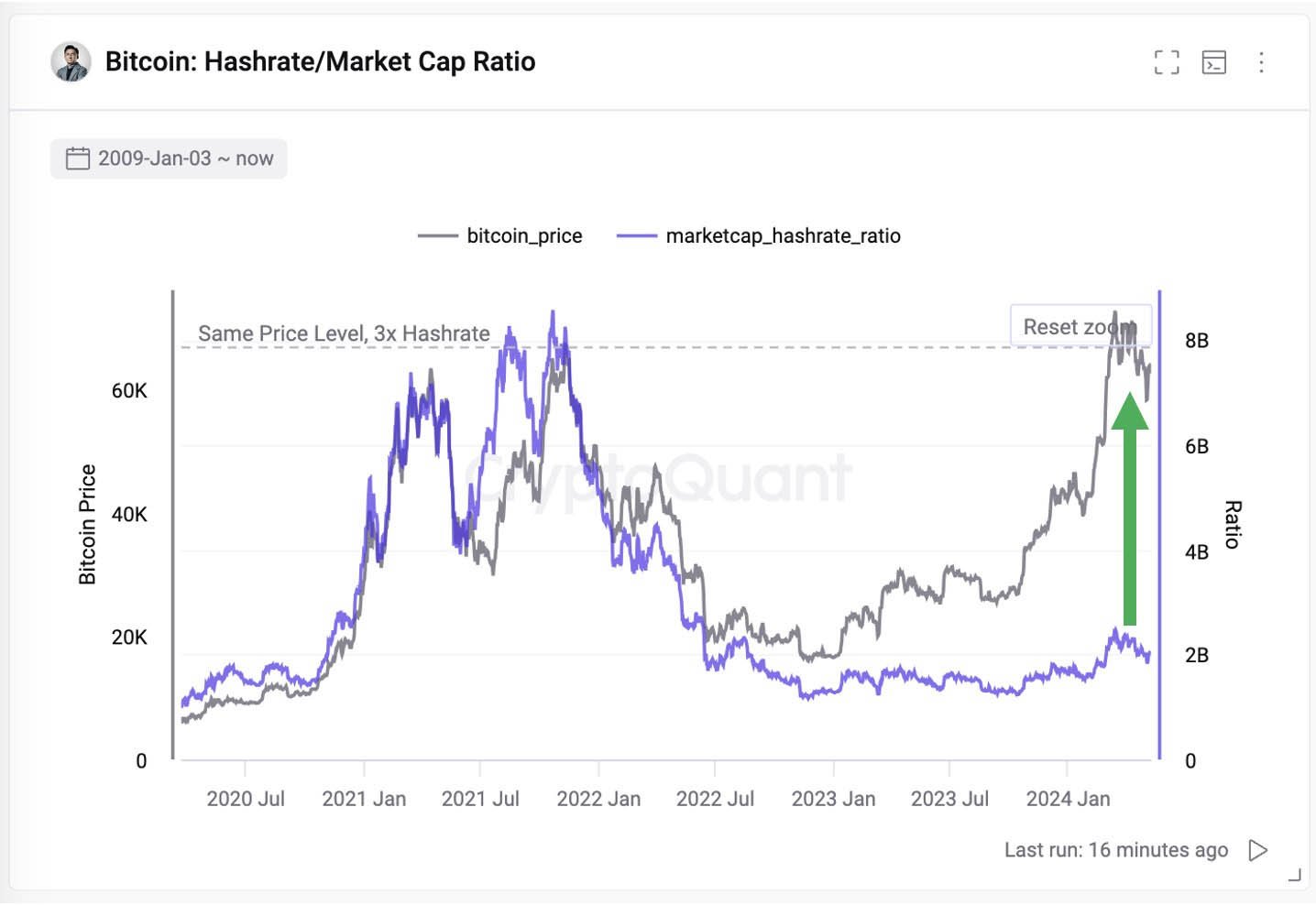

According to CryptoQuant CEO Ki Young Ju, the world’s leading digital asset could potentially surge to a remarkable $265,000.

To comprehend this bold prediction of bitcoin surge, it’s essential to delve into the underlying factors driving such optimism. Analysts have pointed to a combination of technical, macroeconomic, and network fundamentals aligning to propel bitcoin’s price to unprecedented heights.

Ki Young Ju’s analysis provides a unique perspective on bitcoin’s potential trajectory. He suggests that historical data and network fundamentals support the notion of bitcoin sustaining a market value three times its current size. In a tweet, Ju stated:

“The Bitcoin network could potentially support a market value three times its current size, which equates to a price of approximately $265,000.”

One of the key drivers behind the Ju’s optimistic price target is Bitcoin’s network fundamentals.

Bitcoin Surge to $265,000: Network Fundamentals

He emphasized the significance of Bitcoin’s hashrate-to-market cap ratio. This metric reflects the overall computing power dedicated to Bitcoin mining relative to its market capitalization. Ju suggests that the current network fundamentals could potentially sustain a price of $265,000.

The prospect of bitcoin reaching $265,000 represents a significant development in the already bullish market. While such projections ignite excitement among investors, it’s crucial to approach them with caution. As with any investment, thorough research and risk assessment are essential.

Bitcoin Bullish Pattern

Other technical analysts have also identified similar bullish patterns in bitcoin’s price charts, hinting at a potential rally.

According to Crypto Ceaser, an analyst, if certain patterns are confirmed, bitcoin could soar towards $273,693, a sentiment shared by Ju. These technical indicators suggest a positive trajectory for the bitcoin’s price in the coming months.

It’s worth mentioning that bitcoin hash rate has been facing draw backs recently. This drop could be allocated to the recent halving event, which cut miners’ rewards in half, reducing their profits.

In April, Hut 8, a leading Bitcoin mining company in North America, saw a 36% decrease in Bitcoin output after relocating 25,000+ mining machines. Despite the dip, this move indicates a focus on long-term efficiency.

Nevertheless, miners are actively expanding operations to stay profitable. Marathon Digital Holdings, for example, is broadening its reach, exploring Bitcoin mining opportunities in Kenya through talks with government officials.

Beyond technical analysis, macroeconomic and political developments also play a crucial role in shaping bitcoin’s future price action.

Standard Chartered’s head of FX and digital asset research suggests that a supportive regulatory environment, possibly under a second Trump administration, could lead to a price between $150,000 and $200,000 by the end of 2025.

Such assertions underscore the importance of considering broader economic trends when analyzing bitcoin’s potential.

Notably, options traders are also betting on significant price increases, with open interest data indicating confidence in targets like $80,000 by the end of May and $100,000 by the end of July.

This optimistic sentiment is fueled by various factors, including the recent Bitcoin halving, the introduction of new functionalities, and the potential for further developments in decentralized finance (DeFi).