The recent bitcoin (BTC) price downturn has prompted skepticism among critics, with prominent figure Peter Schiff openly mocking BTC investors and predicting a challenging period ahead for bullish sentiments.

Notably, the BTC price wiped out all gains made in 2024, just hours after the commencement of ETF trading in the United States. It plummeted from $49,000 to below $42,000 within a day, sending renowned gold enthusiast Schiff to his X account to mock BTC investors.

Peter Schiff Predicts Bearish Trend

Schiff did not hold back in expressing his skepticism regarding BTC’s performance post-ETF approval. He predicted a long weekend for bulls, hinting at the potential continuation of the bearish trend into the week by stating:

“It could be a long weekend for bitcoin bulls. If the new bitcoin ETFs gap way down on Monday it will be interesting to see how investors react. I doubt they’ll HODL.”

This is not the first time Schiff has displayed skepticism towards the digital asset. On January 9, when the whole digital asset community was eagerly waiting for spot BTC ETF approval, Schiff called the currency “a failure.” He expressed concerns that the approval of ETFs would attract a new wave of speculative investors, likening it to a casino. Schiff stated at the time:

“Since bitcoin failed as a digital currency, its only success has been as a means of speculation. The hope is that these ETFs will open a door that will allow a new group of gamblers to enter the casino.”

Community Reacts

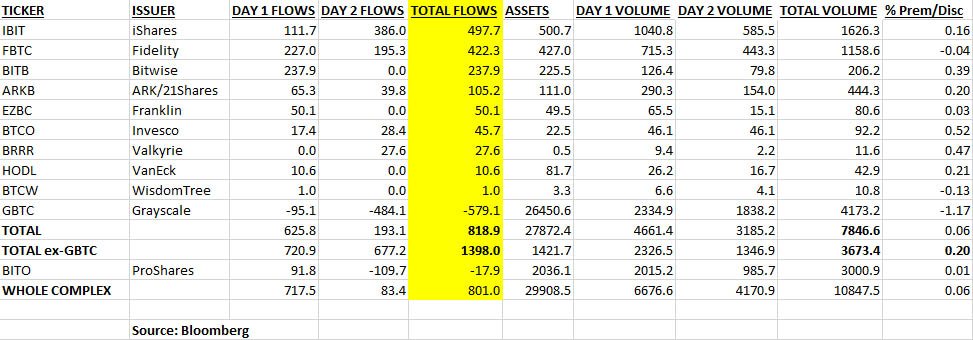

The decline in BTC price has left analysts contemplating the potential factors driving this downturn. The community speculated that the market’s overhyping of this approval, coupled with the migration of liquidity from Grayscale‘s Over-the-Counter (OTC) trusts, played a role in the sudden downturn.

Anthony Scaramucci, the founder of SkyBridge Capital, pointed to the sell-off of Grayscale’s Bitcoin Trust (GBTC) shares as a significant trigger for the sharp decline in BTC value, sending it to two-week lows.

The prevalent sentiment surrounding the GBTC sell-off revolves around two main factors. Some individuals initially engaged in trading $GBTC for its discount, which has now diminished. Others have opted to sell due to the associated fees.

Many anticipate that a substantial portion of these funds will seek alternative ways to come back into the market in the coming week. This prevailing outlook is leading many community members to strategically leverage a long position on BTC.

Concerns Surrounding the Bitcoin ETF

While the approval of Bitcoin ETFs is widely acknowledged as a pivotal moment for the industry, concerns are emerging about their potential impact on Bitcoin as both an asset and a technology. BitMEX founder Arthur Hayes views the ongoing events as more than a typical “sell the news” scenario, cautioning that Bitcoin might transform into a conventional Traditional Finance (TradFi) asset.

Ironically, the sentiments expressed by Hayes align with those of SEC Chairman Gary Gensler, who believes that the concept of a Bitcoin ETF contradicts Satoshi Nakamoto’s original vision for the digital asset.

This raises questions about the evolution of the digital asset within the broader financial landscape and the potential ramifications of its increasing integration into traditional financial markets. As the fallout from the Bitcoin ETF approval continues to unfold, investors and enthusiasts alike are left to navigate the uncertainties, pondering the future trajectory of BTC.