MicroStrategy, a business intelligence firm led by Bitcoin advocate Michael Saylor, has announced that it has added another 27,200 BTC to its coffers. This purchase was reportedly made with approximately $2.03 billion in cash for the price of $74,463 per bitcoin.

This latest acquisition has brought the company’s bitcoin holdings to 279,420 BTC acquired at an average price of $42,692 per bitcoin.

MicroStrategy is witnessing explosive gains from its bold Bitcoin strategy, especially as the price of bitcoin has recently reached new heights.

With bitcoin’s recent peak above $85,000, the firm’s bitcoin holdings have risen dramatically in value, positioning MicroStrategy as a central player in the world of corporate Bitcoin investment.

Since its initial bitcoin purchases in 2020, MicroStrategy has been on a steady acquisition spree. With the recent bitcoin rally, the value of these holdings has surged past the $24 billion mark, yielding more than $12 billion in unrealized gains.

The success of this strategy underscores the firm’s conviction in Bitcoin as a long-term asset and its potential to act as a reserve asset for corporations.

MicroStrategy’s $12 billion in unrealized profits marks a substantial success for the company, which initially invested roughly $9.9 billion in bitcoin.

Bitcoin’s recent surge is largely attributed to several factors, including Donald Trump’s recent re-election, which has boosted optimism among Bitcoin enthusiasts.

The former president’s stance on digital assets is seen as supportive, with his campaign pledging to establish a “national strategic bitcoin reserve.”

Trump’s election has been accompanied by monetary policy changes, with the Federal Reserve and Bank of England implementing rate cuts.

These external factors, combined with MicroStrategy’s consistent bitcoin accumulation, have elevated the company’s stock price significantly.

The company’s stock (MSTR) is now trading near $340, marking an increase of over 600% year-to-date. As of today, MicroStrategy’s stock has outpaced high-performing stocks like NVIDIA, a reflection of how strongly correlated MSTR’s valuation has become with the price of bitcoin.

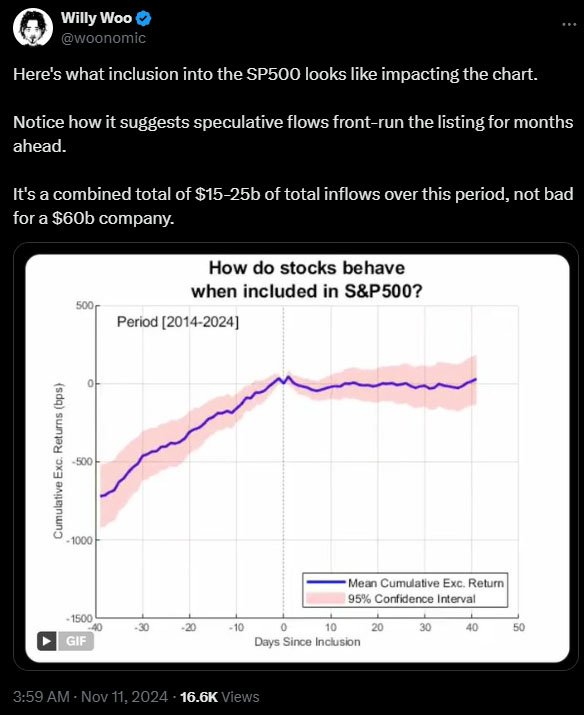

In a potential game-changer, analysts anticipate that MicroStrategy could be included in the S&P 500. Such a move would drive inflows of billions from index-tracker funds and ETFs, as noted by popular analyst Willy Woo.

Woo commented, with S&P 500 inclusion, he is looking at potential inflows of $10-15 billion into MSTR. This could also attract another $5-10 billion in speculative inflows.

The path to S&P 500 inclusion is largely driven by upcoming changes to accounting standards, allowing companies like MicroStrategy to meet the S&P 500’s listing requirements.

The Financial Accounting Standards Board (FASB) has made adjustments, and once these take effect on January 1, 2025, MicroStrategy will be well-positioned for inclusion if approved by the S&P committee.

Related: FASB’s Fair Value Accounting Shift and Bitcoin’s New Dawn

MicroStrategy’s founder, Michael Saylor, has ambitious plans for the company.

In a recent interview, Saylor described his vision of transforming MicroStrategy into a “Bitcoin bank.” This strategy involves increasing bitcoin reserves, driving demand, and ultimately impacting the broader market.

Saylor’s optimism around bitcoin’s future as a reserve asset has also prompted the company to initiate a “21/21 Plan,” which aims to raise $42 billion over the next three years to fund further bitcoin purchases.

MicroStrategy’s bitcoin holdings reflect a growing trend of bitcoin adoption among institutional investors. Nation states like Bhutan and El Salvador are also making significant investments in Bitcoin as part of their economic strategies.

Bhutan’s holdings have reached over $1 billion, representing a considerable portion of the country’s GDP, while El Salvador’s bitcoin investments have reportedly brought in unrealized gains of around $214 million.

MicroStrategy’s success has created a ripple effect in the market, encouraging other firms to consider bitcoin as a potential long-term asset.

With bitcoin becoming more widely accepted and major corporations adopting it as part of their reserve assets, its use in corporate finance could soon become commonplace.

While bitcoin’s high valuation has undoubtedly benefited MicroStrategy, there are also significant risks associated with this level of exposure to a highly volatile asset.

Should bitcoin’s price drop substantially, the company could face considerable losses. However, Michael Saylor remains steadfast in his belief that Bitcoin is the future of financial security for corporations.

“Bitcoin is a matter of national security,” Saylor recently remarked, echoing sentiments shared by Fred Thiel, CEO of Bitcoin mining firm Mara. This assertion was made following reports that Russia had mined billions worth of bitcoin last year, generating substantial revenue amid Western sanctions.

In line with this perspective, both Saylor and Trump have suggested creating strategic reserves of bitcoin, with Trump arguing that it could solidify the role of U.S. as the global center for Bitcoin and financial technology.

As speculation around S&P 500 inclusion grows, some analysts project that MicroStrategy’s stock could climb even higher, potentially reaching $500 in the near future.

The rally could gain momentum as investors anticipate the effects of the company’s 600% year-to-date returns and ongoing bitcoin accumulation.

While there are still steps before S&P 500 inclusion becomes a reality, market analysts are already setting targets as high as $400 as a near-term goal. A convincing breakout above this level, analysts say, would signal further potential gains and might set up a pathway for MSTR’s next rally.

MicroStrategy’s unprecedented Bitcoin strategy is proving successful amid a series of favorable economic and political developments.

As bitcoin reaches record-high prices, the firm’s holdings are now valued at over $20 billion, generating massive unrealized gains. With S&P 500 inclusion on the horizon, analysts anticipate billions in new inflows to MicroStrategy’s stock, potentially propelling its value even higher.

Michael Saylor’s ambition to make MicroStrategy a leader in the bitcoin market is clear, and if his vision plays out, the company may indeed shape how corporations interact with digital assets in the future.

This strategic approach has already positioned MicroStrategy as an influential figure in the Bitcoin ecosystem, marking it as a trendsetter in corporate bitcoin investment.