The spot Bitcoin ETF market has recently faced a period of subdued activity, coinciding with a decline in bitcoin’s price. Despite this, there are indications that a resurgence may be on the horizon, as highlighted by insights from CryptoQuant CEO, Ki Young Ju.

Ki Young Ju Predicts Uptick in Inflows

Ju, a renowned analyst, has offered a nuanced perspective on the current state of the spot Bitcoin ETF market. He predicts a potential uptick in net flows for Bitcoin ETFs despite the ongoing downward trajectory of bitcoin’s price.

On March 22, Ju shared his observations on X, shedding light on the historical trends of net flows in relation to bitcoin’s price movements. He suggests that demand for Bitcoin ETFs tends to strengthen, stating:

“Demand may rebound if the $BTC price approaches critical support levels.”

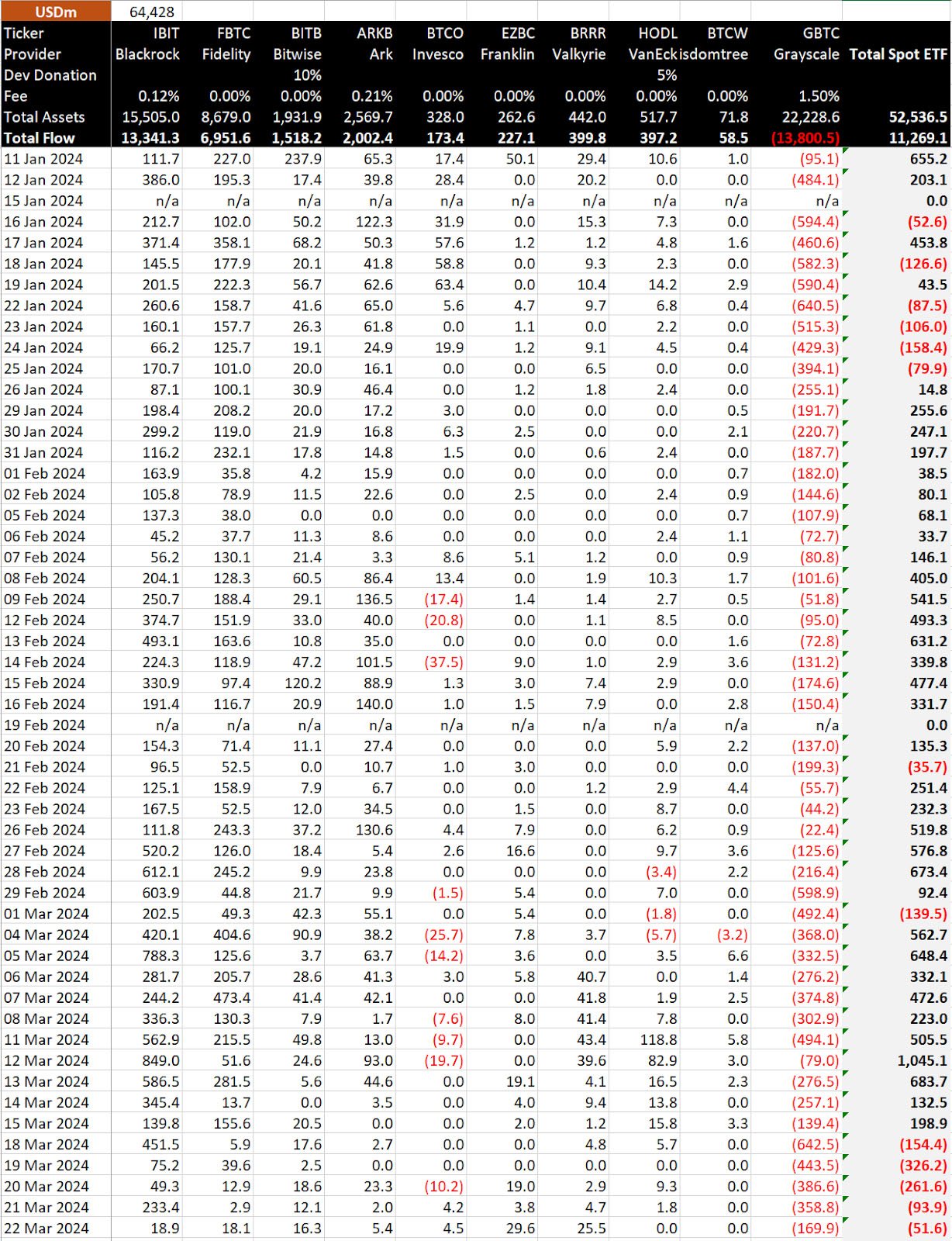

Notably, according to BitMEX Research’s data, Bitcoin spot ETFs have experienced net outflows for five consecutive days, totaling $154 million, $326 million, $261 million, $93 million, and $51 million, respectively, from Monday to Friday. Noteworthy among these trends are significant outflows from Grayscale’s GBTC and record-low inflows for other market leaders such as BlackRock’s IBIT and Fidelity’s FBTC.

A Crucial Level

Ju’s analysis delves deeper into the behavior of new BTC whales, particularly ETF buyers, who exhibit an on-chain cost basis of around $56,000. This insight implies that significant holders of bitcoin, notably ETF investors, have generally entered the market at an average price point of $56,000.

Moreover, Ju suggests that if bitcoin was to approach this price threshold, it could trigger substantial inflows into the spot Bitcoin ETF market. With bitcoin’s recent all-time high at $73,750, he forecasts a potential correction to as low as $51,000. Despite recent price fluctuations, ranging from $62,000 to $68,000, Ju believes that corrections of up to 30% are not uncommon.

Pre-Halving Retrace

Recent market movements support Ju’s analysis, with bitcoin experiencing a 13% drop from its new all-time high of $73,835 to briefly trade around $61,000. Analysts attribute this correction to overheated market conditions, colloquially referred to as a “pre-halving retrace,” in anticipation of the upcoming Bitcoin halving event, around 30 days away.

Despite these fluctuations, a report by CryptoQuant suggests that the Bitcoin bull cycle remains intact, citing the relatively low level of investment flows from new investors and price valuation metrics still below levels observed in previous market cycles. It states:

“Bitcoin has reached levels similar to mid-2019 (52%) when Bitcoin also experienced a meaningful correction.”

Future Outlook

Looking ahead, the impending Bitcoin halving event looms as a significant catalyst expected to bolster bitcoin’s price and potentially ignite a parabolic uptrend. CoinMarketCap’s halving countdown indicates that Bitcoin’s next halving event is less than 30 days away, further fueling anticipation within the bitcoin community.

While recent market dynamics may indicate a period of uncertainty for spot Bitcoin ETFs amid bitcoin’s price decline, insights from industry experts like Ki Young Ju suggest potential opportunities for resurgence. As the ETF market navigates these outflows, attention remains focused on the upcoming Bitcoin halving event and its potential impact on the asset’s price trajectory.