Russian experts have claimed that the current Bitcoin bull market is falling short of the highs experienced in 2017.

This statement was made in a Bitcoin-themed report titled “Bitcoin Bull Market Fever Will Falter,” published by the Roscongress Foundation, one of Russia’s most significant development-focused NGOs and conference organizers.

The report states that the new all-time high for bitcoin (BTC) observed in March this year was driven by a “speculative game” against the backdrop of spot Bitcoin ETF approvals.

Despite this sudden rise in bitcoin prices, the authors argue that the digital asset failed to generate the same level of excitement seen at the end of 2017.

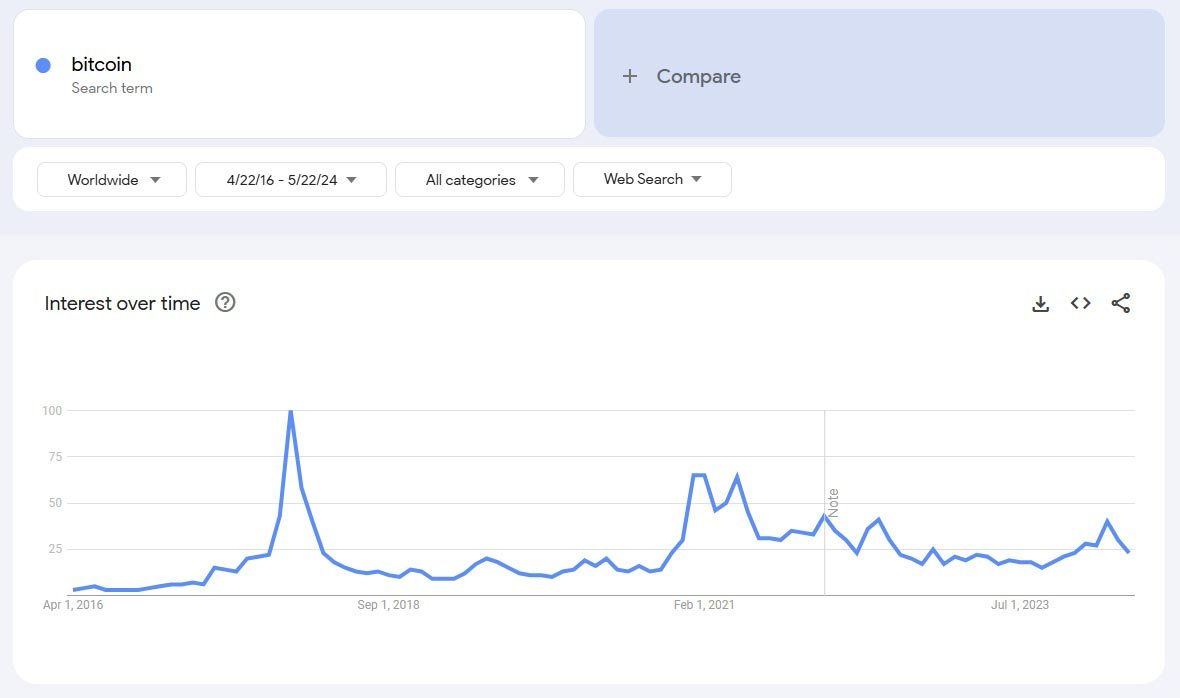

They supported their claim by pointing to internet search engine queries related to digital assets, which have remained significantly below their peak values.

According to the report, only half as many people worldwide were searching for BTC in 2024 compared to 2017. This trend raises questions about the broader interest and engagement with Bitcoin in the current market.

The experts noted that the approval of spot Bitcoin ETFs was expected to make digital asset investments more accessible to a broader audience. However, the evidence suggests that this has not yet materialized as anticipated.

The foundation explained that the “mining-based transaction protocols of the Bitcoin network” pose an obstacle to its adoption. They stated that Bitcoin is generally still a poor fit for full integration into the traditional financial system due to its unsuitability for offsetting.

Notably, offsetting, also known as netting, refers to the net presentation of separate assets and liabilities or income and expenses in financial statements.

The foundation added that market data shows most investors continue to view bitcoin as a high-risk asset, akin to tech stocks. They noted that the bitcoin’s price trajectory depends mostly on the willingness of financial market participants to take on risks.

Furthermore, Bitcoin is “much more strongly correlated with stock market movements” than with assets like gold, according to the Russian experts.

Despite the mixed short-term outlook, the report was not entirely pessimistic about Bitcoin or the impact of spot Bitcoin ETFs’ approval in the United States.

The authors acknowledged that, in the long run, spot Bitcoin ETFs would undoubtedly make investing in the digital asset more accessible to all market participants. However, they cautioned that temporary price rises were likely the result of speculative play by traders.

The authors highlighted the wide range of bitcoin price forecasts for the end of the year. The report reads:

“The range of forecasts of bitcoin quotes by the end of the year is extremely wide: the average maximum value is 121,764 dollars, the average minimum is 50,138 dollars per unit.”