In a comprehensive report titled “Digital (De)Dollarization?” released recently, financial giant Morgan Stanley explores the potential disruption to the long-standing dominance of the U.S. dollar in the global economy by the rise of Central Bank Digital Currencies (CBDCs) and digital assets like Bitcoin.

The “dedollarization” report begins by highlighting the current state of the U.S. dollar, which, despite the U.S. contributing 25% of global GDP, constitutes around 60% of global foreign exchange reserves. However, due to the U.S.’s growing deficits and recent strategic economic sanctions, this dominance is now under scrutiny, leading nations to look for alternatives.

Dedollarization and Decreasing Reliance on the U.S. Dollar

The report suggests that the ascent of digital currencies and CBDCs represents a significant challenge to the traditional dominance of the dollar in international finance. Interestingly, the European Union is concentrating on elevating the euro’s dominance, particularly in energy and commodity transactions.

Related reading: Petro-Bitcoin: Bitcoin Standard Reshaping Global Energy Dynamics

On the other hand, China is strategically supporting the yuan via its Cross-Border Interbank Payment System, posing a challenge to the prevailing dollar-centric payment systems. Russia has also been exploring the utilization of private digital currencies for certain cross-border trades, further reducing its dependency on the U.S. dollar.

In parallel efforts, several nations have formed the BRICS organization, representing Brazil, Russia, India, China, and South Africa, with the aim of establishing alternative, non-dollar methods of trade amongst themselves. Several other countries including Egypt, Ethiopia, Iran and the United Arab Emirates have also joined the organization. Notably, the organization accounts for a third of world economic output and holds 40% of the global population.

Andrew Peel, the Executive Director at the company, highlights the role of digital assets in these scenarios by stating:

“Macro investors should consider how these digital assets, with their unique characteristics and growing adoption, could reshape the future dynamics of the dollar, including their implications for aspects such as global financial stability and monetary policy.”

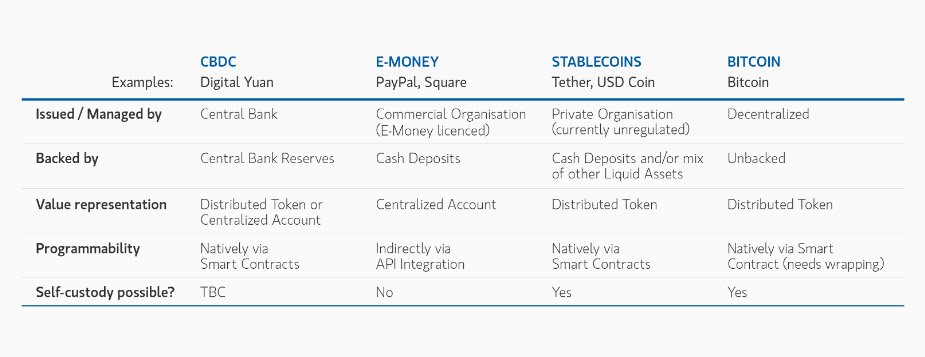

Morgan Stanley suggests that as these technologies gain acceptance and usage, they could offer practical alternatives to traditional cash and fiat currencies, thereby reducing the reliance on the dollar for international transactions and central bank reserves.

Bitcoin’s Massive Adoption

The report points to Bitcoin as a globally recognized asset with an adoption rate of 106 million owners worldwide. The report highlights the digital asset’s decentralized nature and capped supply, signaling a historic shift in national financial strategies, especially with countries like El Salvador adopting it as legal tender.

“The presence of Bitcoin ATMs in 84 countries further demonstrates its growing international reach. In terms of global scale, Bitcoin’s market capitalization is currently around the value of Switzerland’s GDP and, at its peak in 2021, surpassed that of Saudi Arabia,” reads the report.

Stablecoins, with transactions amounting to $10 trillion in payments in 2022, are identified as another significant player in the shifting financial landscape. The report notes their 24/7 access and instant settlement, along with their integration into the payment systems of major companies like Visa and PayPal.

Morgan Stanley acknowledges the progressive recognition of digital assets by several nations and significant institutions. It states:

“This integration not only validates the technology and business use cases but also marks a transition towards more efficient, faster, and cost-effective international transactions.”