Bitcoin has always been the subject of intense speculation and analysis. Recent predictions by notable figures in the industry, including Samson Mow, have stirred significant interest and debate.

Despite recent dips and stagnant prices, many believe bitcoin is on the brink of a dramatic surge, with some forecasts suggesting it could reach as high as $10 million per coin.

Bitcoin’s price has been relatively stable around the $70,000 mark since mid-May, frustrating traders and investors.

Over the past 48 hours, the digital asset experienced a drop of almost 3%, trading at around the $67,000 mark before rebounding above $69,000 again. This decline broke a three-day consolidation period, with the price falling below an ascending parallel channel.

This movement has pushed bitcoin towards a more bearish outlook.

Samson Mow, the CEO of Jan3 and a well-known Bitcoin advocate, has been vocal about his bullish outlook on bitcoin. Mow predicts that bitcoin’s price will experience an “explosive” rally, driven by the current market conditions.

He believes that “entities shorting bitcoin massively on futures” will soon be “annihilated,” leading to a significant upward movement in the price. Mow noted:

“Bitcoin being kept at sub $0.07M is like compressing a coil. It’s going to be explosive to the upside soon.”

Adam Back, a prominent figure in the Bitcoin world whose name has been cited in the Bitcoin Whitepaper, has suggested that the current price stagnation might be due to certain sellers urgently needing cash.

These sellers are offloading their holdings, and once their limited supply is depleted, the market could start to rise again. Back highlights data supporting the presence of basis trading, where collateral is bitcoin rather than Bitcoin ETFs.

He also points to continued buying activity through CME futures, indicating latent demand.

Mow supports Back’s analysis, noting the rise in short interest from new, less experienced traders who misunderstand the cash and carry trade.

He argues that the significant shorting activity on futures is likely unsustainable, and those involved could face massive liquidations soon, suddenly driving bitcoin’s price upward.

Notably, the TD Sequential, a technical analysis indicator, recently flashed a buy signal on the hourly bitcoin chart. This indicator, created by Tom DeMark, is used to identify potential turning points in asset prices.

The appearance of this buy signal suggests that bitcoin might rise by one to four hourly candlesticks, providing a short-term break from the current downward trend.

However, the market has seen outflows from U.S. Bitcoin ETFs, which experienced a net outflow of $64 million recently, breaking a 19-day streak of inflows. This shift in investor sentiment from accumulation to selling has added to the downward pressure on bitcoin’s price.

Despite the current market turbulence, Mow remains confident in bitcoin’s long-term potential.

He emphasizes that bitcoin trading below $70,000 is an anomaly given its trajectory and predicts that not only would $1 million per bitcoin eventually seem like a bargain, but the price could ultimately surge to $10 million.

This bold prediction highlights the potential for substantial returns for early investors. Mow tweeted:

“Watching the Bitcoin price dropping, just remember where it inevitably goes.”

This statement reinforces his bullish stance. He believes that the long-term investment proposition for Bitcoin remains intact, with global capital poised to compete for the remaining 1.3 million unmined coins.

Mow expressed astonishment at the ongoing decrease in bitcoin’s value, especially considering the remarkable level of adoption it currently enjoys. He remarked, “Feels weird seeing Bitcoin price go down when we’re at a level of unprecedented adoption. BTFD!”.

Related: Kiyosaki Says He Will Be Happy If Bitcoin Crashes

The Bitcoin community has been active in discussing these predictions and the current market conditions.

Many Bitcoin enthusiasts agree with Mow’s bullish outlook, pointing out the scarce digital asset’s fixed supply, immutable ledger, and permissionless nature as key factors that will drive its value higher in the long term.

In response to Mow’s tweet with the diagram illustrating the proportion of available capital versus bitcoin, many fans noted that the triangle of available capital should be much larger, emphasizing the limited supply of bitcoin compared to the vast amount of global capital that can be used to purchase it.

Recent indicators suggest a surge in capital, like Wisconsin Pension Fund’s $164 million investment in Bitcoin ETFs and rumors of sovereign wealth funds’ interest. Despite this, BTC’s recent price performance has been lackluster.

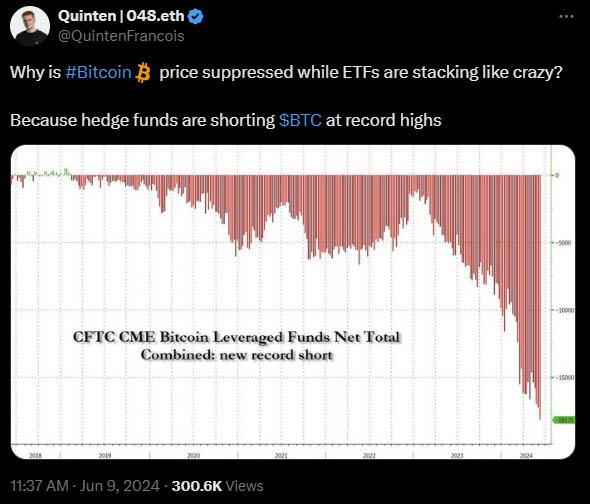

Mow’s claims echo the sentiments expressed by Bitcoin investor Quinten on June 9, who suggested that despite a surge in ETF investments, the price of bitcoin remains artificially low.

Quinten, like Mow, pointed towards hedge funds engaging in massive short selling of bitcoin as the primary reason for this phenomenon occurring despite the significant influx of investment.

As the market continues to evolve, the potential for an explosive rally in bitcoin’s price remains a possibility. Whether driven by a short squeeze, increased adoption, or the inherent scarcity of bitcoin, the next few months could be pivotal in determining the future trajectory of this digital asset.