Bitcoin’s recent sharp decline has reignited the debate over its stability and potential as an investment asset. The sudden drop in price has prompted long-standing Bitcoin skeptics to once again voice their criticism of the leading digital asset.

Peter Schiff Bitcoin Critique: A Repetitive Narrative

Peter Schiff, known for his skepticism towards Bitcoin, took to social media platform X to compare its ever-volatile nature to the steadiness of gold. On Tuesday, Schiff highlighted bitcoin’s sudden drop, which saw its value plummet by over $3,000 in a mere 10 minutes. Drawing a sharp contrast, he pointed out that such a drop in the price of gold, a traditional safe-haven asset, would equate to a $100 decrease within the same timeframe.

Are ETF Investors Trapped?

Schiff emphasized that while bitcoin experienced turbulence, gold’s price had actually seen a slight increase, leaving ETF investors “trapped” until the market opens.

Additionally, Schiff referenced a remark made by CNBC’s Joe Squawk, who appeared taken aback by the rise in gold prices. Schiff responded assuredly, stating, “I know exactly what it means!” Schiff proceeded to state that Bitcoin holds varying interpretations for different individuals and critiqued CNBC’s inability to determine whether it functions as a risk-on or risk-off asset. Concluding his thoughts, Schiff emphatically concluded that Bitcoin was nothing more than a “fake asset.”

Contrasting Opinions

The ongoing debate over the stability and potential of Bitcoin versus gold continues to fuel discussions within financial circles.

Notably, these comments from Schiff follow his recent prediction of a significant surge in commodity prices, further solidifying his stance against Bitcoin’s comparison to gold, despite the digital asset’s recent record-breaking run.

However, Schiff’s viewpoint stands in stark contrast to that of Mark Yusko, CEO and Chief Investment Officer of Morgan Creek Capital Management. Yusko recently predicted a staggering $150,000 valuation for bitcoin within a year and advocated for a 1% to 3% allocation to bitcoin in investment portfolios.

Bitcoin Price Plummets

Meanwhile, bitcoin’s recent price performance paints a turbulent picture. The digital asset experienced a significant 7.1% drop in the past day, slipping below the $65,000 mark for the first time since previous month. It is interesting to note that historically, the 14th week of the year has been one of the worst for bitcoin’s price performance, with an average decline of 8.33%.

Renowned Bitcoin analyst Rekt Capital warns that Bitcoin’s post-breakout retest has failed, signaling a potential slowdown in price momentum as the Bitcoin halving approaches. Rekt Capital suggests that while Bitcoin could technically recover above the old all-time high of around $69,000, it needs to sustain a price above the $65,600 weekly range low to prevent further losses.

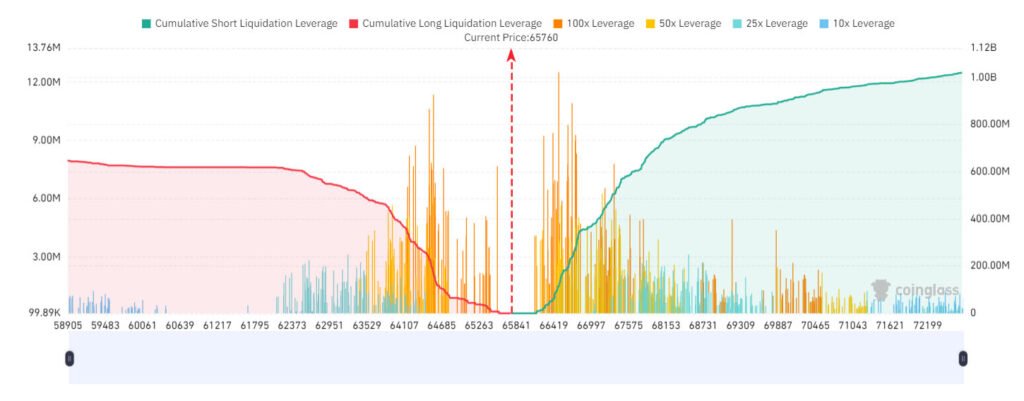

On the other hand, CoinGlass data indicates that over $249 million worth of long leveraged positions would face liquidation across all exchanges if the BTC price were to drop to the $65,000 mark.

As bitcoin continues to navigate through turbulent waters, the debate over its future as a viable investment option remains at the forefront of discussions, leaving advocates and critics alike with divided opinions on its trajectory.