In a move that reinforces its unwavering commitment to Bitcoin, MicroStrategy, the largest corporate holder of the scarce digital asset, has announced yet another significant purchase.

The company revealed it has acquired 15,400 BTC for $1.5 billion at an average price of $95,976 per bitcoin. This latest acquisition brings MicroStrategy’s bitcoin holdings to 402,100 BTC, worth approximately $38 billion at current market prices.

MicroStrategy’s recent purchase marks the fourth consecutive week of large bitcoin acquisitions.

Related: MicroStrategy Buys its Largest Batch of Bitcoin | 51,780 BTC Added

The company executed the transaction between November 25 and December 1, leveraging proceeds from the sale of 3.7 million Class A common shares, which raised $1.48 billion.

This activity is part of a larger $42 billion capital-raising plan through stock sales and fixed-income securities to fund further bitcoin purchases over the next three years.

Michael Saylor, MicroStrategy’s co-founder and executive chairman, remains a steadfast advocate of Bitcoin.

He has transformed the business intelligence firm into what he calls a “Bitcoin Treasury” company, aiming to maximize shareholder value through bitcoin investment. In a statement shared via social media, Saylor confirmed the latest acquisition.

The company’s current treasury of 402,100 BTC represents nearly 2% of bitcoin’s total fixed supply of 21 million coins.

MicroStrategy has spent approximately $23.4 billion to build its stash, at an average purchase price of $58,263 per bitcoin, inclusive of fees. This bold strategy reflects the firm’s belief in bitcoin as a superior store of value.

Blockstream co-founder Adam Back, a noted Bitcoin advocate, praised MicroStrategy’s purchase, saying the $95,976 average acquisition price was “a good deal.”

MicroStrategy’s aggressive bitcoin buying has had notable implications for the market.

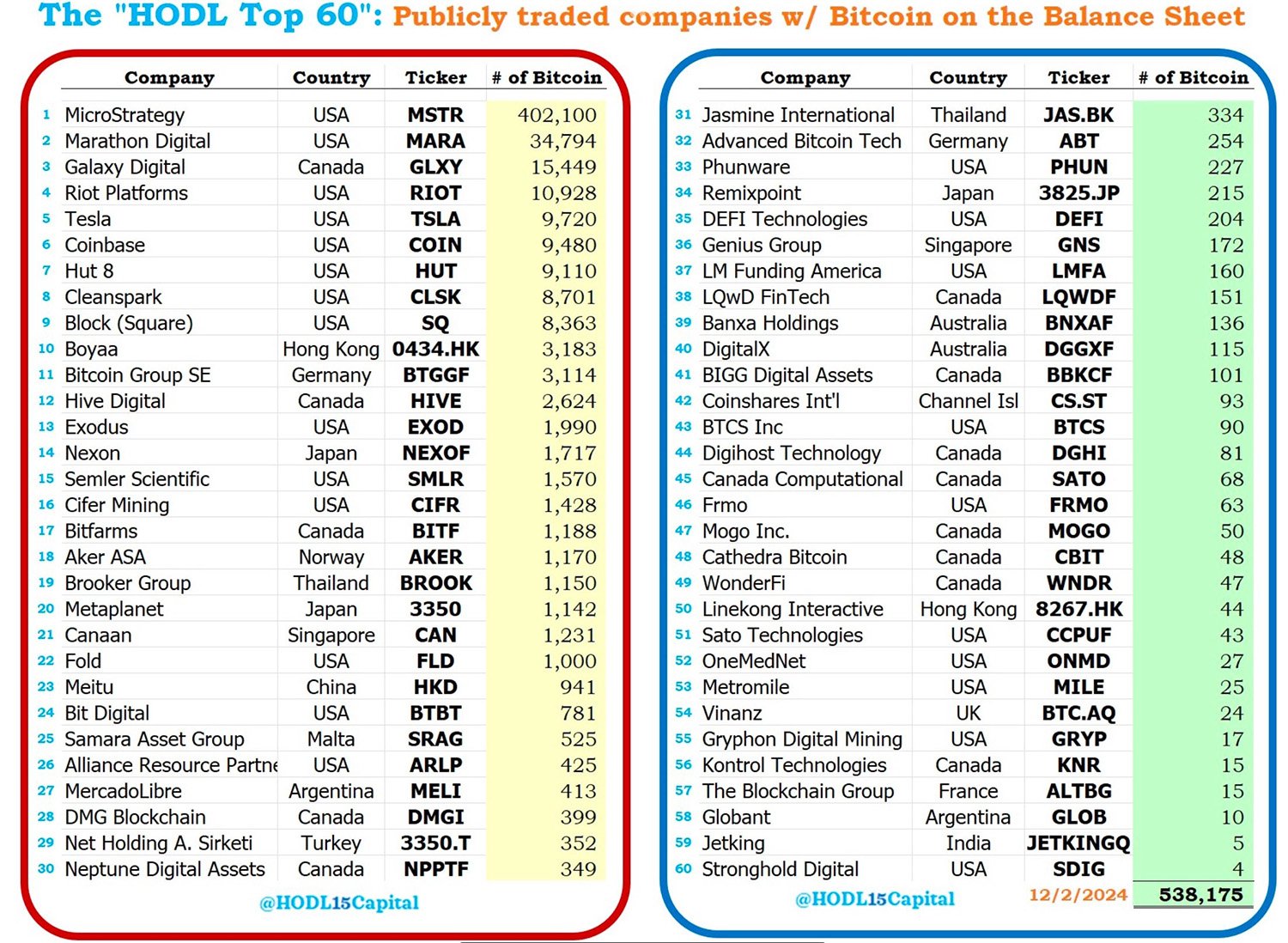

The company’s activities align with other institutional players like Marathon Digital and Riot Platforms, which have also increased their bitcoin holdings. However, MicroStrategy’s scale dwarfs its competitors.

Marathon Digital Holdings (MARA), the second-largest corporate bitcoin holder, currently owns 34,794 BTC, a fraction of MicroStrategy’s total holdings. MARA recently announced plans to raise $700 million to fund further acquisitions, underscoring the growing corporate interest in bitcoin as a treasury asset.

MicroStrategy’s acquisitions have been funded primarily through share sales under an at-the-market program established with TD Securities and other financial agents.

Since October 30, 2024, the company has raised significant capital, leaving $11.3 billion worth of shares available for future issuance.

Benchmark analyst Mark Palmer noted that MicroStrategy’s pace of fundraising and bitcoin purchases suggests it may exceed its original $42 billion target. He stated:

“One of the questions that remains to be answered is whether this implies that the ultimate size of this initiative will exceed the $42 billion that the company had targeted, or if it’s simply a matter that those issuances and purchases are being pulled forward.”

MicroStrategy’s stock (MSTR) has performed exceptionally well since adopting its bitcoin strategy in 2020, with gains exceeding 1,000%. Despite this success, some critics caution against potential risks.

Anthony Pompliano, a prominent digital asset investor, warned about regulatory uncertainty. Pompliano stated that if the U.S. bans Bitcoin, the MSTR stock price could suffer a significant decline.

Still, the company remains bullish. Its proprietary “Bitcoin Yield” metric, which measures the percentage change in bitcoin holdings relative to share dilution, shows a 63.3% year-to-date yield, emphasizing the strategic balance between acquiring bitcoin and managing shareholder equity.

MicroStrategy’s sustained bitcoin buying spree reflects its deep commitment to the digital asset’s long-term value proposition. Saylor has gone so far as to advise other corporate leaders, including Microsoft CEO Satya Nadella, to adopt bitcoin as a treasury asset.

As bitcoin hovers near $95,000, with its price approaching $100,000, industry analysts speculate that MicroStrategy’s strategy could yield even greater returns. CryptoQuant CEO Ki Young Ju highlighted:

“$MSTR spent $13.5B on 149,900 BTC, with holdings up $21.5B in 30 days. Bitcoin market can’t absorb tens of billions short-term without driving prices up, making returns nearly inevitable. If BTC breaks $100K, the gains could grow even more as it enters price discovery.”

For now, MicroStrategy appears poised to maintain its leading position as the foremost corporate bitcoin holder, setting an aggressive pace that few competitors can match.

Whether the market will reward or punish this strategy in the long run remains a key question for investors and industry observers alike.