A new “cryptocurrency” backed by Argentina’s President, Javier Milei, skyrocketed in value before crashing hours later.

The Solana-based meme coin, called LIBRA, lost over 95% of its value, leaving investors in the red. The sudden dump has raised concerns of insider trading and fraud, with blockchain analysts revealing insiders cashed out millions before the price tanked.

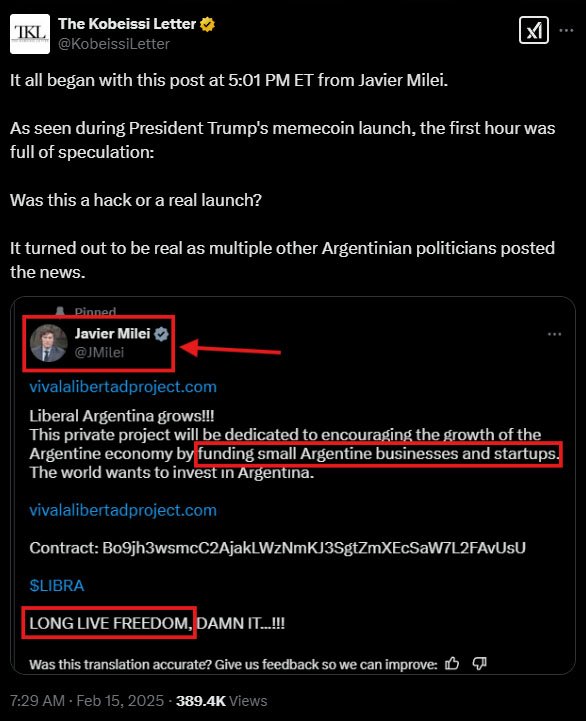

LIBRA was introduced as part of the Viva La Libertad Project, which claimed to support Argentina’s economy by funding small businesses and startups.

President Milei posted about the coin on his X account, telling his 3.8 million followers, “This private project will be dedicated to encouraging the growth of the Argentine economy by funding small Argentine businesses and startups.”

After Milei’s endorsement, LIBRA shot up 3000% and reached a price of $4.50. At its peak, LIBRA’s market cap was $4.5 billion, with global attention and comparisons to other political meme coins, like TRUMP token.

But the party was short-lived.

Blockchain analysts soon noticed telltale signs of insider activity. Data from Bubblemaps and EmberCN showed that 82% of LIBRA’s total supply was unlocked and held by a small group of insiders. They started selling almost immediately after the price skyrocketed.

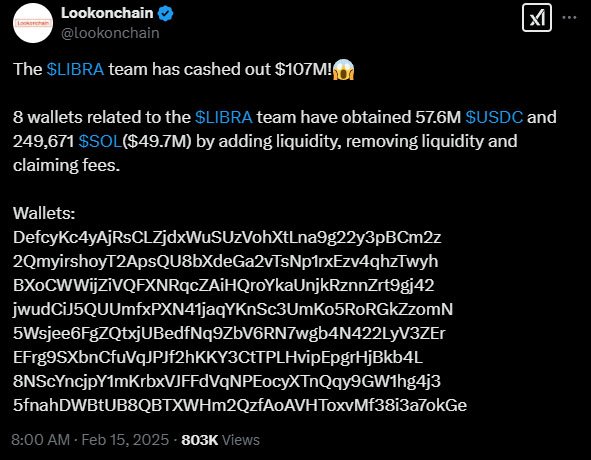

Within hours, the LIBRA team withdrew $87 million in USDC and SOL from liquidity pools, draining the funds and causing a sell-off, with some wallets turning $1 million into over $8 million in profit. The result? LIBRA went down 90% in 3 hours and its market cap was reduced to $221 million.

One blockchain analyst said, “They already made $87M by removing USDC and SOL from liquidity pools. LIBRA is down 85% because the devs absorbed $87M of buy pressure into their pockets. $500M more to go.”

As the controversy grew, President Milei deleted his original X post about LIBRA and posted a statement saying he had no idea what was going on with the token.

“A few hours ago I posted a tweet, as I have countless times before, supporting an alleged private venture with which I obviously have no connection,” Milei wrote. “I wasn’t informed of the project’s details, and after learning about them, I decided not to continue promoting it.”

Then he attacked his political opponents, calling them “filthy rats of the political caste” and saying they were using the opportunity to ruin his reputation.

For many investors, the damage was already done. Over 50,000 wallets had bought LIBRA tokens before the crash and reports say all non-insider investors lost money. One trader lost $2 million in 2 hours after buying LIBRA at the peak.

The rapid collapse of LIBRA has raised concerns of market manipulation and some experts say it could have legal consequences.

In Argentina Article 265 of the Penal Code prohibits public officials from using their position to influence the market and some legal experts say Milei’s endorsement could be seen as a violation.

When Milei first endorsed digital assets and bitcoin, Bitcoiners became hopeful that he might follow a path similar to El Salvador’s Nayib Bukele, and save the country from corruption and rampant inflation.

He met with Bukele in September 2024, giving Bitcoiners even more optimism about the future of Argentina. But apparently, Bukele has not been very successful in showing Milei why Bitcoin is the only way to go.

Interestingly enough, Max Keiser, Bitcoin Advisor to the Government of El Salvador, predicted this last year.

Keiser stated that Milei made a fatal mistake of mixing Bitcoin with “Crypto” in the same bag and that it would have dire consequences.

As it turned out, Keiser was right. Now the ultimate question is, was Milei himself a part of this rug pull, or did he unknowingly promote the token out of ignorance? This is a very important question that needs to be answered.

As of the latest development, Milei has stated that the Anti-Corruption Office has been involved to “determine whether there was improper conduct on the part of any member of the National Government, including the President himself.”