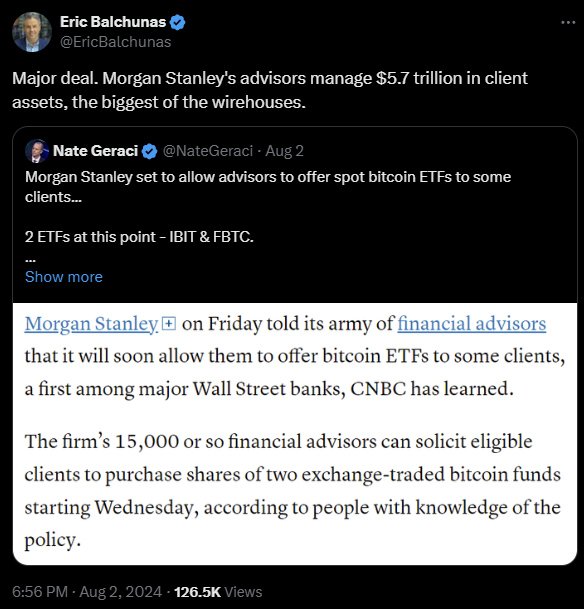

In a landmark move, Morgan Stanley is set to become the first major Wall Street bank to offer Bitcoin ETFs to its clients.

Starting Wednesday, the bank’s 15,000 financial advisors will be able to solicit investments in two Bitcoin ETFs: BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund (FBTC).

This development is a significant step in the mainstream adoption of Bitcoin, reflecting the increasing demand from high-net-worth individuals for exposure to digital assets.

Morgan Stanley’s decision to offer Bitcoin ETFs is not without its precautions. The bank has set strict eligibility criteria for its clients. To qualify, clients must have a net worth of at least $1.5 million, exhibit an aggressive risk tolerance, and have a desire to make speculative investments.

These investments will be available only in taxable brokerage accounts, not retirement accounts, ensuring that clients are fully aware of the speculative nature of the asset.

A source familiar with the bank’s policies noted that Morgan Stanley is taking this step due to clients’ demand and to stay competitive in the rapidly changing digital asset market. One of the executives claimed:

“We’re going to make sure that we’re very careful about it. We are going to make sure everybody has access to it. We just want to do it in a controlled way.”

The approval of spot Bitcoin ETFs by the U.S. Securities and Exchange Commission (SEC) in January 2024 paved the way for this significant development.

The introduction of these ETFs has made Bitcoin investments more accessible, cheaper to own, and easier to trade. Despite initial skepticism from major financial institutions, the success of these ETFs in attracting substantial inflows has been undeniable.

In just eight months, spot Bitcoin ETFs have accumulated nearly $18 billion in net inflows, with BlackRock’s iShares Bitcoin Trust and Fidelity’s Wise Origin Bitcoin Fund being the primary beneficiaries.

These products have set new records in the investment world, demonstrating the strong demand for bitcoin exposure among institutional investors.

Morgan Stanley’s move to offer Bitcoin ETFs is seen as a direct response to growing client interest. The bank’s decision is also a reflection of the broader acceptance of Bitcoin in mainstream finance.

Despite the asset’s volatility and past criticisms from prominent figures like JPMorgan Chase CEO Jamie Dimon and Berkshire Hathaway CEO Warren Buffett, Bitcoin has continued to gain traction. Its price has more than doubled in the past year, reaching new all-time highs.

To manage the risks associated with Bitcoin investments, Morgan Stanley will closely monitor its clients’ digital asset holdings. The bank aims to prevent excessive exposure to this volatile asset class.

Morgan Stanley’s cautious yet pioneering strategy sets it apart from other major banks like Goldman Sachs, JPMorgan, Bank of America, and Wells Fargo, which have so far maintained more restrictive policies on Bitcoin ETFs.

These institutions currently offer Bitcoin ETFs only on an unsolicited basis, meaning that clients must actively seek out these products.

This move by Morgan Stanley is a milestone in the adoption of bitcoin by traditional financial institutions.

Eric Balchunas, a senior ETF analyst at Bloomberg, called the decision a “major deal,” noting that Morgan Stanley’s advisors manage nearly $5.7 trillion in client assets, the largest among U.S. wirehouse brokers.

The performance of Bitcoin ETFs has been a mix of highs and lows.

On August 2, spot Bitcoin ETFs recorded major outflows, totaling $237.4 million. BlackRock’s IBIT saw $104.1 million in outflows, followed by Ark 21shares’ ARKB, with $87.7 million.

The industry’s reaction to Morgan Stanley’s announcement has been largely positive. Bitcoin investors view the bank’s move as bullish, anticipating increased demand for Bitcoin through ETFs.

In the meantime, bitcoin’s price has yet to react significantly to the news, with recent downfall to the $60,000 mark. Many have attributed the 6.9% drop in bitcoin’s price in the past couple of days to the escalating tensions in the Middle East.

The long-term implications of Morgan Stanley’s move could be profound. The increased demand from high-net-worth clients could provide a steady inflow of capital into the Bitcoin market.