Renowned digital asset financial services platform Matrixport shared a compelling outlook for bitcoin, foreseeing a substantial surge in its value. In a report, the firm predicted that the price of bitcoin would skyrocket in January 2024 and that BTC could break above $50,000 by then.

This bullish forecast aligns with similar sentiments expressed by industry figures such as MicroStrategy executive Michael Saylor and Blockstream CEO Adam Back.

Published on December 21, a Matrixport blog post sheds light on the driving factors behind this optimistic prediction. The report notes the eagerly anticipated approval of Spot Bitcoin Exchange-Traded Funds (ETF), bringing a significant accumulation of stocks associated with digital asset mining firms and exchanges, like Coinbase.

Matrixport: Bitcoin to Break Out

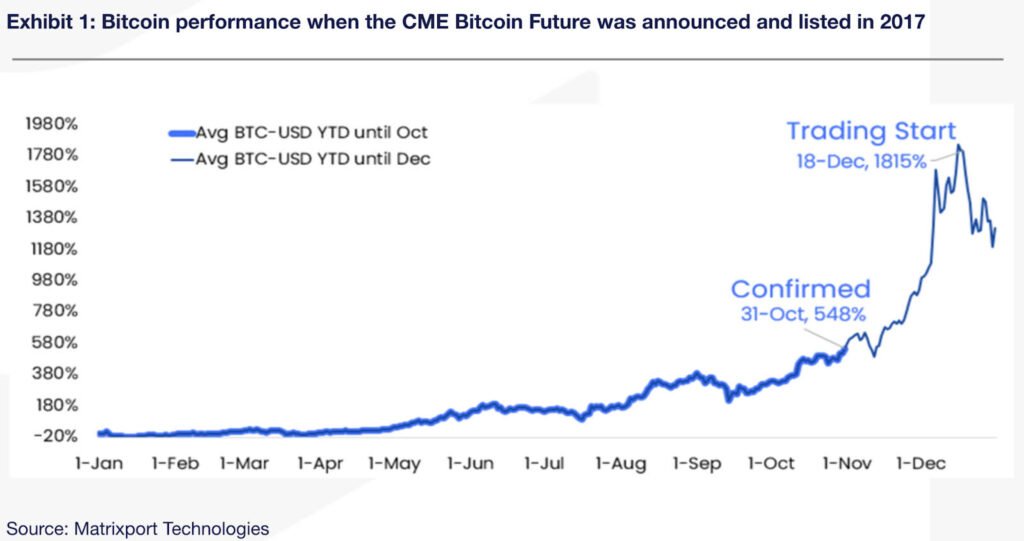

Matrixport cited the CME Group’s Bitcoin Futures launch in 2017, which resulted in Bitcoin skyrocketing by 196%. It suggests that a comparable market movement may unfold post-approval of a Spot ETF by the United States Securities and Exchange Commission (SEC).

Highlighting the potential breakout, Matrixport points out that Bitcoin traditionally experiences a surge of around 3% during Christmas and New Year’s week. Citing instances from 2011, 2013, and 2020 when Bitcoin recorded gains exceeding 22% between December 24 and December 31, Matrixport suggests that a similar upward trajectory could be on the cards.

“We are expecting the SEC to approve Bitcoin Spot ETFs in January. This should lift Bitcoin prices above $50,000 by the end of January 2024. Many investors have bought shares in Bitcoin mining or related crypto stocks as a proxy,” said Matrixport.

Approval of a Spot Bitcoin ETF

Matrixport anticipates a cascade effect in the market as asset management firms intensify their promotional efforts for Exchange-Traded Funds. The firm notes the initiation of TV commercials by multiple ETF applicants, predicting that the reach of these ads will increase with time as the race for dominant Bitcoin ETF players intensifies. Matrixport stated:

“As is typical of ETFs, TV commercials are being rolled out already from multiple ETF applicants, which will continue to support Bitcoin prices. These TV commercials will intensify over Christmas, as there is a race to become the dominant ETF player. This also means that Bitcoin has a high chance of breaking higher during Christmas, and we firmly expect Bitcoin to reach $50,000 if Bitcoin Spot ETFs are approved by then.”

In another blog post published on December 13, Matrixport stated that even if the SEC fails to approve a Spot Bitcoin ETF in 2024, the probability of Donald Trump winning the 2024 presidential elections in the U.S. is high, which could further boost the price of U.S. stocks and Bitcoin. Moreover, 2024 is the year of Bitcoin halving, which has historically resulted in higher prices for the digital asset.

“2024 is also an election year, and the likelihood that former President Donald Trump will be elected again is high. His policies could boost the US economy and, with it, US stock prices and cryptocurrencies,” noted Matrixport.

As reported earlier by Bitcoinnews, in the coming days leading up to the SEC’s decision on all Spot ETF applications, Bitcoin investor Pomp anticipates PR wars, CEO appearances on financial media, TV commercials, Super Bowl ads, newspaper takeovers, and a flood of content across social media platforms.