In recent months, Japanese investment firm Metaplanet, often dubbed “Asia’s MicroStrategy,” has been making headlines for its aggressive bitcoin acquisition strategy.

With a series of significant purchases, the company has positioned itself as one of the region’s most notable players in the Bitcoin space, closely following the playbook of American firm MicroStrategy.

The firm’s ongoing investments reflect its growing confidence in Bitcoin as a long-term asset, even amid market volatility.

Related: Metaplanet’s Bold Shift to Betting Big on Bitcoin

Metaplanet’s journey into Bitcoin began earlier this year as part of a strategic response to Japan’s ongoing economic challenges. Inspired by MicroStrategy’s success in using bitcoin as a corporate reserve asset, Metaplanet decided to adopt a “Bitcoin First, Bitcoin Only” approach.

The firm started buying bitcoin consistently, with each month marking an addition to its digital treasury.

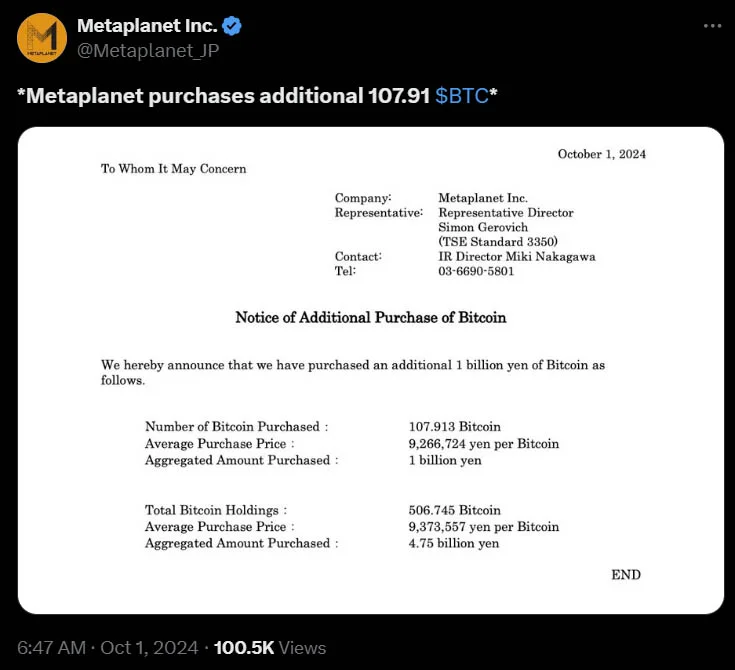

As of October, the Japanese company had purchased over 500 bitcoin, valued at approximately $32 million. Their most recent purchase, 107.91 bitcoin worth ¥1 billion ($6.9 million), demonstrates the company’s unwavering commitment to building a substantial bitcoin reserve.

Despite fluctuations in the bitcoin market, Metaplanet remains bullish on its strategy. According to reports, the firm has not let temporary downturns affect its buying spree.

The company considers bitcoin as a long-term investment, said Metaplanet CEO Simon Gerovich in an interview with Japanese Web3 magazine Iolite. He further emphasized the company’s belief in bitcoin’s potential to surpass $1 million per coin within the next five to ten years. Gerovich explained:

“This [strategy] is based on several factors […] Bitcoin’s fixed supply, increased adoption by institutional investors as a store of value, and the broader macroeconomic environment that favors hard assets over fiat currencies.”

Metaplanet’s decision to pivot towards Bitcoin is a direct response to economic pressures facing Japan.

Inflation concerns and currency fluctuations have led many companies to explore digital assets as a hedge. Metaplanet isn’t alone in this shift. Other Japanese firms, such as Remixpoint, have also invested in bitcoin and other digital currencies.

However, what sets Metaplanet apart is its unwavering focus on Bitcoin only.

While some firms have diversified into altcoins, Metaplanet remains committed to accumulating only bitcoin. The company has no reason to diversify into altcoins, said Gerovich, underscoring the company’s single-minded strategy.

Since the beginning of 2024, Metaplanet has consistently added to its bitcoin holdings.

The company’s total bitcoin stash now stands at 506.745 BTC, acquired at an average price of ¥9.37 million ($64,931) per bitcoin. These acquisitions have brought the total investment to ¥4.75 billion ($32 million), a testament to the firm’s confidence in bitcoin’s future potential.

In addition to the ¥1 billion spent on bitcoin in October, Metaplanet had previously secured a ¥1 billion credit facility from shareholder MMXX Ventures to fund its purchases.

This loan, which comes with a 0.1% interest rate, is earmarked exclusively for bitcoin purchases, highlighting the company’s focused approach.

Metaplanet’s Bitcoin strategy has had a positive impact on its stock price. Following the latest bitcoin purchase, the company’s stock surged by 3.63%, trading at above ¥1,000 per share.

Year-to-date, the stock has gained an impressive 540%, showing how closely tied its fortunes are to bitcoin.

Investors and analysts are optimistic about bitcoin’s performance in the fourth quarter, a period that has historically been favorable for the digital asset.

The term “Uptober” is often used in the Bitcoin community to describe October’s typically bullish trends. With bitcoin up nearly 10% in September and showing a 51% year-to-date gain, many believe the stage is set for further price increases in the coming months.

Some experts predict that bitcoin could rally to $70,000 by the end of the year, with even higher targets possible if favorable macroeconomic conditions persist.

Factors such as the U.S. Federal Reserve’s potential rate cuts and increasing global money supply are seen as catalysts for bitcoin’s continued rise.

Metaplanet’s strategy is clear: accumulate as much bitcoin as possible and hold it for the long term.

The firm’s leadership believes that bitcoin’s value will continue to grow, driven by factors such as its fixed supply and increasing adoption by both institutional investors and individual holders.

This belief is not only reflected in the company’s purchasing behavior but also in its broader corporate strategy, which focuses on using bitcoin as a hedge against inflation and currency risks.

By following MicroStrategy’s lead, Metaplanet is making a bold bet on bitcoin, positioning itself as a key player in the digital assets space.

As more companies and institutional investors begin to explore the potential of Bitcoin, Metaplanet’s strategy could prove to be a pioneering move in the broader adoption of bitcoin as a legitimate asset class.