The anticipation surrounding Bitcoin’s potential Exchange-Traded Fund (ETF) approval by the United States Securities and Exchange Commission (SEC) has triggered significant market fluctuations. Analysts from Matrixport, a prominent digital asset investment services provider, forecast that there is a possibility that the SEC rejects Bitcoin ETF applications.

SEC Rejects Bitcoin ETF Applications in January? Matrixport’s Projections

Matrixport analysts projected the SEC’s rejection of Bitcoin Spot ETFs, citing political dynamics and compliance concerns. They emphasized the SEC Chair Gary Gensler‘s cautious stance toward digital assets, indicating a low likelihood of approval. This forecast ignited widespread speculation, shaping market sentiments.

Related reading: Ex-SEC Official Tom Gorman Doubts Bitcoin ETF Approval

It is stated in Matrixport report:

“From a political perspective, there is no reason to approve a Bitcoin Spot ETF that would legitimize Bitcoin as an alternative store of value. Since traders started betting on an ETF approval in September 2023, at least $14 billion of extra fiat and leverage has been deployed into crypto.”

Matrixport highlighted the significant role of ETF expectations in shaping the digital asset market. They estimated that a substantial portion of the $14 billion influx into digital assets since September 2023 was linked to ETF anticipations, contributing to heightened market volatility.

Impact on Bitcoin Price

The mere speculation of ETF rejection led to abrupt and substantial price fluctuations in Bitcoin. On the 15th anniversary of the ‘Genesis’ day, bitcoin price witnessed a rapid decline, plummeting from an intraday high of $45,600 to as low as $40,700 in a matter of hours. The volatility persisted as bitcoin hovered around $42,000, experiencing a notable 7% decline within 24 hours.

Community Insights

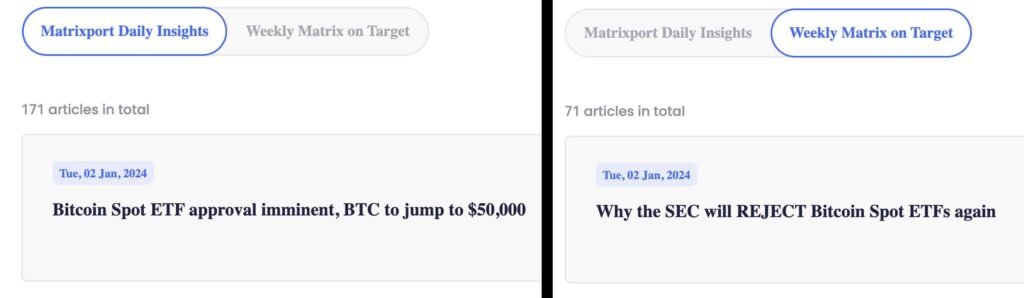

Apparently, Matrixport published two reports on the same day, one titled “Bitcoin Spot ETF Approval Imminent, BTC to jump to $50,000”, and another one titled “Why the SEC will REJECT Bitcoin Spot ETFs again.” The Bitcoin community was keen enough to observe the irony and point it out.

Alistair Milne, a Bitcoin investor, highlighted Matrixport’s inception by Jihan Wu, a prominent Chinese billionaire in digital assets and co-creator of Bitmain, and the highlighted the irony of double standards in their reporting.

James Van Straten, an industry analyst, highlighted Wu’s advocacy for Bitcoin Cash, a 2017 Bitcoin fork. He said : “If anyone believes anything that Matrixport publishes, I have a bridge to sell to you.”

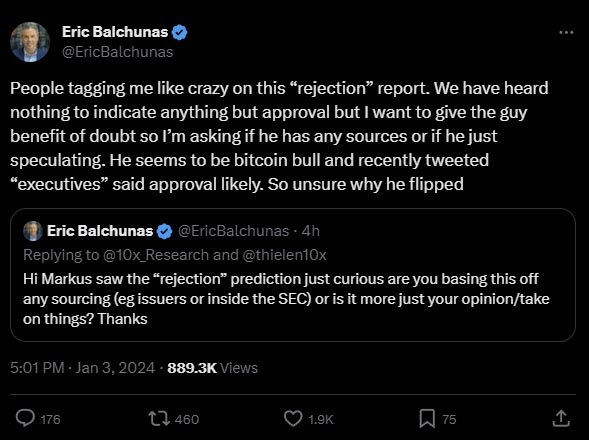

Bloomberg ETF analyst Eric Balchunas also weighed in on the matter, stating:

“We have heard nothing to indicate anything but approval but I want to give the guy benefit of doubt so I’m asking if he has any sources or if he just speculating,”

He added in another post:

To be clear tho: not saying rejection outright imposs.. but we’ve heard nothing to indicate that. And we aren’t alone, many news orgs now in tune with us based on their own independent reporting.

Political Landscape and SEC Dynamics

Its stated in the report, that the political landscape, particularly the dominance of Democrats within the SEC’s five-member leadership, raises doubts about the approval prospects. Gensler‘s emphasis on stringent compliance further reinforced Matrixport’s skepticism about Bitcoin Spot ETF approvals in the near term.

The report adds that Gensler has shown reluctance towards embracing digital assets in the US. Notably, last month, he told CNBC that there has been “far too much fraud and bad actors in the crypto field,” and that there is a lot of non-compliance from the players, both with securities law and the laws surrounding anti-money laundering policies. He highlighted that the SEC is trying to “protect the public against bad actors.”

The report highlights that Gensler’s comments in December 2023 indicate a belief that the digital asset industry needs stricter compliance. Politically, there may be no incentive to approve a Bitcoin Spot ETF, as it could legitimize Bitcoin as an alternative store of value, which may not align with current sentiments.

Matrixport claims that despite numerous meetings the applicants have had with the SEC, their submissions lack a “critical requirement”. It states:

While we have seen frequent meetings between the ETF applicants and staff from the SEC, which resulted in the applicants refiling their applications, we believe all applications fall short of a critical requirement that must be met before the SEC approves. This might be fulfilled by Q2 2024, but we expect the SEC to reject all proposals in January.

Potential Market Ramifications

Should the SEC reject the proposed Spot Bitcoin ETFs, Matrixport predicts cascading liquidations in the market. It projects this scenario could trigger a rapid 20% decline in bitcoin’s value, potentially revisiting the $36,000 to $38,000 price range.

Despite short-term market uncertainties, Matrixport maintained a bullish outlook for Bitcoin in 2024. Leveraging historical trends related to U.S. election cycles and Bitcoin mining patterns, they projected Bitcoin’s value to surpass $42,000 by the year-end, providing optimism for long-term investors amid regulatory ambiguity.