Jan3 CEO Samson Mow recently compared the upcoming bull cycle with that of 2017, predicting BTC to reach $1 million.

The ongoing narrative surrounding the increasing institutional interest in Bitcoin exposure has led to multiple analysts coming up with their forecasts for the upcoming bull cycle. Amid this optimistic wave, Jan3 CEO Samson Mow has made a particularly bold statement, predicting Bitcoin to hit an astonishing $1 million per coin. This projection, shared on Mow’s Twitter, stands out even among maximalist standards.

Samson Mow’s $1 Million Bitcoin Prediction

Mow’s prediction hinges on the belief that Bitcoin is poised to replicate the parabolic growth cycle that fueled the historic bull run in 2017. He points out that during that period, BTC experienced a 20x surge to go from $1,000 to $20,000 in just nine months.

Importantly, this rapid appreciation occurred at a time when exchange supply was higher, concerns about BTC mining’s environmental impact were prevalent, and institutional interest was minimal.

According to Mow, Bitcoin is expected to follow a similar trajectory. He believes that the BTC will undergo a 20-fold price rise, starting at $50,000 and reaching $1 million per BTC. Mow asserts that achieving such exponential growth is more plausible today, given the improved circumstances compared to 2017.

Hal Finney’s Influence

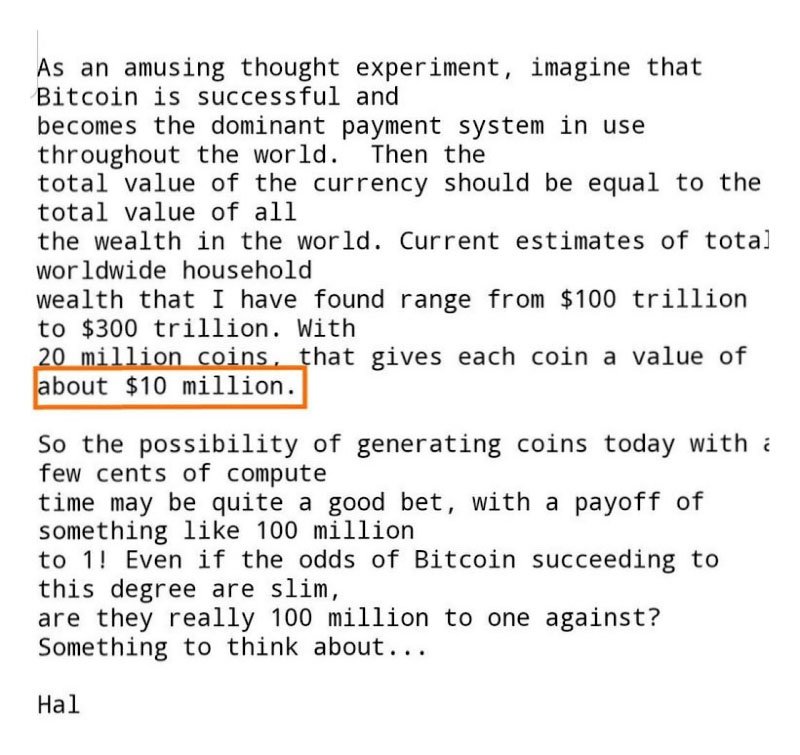

To support his audacious prediction, Mow references Hal Finney, a software developer from bitcoin’s early days. Finney, who received the first Bitcoin transaction from Satoshi Nakamoto, suggested in a cited message that if Bitcoin becomes the dominant global payment system in the future, one coin could reach $10 million. This, he argued, would be feasible when the value of the entire Bitcoin supply equals the world’s total wealth.

Community Reaction

Bitcoin analyst Bit Paine conducted a thorough mathematical analysis to support Mow’s forecast. He computes the anticipated new supply for the upcoming cycle, projecting 136,000 BTC for the current epoch and 656,000 BTC for the subsequent one. This results in a cumulative estimate of about 792,000 BTC.

Furthermore, Paine takes into account the potential liquidation of old BTC, referencing the HODL Waves metric. His estimation suggests that 15-20% of the circulating supply of older BTC might enter the market, mirroring patterns from previous cycles. If we assume a 20% sell-off of old BTC in the next four years, this could equate to around 3.8 million BTC.

Despite Mow’s confidence, not everyone shares his optimism. Critics, like the Bit Harington, argue that achieving $1 million per coin would require a significantly larger influx of capital than in 2017, making a 20x increase more challenging.

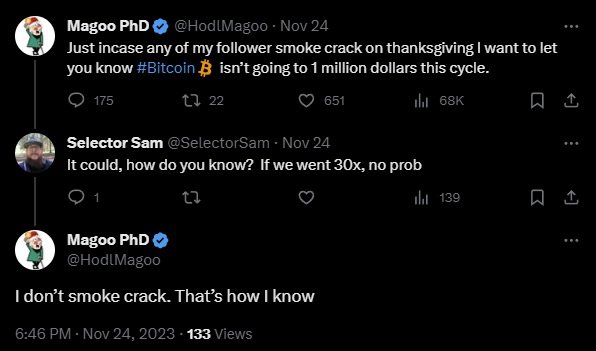

Economist David Andolfatto emphasized the notion of diminishing returns in consecutive cycles, suggesting that the upcoming bull cycle may yield lower percentage gains. Adding a touch of humor, X commentator Magoo PhD dismissed Mow’s ambitious prediction by playfully likening it to smoking crack.

Envisioning a million-dollar Bitcoin is challenging, but its realization could revolutionize finance. If it occurs, hyperbitcoinization would ensue, positioning digital assets to dominate rather than compete with traditional currencies. This transformation could elevate early adopters to a new elite status, providing a sense of validation for Bitcoin, previously dismissed as a scam.