In a significant move indicating Wall Street’s increasing embrace of Bitcoin, Morgan Stanley, one of the largest financial institutions globally, has disclosed an investment in Bitcoin exchange-traded funds (ETFs).

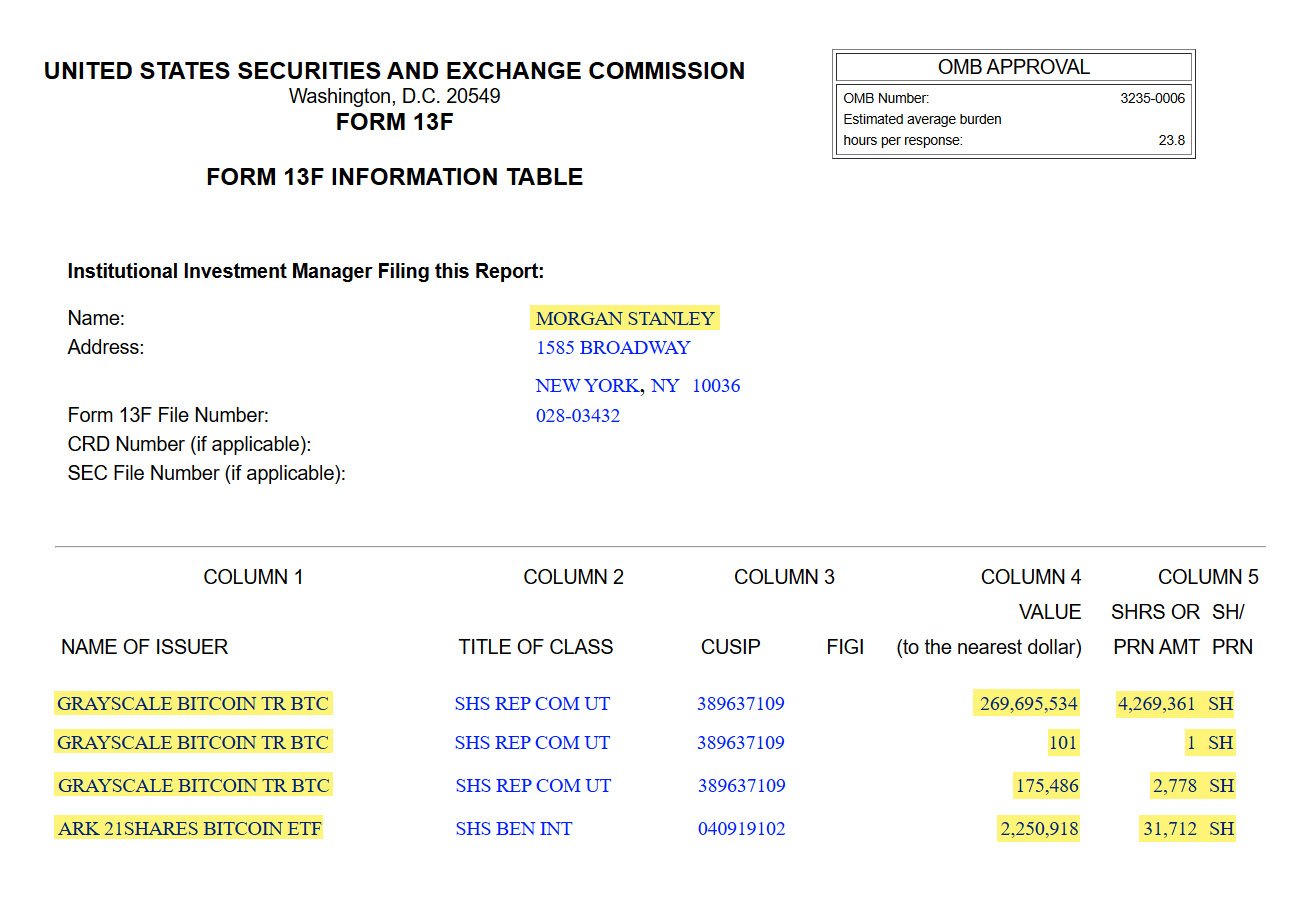

Recent filings with the U.S. Securities and Exchange Commission (SEC) shed light on Morgan Stanley’s positive shift towards owning (albeit indirectly) Bitcoin.

According to the filings, Morgan Stanley has allocated $270 million to various Bitcoin ETFs, making it a major player in the rapidly evolving Bitcoin market.

This move by Morgan Stanley reflects a broader trend among traditional financial firms, who are beginning to recognize the potential of Bitcoin as a viable investment option.

Morgan Stanley‘s investment in Bitcoin ETFs encompasses holdings in prominent funds such as Grayscale’s GBTC and Ark Invest’s ETF.

The bank’s filings reveal a significant allocation of $269.9 million to Grayscale’s GBTC, positioning it as one of the largest institutional holders of GBTC shares.

There is also an allocation of $2.3 million (31,712 shares) of Ark Invest’s spot Bitcoin ETF, ARKB.

Andrew Peel, Head of Digital Asset Markets at Morgan Stanley, emphasized the importance of the U.S. spot Bitcoin ETF launch, describing it as a potential paradigm shift in the global perception and use of digital assets. Peel stated:

“We see Bitcoin ETFs as an essential component of diversified portfolios, offering exposure to the potential growth of digital assets.”

The firm’s investment joins the ranks of other major financial institutions, including JP Morgan, BNP Paribas, and Canada’s Bank of Montreal, which have also disclosed investments in spot Bitcoin ETFs.

Millennium Management, a management company overseeing assets worth over $64 billion, also made a substantial move by investing an extraordinary ~$2 billion across several Bitcoin ETFs, marking one of the largest investments seen in recent weeks.

As more traditional financial institutions warm up to Bitcoin, accessible ETFs have enabled them to dip their toes into the Bitcoin market, further fueling its adoption. Many analysts believe that this is just the beginning, and institutions are just testing the waters, predicting larger investments in the future.

Despite initial skepticism from some firms like Vanguard, the broader shift has been towards embracing Bitcoin exposure, driven by robust client demand for access to Bitcoin’s future growth prospects.

A spokesperson from Morgan Stanley commented:

“Our clients are increasingly seeking exposure to digital assets like Bitcoin as part of their investment strategies. We believe that Bitcoin ETFs provide an efficient and regulated way to gain exposure to the cryptocurrency market.”

The recent wave of filings from institutional investors highlights a historical scale of professional investor ownership in Bitcoin markets. Latest analyses show that over 700 professional firms have invested nearly $10 billion in spot Bitcoin ETFs by the recent deadline.

Matt Hougan, Chief Investment Officer at Bitwise, likened this trend to the launch of gold ETFs in 2004, which was reported as the most successful ETF launch ever at that point in time.