MicroStrategy, the software company that went all in on Bitcoin, has hit a major milestone by joining the Nasdaq-100 Index. This happens on December 23 and puts MicroStrategy alongside Apple, Microsoft and Tesla, which is a big win for the Bitcoin industry.

Founded as an enterprise software company over 30 years ago, MicroStrategy has become a major player in the Bitcoin space.

The company started buying bitcoin in 2020, led by Executive Chairman Michael Saylor who has been a long time Bitcoin proponent. With over 423,000 bitcoin worth $42 billion, MicroStrategy is the largest corporate holder of the scarce digital asset.

“Primarily, our job is to bridge the traditional capital markets that want bonds, equity, or options with the crypto economy,” Saylor said recently.

The company’s strategy is working, the stock is up over 500% in 2024, way ahead of bitcoin’s 140% increase this year.

Related: MicroStrategy Will Be “The Leading Bitcoin Bank”

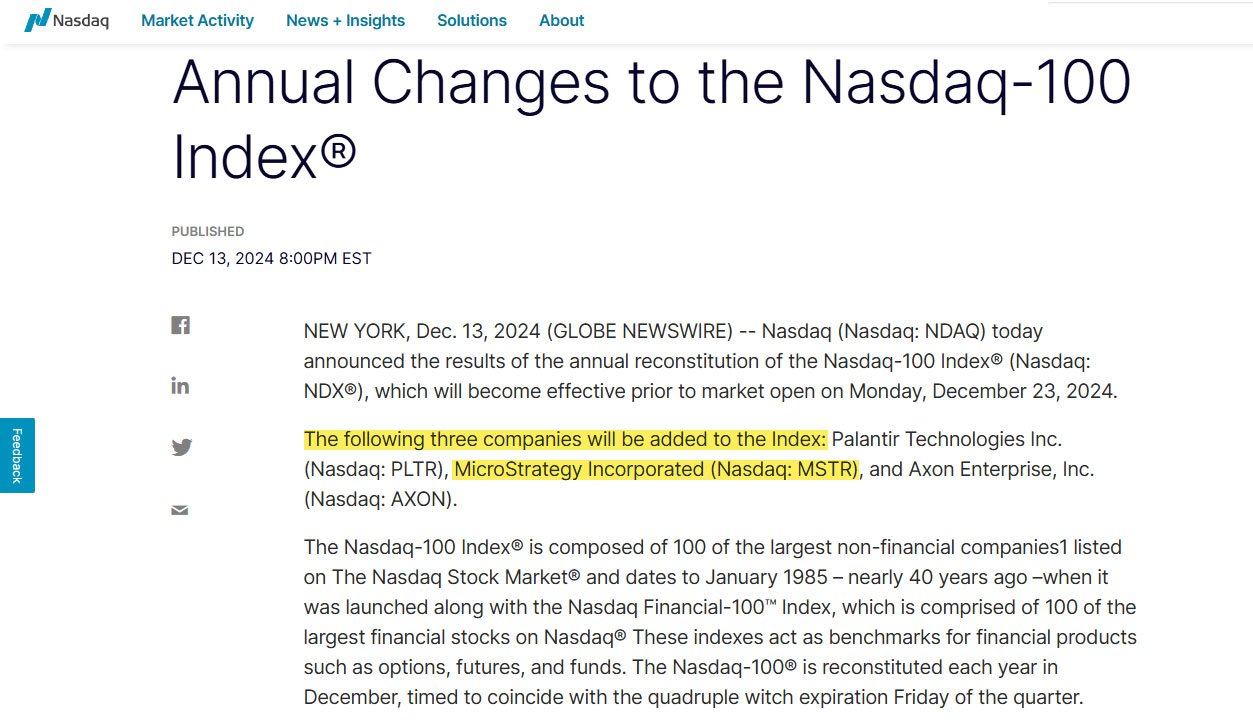

The Nasdaq-100 Index tracks the largest non financial companies listed on the Nasdaq. MicroStrategy was added as part of the annual rebalancing which also added Palantir Technologies and Axon Enterprise. Illumina, Super Micro Computer and Moderna were removed.

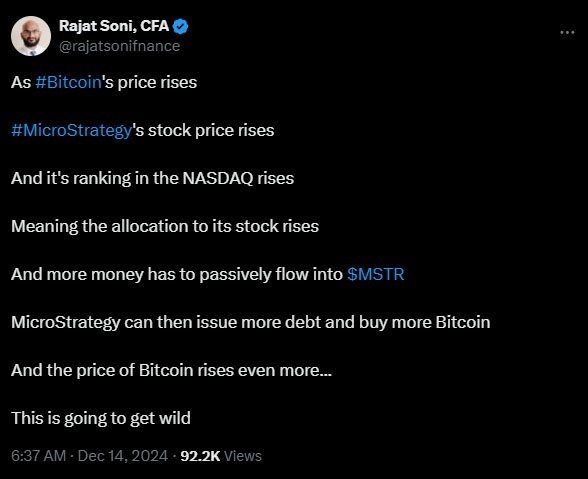

Being in the Nasdaq-100 means large investment inflows from exchange-traded funds (ETFs) that track the index. The Invesco QQQ Trust, one of the largest ETFs with $325 billion in assets, must now include MicroStrategy in its portfolio.

“This would lead to inclusion of MSTR in some of the largest ETFs such as QQQ (5th largest ETF) etc, leading to one-time fresh buying … and ongoing participation in future inflows,” said Gautam Chhugani, Bernstein analyst.

MicroStrategy’s stock, often used as a bitcoin proxy, has gone ballistic.

Its 6x increase this year has taken the company’s market cap to nearly $94 billion which meets the Nasdaq’s requirements. Analysts think this will not only boost MSTR but also increase bitcoin’s exposure in traditional finance.

Analyst Will Clemente said, “Now that MSTR is getting added to the Nasdaq, every large pension fund, sovereign wealth fund, and individual retirement account in the world is going to have Bitcoin exposure.”

While getting into the Nasdaq-100 is a big win, some analysts warn it won’t last. MicroStrategy’s heavy bitcoin exposure could get them reclassified as a financial company. If that happens they won’t be in the Nasdaq-100 anymore.

Bloomberg’s James Seyffart points out the risk of reclassification comes from the company prioritizing bitcoin over their software business.

And some are questioning the sustainability of MicroStrategy’s strategy given their reliance on bitcoin’s price moves. Their software business was once their main revenue driver and has been struggling lately.

Saylor has been talking about his vision for Bitcoin in the financial system. Him and senator Lummis recently suggested the US government should sell its gold reserves and invest in bitcoin to help the dollar maintain its global reserve currency status.

As MicroStrategy gets into the Nasdaq-100, analysts are already wondering if the S&P 500 could be next. While there are challenges ahead, the company certainly made a big splash in the stock market and Bitcoin world.

For now they’re on top, solidifying their position as a leader in the new financial landscape. Getting into the Nasdaq-100 is a win for the company and a big deal for Bitcoin’s entry into mainstream finance.