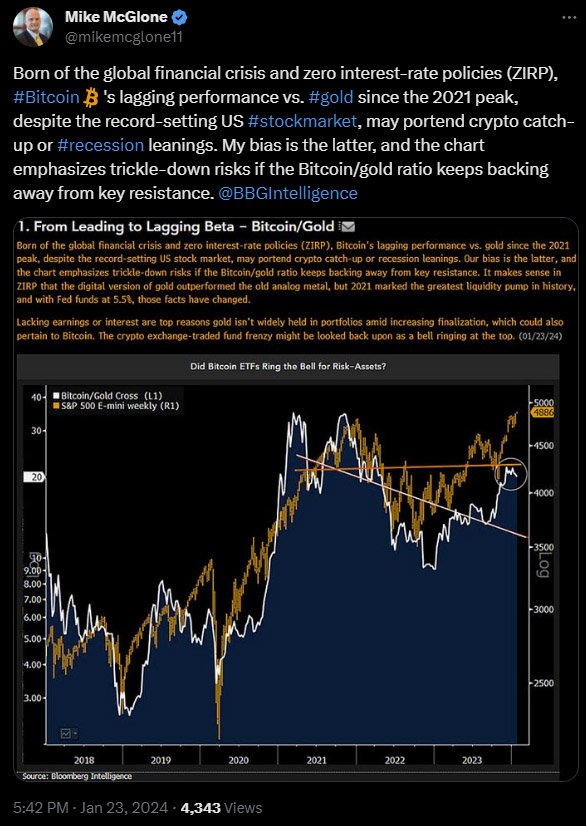

In a notable shift since its all-time high in 2021, bitcoin finds itself trailing behind gold, signaling potential economic concerns. Particularly, the bitcoin/gold ratio is encountering significant resistance against the record-setting United States stock market, warning of the possibility of a recession 2024 episode. Bloomberg’s commodity expert, Mike McGlone, expresses concerns about the digital asset market’s trajectory.

McGlone’s analysis, shared on X on January 23, highlights his inclination towards an approaching recession, emphasizing trickle-down risks.

Recession 2024: What’s Different This Time?

Bitcoin has historically maintained an inverse relationship with traditional equities, serving as a counterbalance during stock market fluctuations. When stocks face volatility or decline, bitcoin has traditionally witnessed heightened demand from investors. This inverse correlation presents an appealing feature for investors seeking portfolio diversification, particularly in challenging market conditions.

McGlone points to bitcoin’s historical surge during the period of zero-interest rate policies (ZIRP) after financial crises. However, as interest rates rose, bitcoin has started to lag behind gold, a trend echoing concerns in the current economic landscape. He stated:

“Born of the global financial crisis and zero interest-rate policies (ZIRP), Bitcoin’s lagging performance vs. gold since the 2021 peak, despite the record-setting US stock market, may portend crypto catch-up or recession leanings. Our bias is the latter.”

Notably, this year, both gold and bitcoin have experienced a major decline, with the bitcoin/gold ratio showing signs of potential downturn despite the S&P 500 reaching new highs. This crucial indicator is currently not only trailing behind gold but also facing resistance from the stock market.

McGlone predicts a potential downward trend for this ratio, sounding the alarm for a recession in the Bitcoin market.

Bitcoin/Gold Ratio Insights

McGlone draws attention to the recent spot Bitcoin Exchange-Traded Funds (ETF) frenzy as a noteworthy precursor to the forecasted recession. He draws a parallel to gold’s lack of yield, suggesting:

“Lacking earning and interest are top reasons gold isn’t widely held in portfolios amid increasing finalization, which could also pertain to Bitcoin. The crypto exchange-traded fund frenzy might be looked back upon as a bell ringing at the top.”

Recent Trend Supporting McGlone

Bitcoin’s recent performance reflects this concern, losing nearly 18% since reaching $48,965 on January 11, following the approval of 11 spot bitcoin ETFs by the Securities and Exchange Commission (SEC). Currently trading around $40,000, the digital asset struggles to regain its footing after breaching a crucial support line.

Additionally, BTC’s daily Relative Strength Index (RSI) signals weakness, indicating a challenging period for the digital asset. Despite this, the analysts are still optimistic that bitcoin could retrace to December’s range and recover its strength in an upward trend.

The underperformance of bitcoin against gold, coupled with concerns about the bitcoin/gold ratio, spot ETF frenzy, and potential recession, paints a complex picture for the digital asset market in 2024.

Investors are advised to closely monitor developments, exercising caution in their decision-making process.