Renowned investment management firm Millennium Management LLC, led by billionaire Izzy Englander, has emerged as a dominant force in the Bitcoin ETF arena.

As of March 31, 2024, Millennium has invested around $2 billion across several Bitcoin-related ETFs, securing major shares in industry giants like BlackRock’s iShares Bitcoin Trust (IBIT), Fidelity’s Wise Origin Bitcoin Fund (FBTC), and Grayscale’s Bitcoin Trust ETF (GBTC).

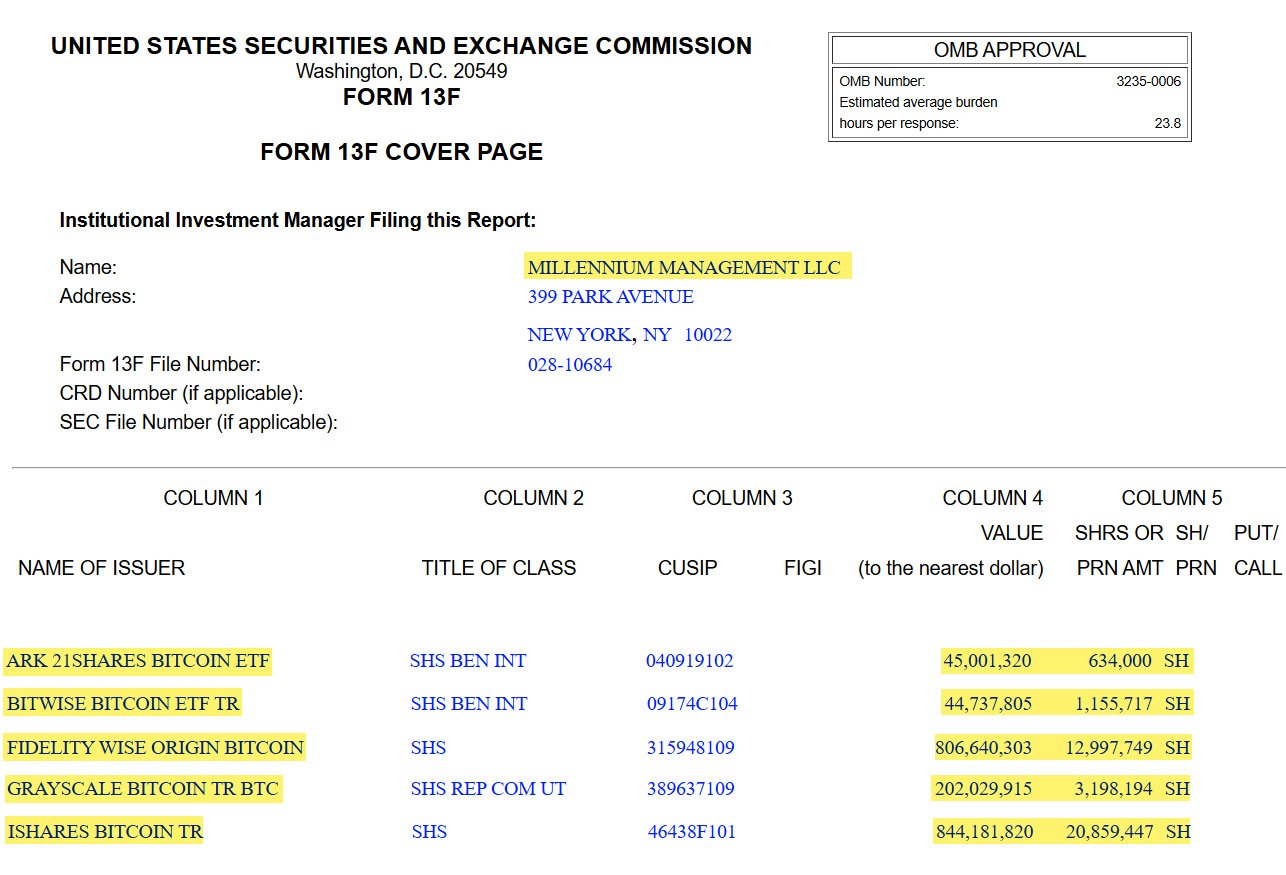

According to the 13F filing, Millennium’s investments include $844.2 million in IBIT, $806.7 million in FBTC, and $202 million in GBTC. The firm has also allocated $45 million and $44.7 million to ARK 21Shares Bitcoin ETF (ARKB) and the Bitwise Bitcoin ETF (BITB), respectively.

The substantial investments by institutions like Millennium Management reflect the growing integration of bitcoin into mainstream financial portfolios. This institutional backing intensifies the bitcoin community’s long-term confidence in the digital asset.

Eric Balchunas, an ETF analyst at Bloomberg, hailed Millennium’s dominance, pointing out its $2 billion investment across ETFs.

He pointed out that while investment advisors make up the majority of ETF holders, hedge funds also have a significant presence, showing broad interest across sectors.

Another popular ETF analyst James Seyffart echoed Balchunas’ observations and challenged those who claim, “It’s only retail traders buying the bitcoin ETFs.”

Morningstar Direct data indicates a surge in institutional interest in Bitcoin ETFs since January, with collective investments reaching around $29 billion.

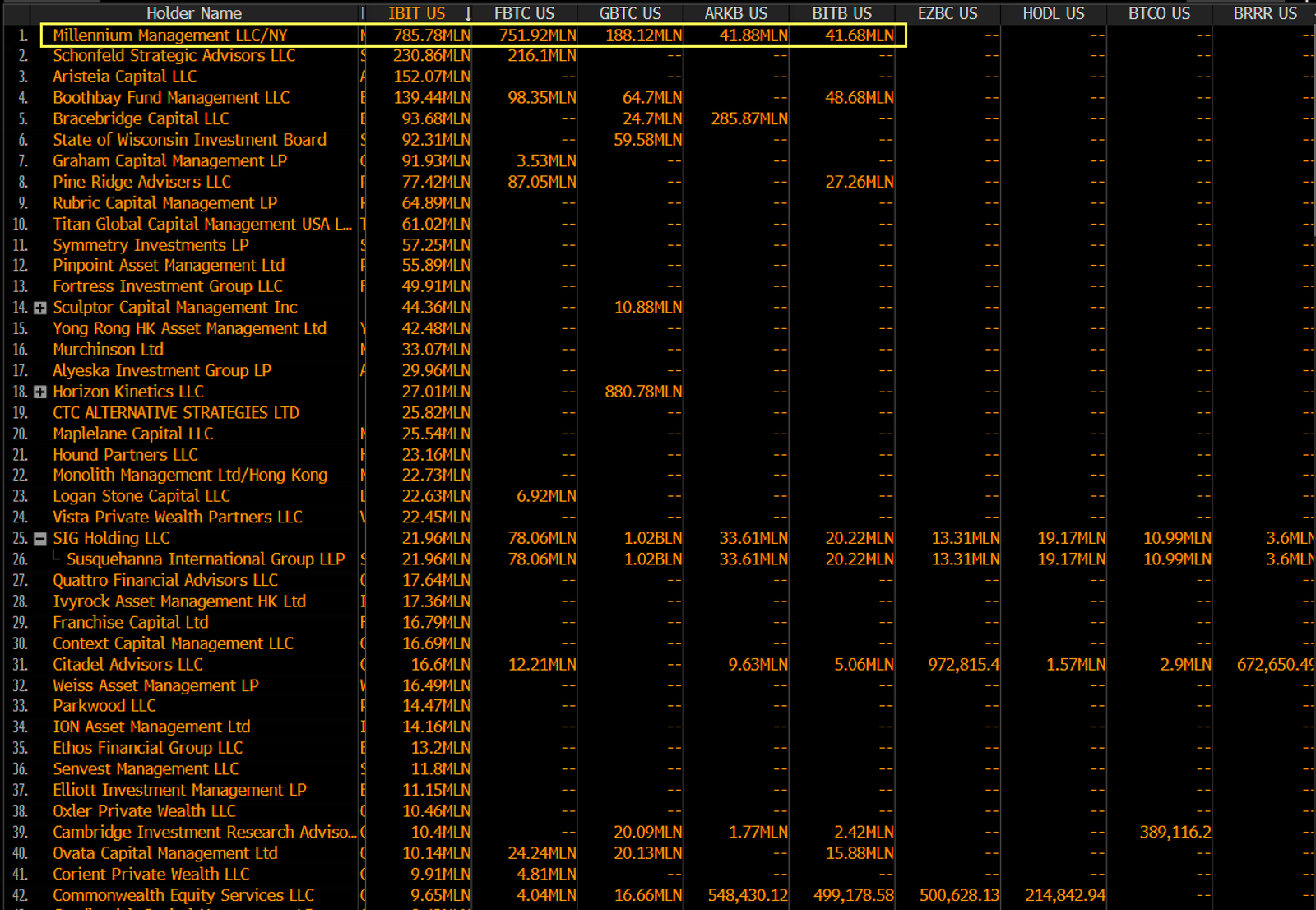

Besides Millennium, heavyweights like Bracebridge Capital and the State of Wisconsin’s investment board have also made significant entries into the Bitcoin ETF space.

Other asset managers like Pine Ridge and Schonfeld Strategic Advisors have reported substantial holdings through IBIT, FBTC, and BITB.

Conversely, Elliott Capital and Apollo Management Holdings have entered with smaller investments, but still noteworthy, totaling nearly $12 million and $53.2 million, respectively.

Matt Hougan, Bitwise’s Chief Investment Officer, emphasized the trend of institutional investment in Bitcoin ETFs. He compared this growing interest to the success of gold ETFs launched in 2004, which attracted over $1 billion in their first five days.

Hougan noted that Bitcoin ETFs have seen a historic success in terms of breadth of ownership, with significant investments from professional investors. He states:

“By the time all the filings are processed, they will show that as many as 700 institutions own $5 billion or more in the new ETFs.”

Meanwhile, on May 15, Bitcoin spot ETFs experienced a total net inflow of $303 million. Among them, Grayscale’s GBTC saw a single-day net inflow of $27 million, Fidelity’s FBTC had an inflow of $131 million, and Bitwise’s BITB received $86 million.

On the other hand, BlackRock’s IBIT experienced zero flow.

Millennium’s aggressive strategy of diversifying holdings across multiple ETFs could possibly maximize potential gains and act as a smart risk mitigation tactic. This approach aligns with the firm’s goal of capitalizing on the growing digital asset market in a regulated way.