The Bitcoin market has taken a significant step forward, with the U.S. Securities and Exchange Commission (SEC) finally approving the listing and trading of options for BlackRock’s spot Bitcoin Exchange-Traded Fund (ETF).

Approval of the first Bitcoin ETF options trading marks a major milestone in the integration of Bitcoin into mainstream finance, signaling greater acceptance of digital assets by institutional investors.

Like other Bitcoin ETFs, BlackRock’s iShares Bitcoin Trust ETF, trading under the ticker symbol “IBIT,” is a financial product designed to offer investors exposure to bitcoin without having to directly purchase or store the digital asset themselves.

ETFs like this are traded on traditional stock exchanges, making it easier for investors, especially those in the institutional sector, to add bitcoin to their portfolios.

With the SEC’s recent approval, options trading on BlackRock’s Bitcoin ETF will now be possible.

Options are a type of financial derivative that gives investors the right, but not the obligation, to buy or sell the ETF at a specific price within a set period. This allows traders to speculate on the future price of bitcoin or hedge their current holdings.

Related: Congressmen Urge SEC to Approve Options on Spot Bitcoin ETFs

The SEC’s green light for BlackRock’s Bitcoin ETF options is a notable moment for the Bitcoin industry, as it brings the digital asset closer to mainstream acceptance.

As one of the largest asset managers in the world, BlackRock’s involvement lends a sense of legitimacy to digital currencies, especially for older generations that are skeptic of new technology that they do not fully understand.

Michael Saylor, CEO of MicroStrategy and a prominent advocate for Bitcoin, commented on the approval, saying it would “accelerate institutional adoption” of Bitcoin.

According to Saylor, the launch of options trading on Bitcoin ETFs will broaden the scope of investment in bitcoin, encouraging larger financial players to enter the market.

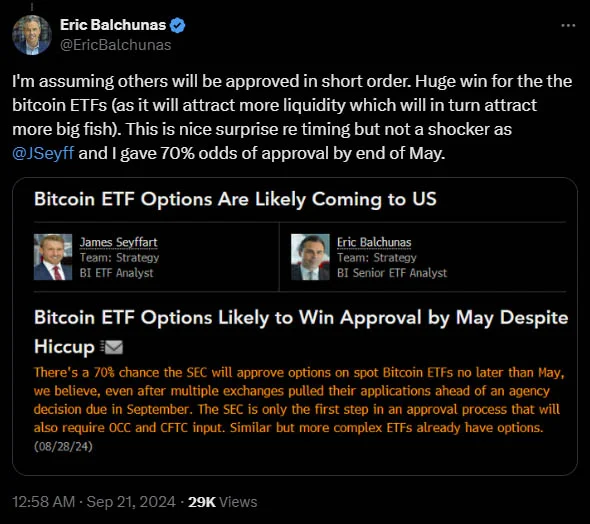

Bloomberg analyst Eric Balchunas shared a similar sentiment.

He noted that this decision would “attract more liquidity” and “more big fish” into the bitcoin market. This means that more institutional investors, such as hedge funds and asset managers, are likely to start trading bitcoin through regulated products like BlackRock’s ETF.

Balchunas also added:

“This is just one stage of approval, the OCC and CFTC has to approve as well before they officially list. The other two don’t have a ‘clock’ so not sure when they’ll be approved. A big step tho nonetheless that the SEC came around.”

For institutional investors, options trading on BlackRock’s Bitcoin ETF offers several advantages.

It provides a more sophisticated and controlled way to gain exposure to bitcoin. Options give investors the ability to hedge against price movements or make speculative investments with limited risk.

Nasdaq emphasizes that options on IBIT must meet specific criteria, ensuring that the underlying asset is widely held and actively traded before the options can be listed.

These options will be physically settled, following American-style exercise rules, which means they can be exercised at any time before their expiration date.

Moreover, these products offer institutional investors a way to amplify their exposure to bitcoin with less capital, thanks to the leverage provided by options. This leverage, however, comes with its own risks, as any losses can be equally amplified.

BlackRock is not the only major player stepping into the Bitcoin options market.

Related: Nasdaq Seeks Approval from SEC to Launch Bitcoin Index Options

Singapore’s DBS Bank, one of Asia’s largest financial institutions, recently announced that it will offer Bitcoin and Ethereum options trading to its institutional clients. This represents another key development in the growing adoption of Bitcoin by traditional financial institutions.

DBS Bank’s Bitcoin options trading will be offered over the counter (OTC), which allows for more tailored and sophisticated investment products for their clients.

According to DBS, these options are designed to meet the growing demand from professional investors who want exposure to digital assets while managing risks.

Despite the excitement surrounding the approval of Bitcoin ETF options, there are risks that investors should be aware of.

Bitcoin’s volatility remains one of the primary concerns for both individual and institutional investors. The price of bitcoin can fluctuate dramatically within short periods, which may affect the value of options contracts tied to the asset.

In addition, options trading involves leverage, meaning investors can control a large position with a relatively small amount of capital.

While this can increase profits, it can also amplify losses. Traders unfamiliar with the complexities of options, such as how “the Greeks” (risk measures in options trading) work, may find themselves at a disadvantage.

Another concern is liquidity. The bitcoin options market is not as liquid as traditional financial markets, which could result in wider bid-ask spreads and make it difficult to execute trades at favorable prices.

The approval of options trading for BlackRock’s Bitcoin ETF and DBS Bank’s move to introduce similar products highlight a broader trend in the financial world: the increasing integration of bitcoin into traditional banking and financial services.

As financial giants like BlackRock and DBS offer more regulated and secure ways for institutional investors to engage with Bitcoin, the digital asset’s legitimacy continues to grow.

This, in turn, could lead to more capital flowing into the market, increased liquidity, and a more stable price environment for bitcoin.

While there are still regulatory hurdles to overcome, such as approvals from other agencies like the Commodity Futures Trading Commission (CFTC) and the Office of the Comptroller of the Currency (OCC), the momentum seems to be in favor of broader bitcoin adoption.