In a recent weekly memo to investors, Bitwise CIO Matt Hougan shared insights into the burgeoning interest from institutional investors in January-approved spot Bitcoin Exchange-Traded Funds (ETFs). According to Hougan, institutions representing trillions of dollars in assets are expected to enter the Bitcoin market through these ETFs by the second quarter of the year.

Major Groups Contributing to the Massive Inflows

Hougan highlighted that the introduction of Bitcoin ETFs was initially perceived as a bridge for professional investors to enter the Bitcoin market. He noted that the past seven weeks have emphatically confirmed this perception, showcasing widespread participation from various investor groups.

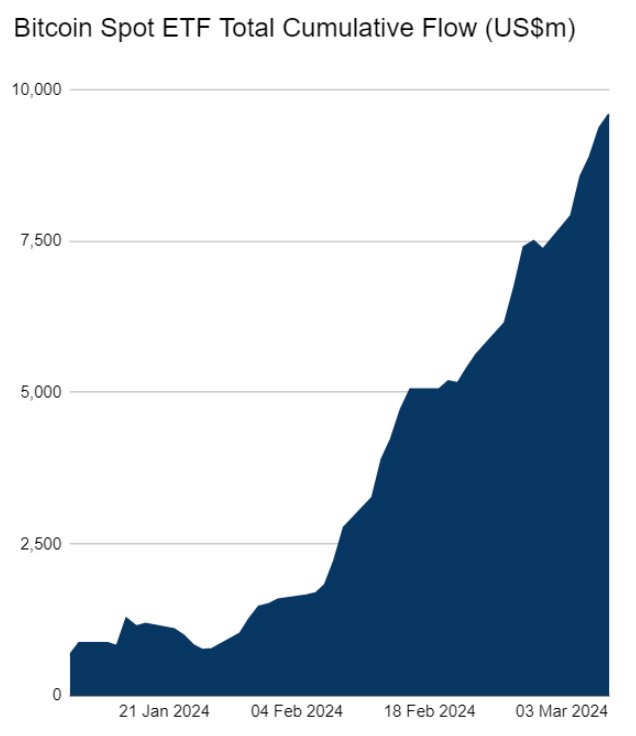

Notably, since their introduction in the United States on January 11, spot Bitcoin ETFs have experienced substantial success, amassing around $9.6 billion in net inflows. This remarkable growth has raised questions within the investment community regarding the driving forces behind it.

According to Hougan’s memo, Bitcoin ETFs have attracted interest from a diverse range of investors, including individual retail investors, hedge funds, asset managers, Registered Investment Advisors (RIAs), family offices, and venture capital funds.

Matt Hougan on Due Diligence Discussions

Hougan disclosed that Bitwise, along with multiple Bitcoin ETF issuers, is actively engaged in serious due diligence discussions with major financial and corporate entities. He explains that these discussions involve a range of participants, stating:

“Just as important as who is buying today is who will be buying tomorrow. At Bitwise, and I’d assume at other bitcoin ETF issuers, we are having serious due diligence discussions with major wirehouses, institutional consultants, and large corporations.”

Although specific details about the identity of these entities remain undisclosed, Bitwise CIO expressed confidence that they would initiate the first significant flows into Bitcoin during the second quarter. Hougan expresses optimism by stating:

“I think those flows will accelerate throughout the year as these investors become more comfortable with the new products.”

Growing Comfort Level

This optimistic projection is grounded in the growing comfort level that institutional players are developing with digital asset products. Institutions are recognizing the potential of these products to provide diversified investment opportunities, marking a significant shift in their attitude towards the bitcoin market.

Notably, leading RIA firm Carson Group, which handles $30 billion on its platform, recently selected four Bitcoin ETFs to be offered to its clients.

In a recent report, JPMorgan acknowledged the noteworthy inflows into spot Bitcoin ETFs, forecasting a substantial growth of approximately $62 billion in inflows over the next 2-3 years. The basis for this projection lies in the comparison with gold as a benchmark and applying a similar volatility ratio to estimate the potential size of Bitcoin ETFs.

The inclusivity of investors from different backgrounds indicates a notable shift in bitcoin market trends. As the market continues to evolve, the expected entry of major wirehouses, institutional consultants, and large corporations into Bitcoin through spot ETFs signals a promising trajectory for the digital asset’s integration into traditional investment portfolios.