In a CNBC interview, Grayscale Investments’ CEO Michael Sonnenshein, defended the firm’s Bitcoin Trust ETF’s 1.5% fee, notably higher than the industry average of 0.2% to 0.4%. The CEO attributed this fee to Grayscale’s position as the world’s largest bitcoin fund, boasting over $25 billion in assets under management. He emphasized the fund’s impressive 10-year track record and a diverse investor base as factors justifying the premium fee.

The rapidly evolving landscape of Bitcoin Exchange-Traded Funds (ETFs) has become a hot topic in the financial world. Grayscale has been at the center of attention this week, defending its unique position in the market.

Michael Sonnenshein And ETF Survival Odds

Sonnenshein boldly stated that, in his opinion, only two or three of the recently approved 11 spot Bitcoin ETFs will endure over the long term. He expressed skepticism about the commitment and track record of other ETF issuers, suggesting that some may not survive the competitive market.

Grayscale Bitcoin Trust Selling Spree

Interestingly, amidst the ETF battle, Grayscale stands out for actively selling Bitcoin rather than accumulating. As of January 20, Grayscale had offloaded more than 50,000 BTC, while other issuers were increasing their holdings. This GBTC selloff approach raises questions about Grayscale’s market strategy and its potential impact on the broader ETF landscape.

The approval of 11 spot Bitcoin ETFs by the U.S. Securities and Exchange Commission (SEC) triggered a fee war among issuers. While many offered zero or minimal fees initially, Grayscale stuck to its 1.5% fee, sparking debates about the correlation between fees, commitment, and long-term viability.

Market Dynamics

Mati Greenspan, founder of Quantum Economics, considers the likelihood of many ETF issuers failing in the long run due to investors favoring asset custody. He notes the current utility of spot ETFs for portfolio managers but deems 11 offerings excessive, anticipating industry consolidation reflected in lowered fees.

He stated:

“For now, having spot ETFs is a good way for some portfolio managers to gain exposure who wouldn’t otherwise be able to […] But having 11 of them is pretty ridiculous. There will have to be a consolidation, and they all know it, which is why fees are on the floor.”

Some leaders in the spot Bitcoin ETF sector argue that holding your own assets and investing through ETFs can coexist. ARK Invest CEO Cathie Wood emphasized this, highlighting their Bitcoin ETF’s modest 0.21% fee and its altruistic approach, focusing on Bitcoin as a public good rather than profit maximization.

She stated:

“We are looking at Bitcoin as a public good. And one of the ways to do that is this low-fee product. We have other actively managed strategies where we can do more on the profitability side. That is not our objective here.”

Market Predictions from Sonnenshein

During the World Economic Forum, Sonnenshein reiterated his belief that the marketplace won’t sustain all 11 approved spot Bitcoin ETFs. He suggested that some issuers might lack a genuine commitment to the asset class, potentially leading to market exits for several ETF products.

He added:

“Investors are weighing heavily things like liquidity and track record and who the actual issuer is behind the product. Grayscale is a crypto specialist. And it has really paved the way for a lot of these products coming through.”

Sonnenshein defended Grayscale’s higher fees by emphasizing the company’s commitment and experience in the Bitcoin space. He implied that lower fees from other ETFs might signal a lack of a track record or dedication to the evolving asset class. Sonnenshein highlighted:

“I think from our standpoint, it may at times call into question their long-term commitment to the asset class […] I don’t ultimately think that the marketplace will have ultimately these 11 spot products we [currently] find ourselves having.”

Conclusion

The Bitcoin ETF arena is witnessing intense competition, with Grayscale standing firm on its unique position. Sonnenshein’s predictions about the survival of only a few ETFs and Grayscale’s unconventional selling approach add intriguing dimensions to the evolving narrative. As the battle continues, the market awaits to see which ETFs will emerge as winners and which may face an uncertain fate.

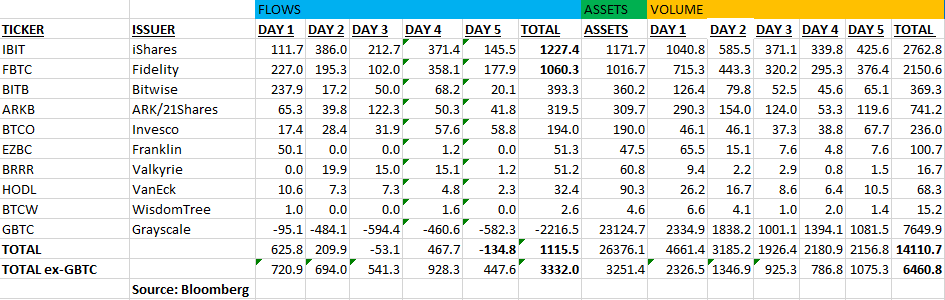

Grayscale’s Bitcoin Trust witnessed a remarkable $2.2 billion withdrawal in the past week, as investors unlocked their BTC holdings. Meanwhile, spot Bitcoin ETFs gained over $1.2 billion in the same period, as reported by Bloomberg data.