Tuesday’s Consumer Price Index (CPI) report, showing lower inflation than expected, sparked a wave of excitement in the markets. This excitement comes from the belief that the Federal Reserve might stop raising interest rates, hinting at a possible return to policies that “boost the economy”, often playfully called “Money Printer Goes Brrr.”

Money Printer Goes Brrr: Analyzing The CPI Index

However, it’s important to take a closer look before getting too excited. The way the CPI measures inflation isn’t perfect, and there might be some issues with how it reflects the true cost of living. For example, the basket of goods and services it uses to measure price changes might not accurately represent what people are currently buying or spending their money on.

So, while the recent report seems to indicate that inflation is cooling off, investors and decision-makers should be careful not to jump to conclusions too quickly about what the Federal Reserve will do next. They need to consider the bigger economic picture and the risks of returning too soon to policies that make money more freely available.

Questionable Assumptions Behind the Numbers

While the CPI report shows inflation slowing overall, the breakdown raises some questions. For example, the CPI claims that grocery bills have only increased 3.2% over the past year – a figure drastically lower than what most shoppers are experiencing. This suggests the CPI may not accurately capture real-world inflationary pressures faced by consumers.

The Health Insurance Cost Conundrum

One particularly glaring inconsistency emerges when examining health insurance costs. The CPI report astonishingly claims these costs have fallen over 30% the past year. However, disability claims have risen significantly since 2020, indicating a steady rise in healthcare costs. It’s illogical that insurance premiums could simultaneously decrease so dramatically. This discrepancy reveals flaws in the CPI’s methodology.

The Chapwood Index: A Contrasting Measure

For a potentially more accurate measure of real inflation, the Chapwood Index offers an intriguing alternative. By tracking prices across 500 goods and services in 50 cities, this index relies on crowdsourced receipts rather than questionable statistical assumptions. Alarmingly, the Chapwood Index shows inflation running 2-3x higher than the official CPI figures.

Questionable Data Feeds Faulty Policy

In summary, mainstream inflation measures like the CPI appear detached from the everyday reality facing American consumers. This distortion paves the way for misguided monetary policies that could ultimately exacerbate economic challenges. While yesterday’s report may offer some encouragement to financial markets, it does not help the families struggling to put food on the table.

Related reading: Bank of Canada Calls for Wage Restraint Amid Rampant Inflation

Inflation reduces the purchasing power of money, which is a form of indirect wealth transfer from the currency holders to the entity controlling the money supply, typically the government or the Central Bank.

Ironically, the same financial system that operates with fiat currency also implements regulations aimed at preventing theft and ensuring sound fair financial practices. This situation can seem paradoxical: a system that is designed to subtly diminish the value of its currency also enforces rules to protect individuals from direct financial theft and fraud.

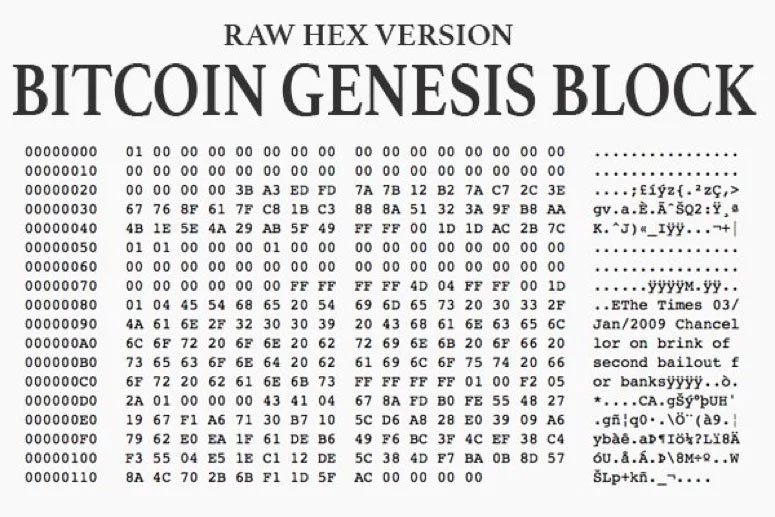

Fortunately, Satoshi Nakamoto opened a savings account for anyone in the world. Nakamoto’s innovation allows anyone globally to opt for a savings mechanism in a currency that isn’t inherently designed to lose purchasing power. No matter how hard people try, “Money Printer Go Brrr” will never be a thing in Bitcoin because the supply was set in stone once Satoshi mined the genesis block.