The US government recently transferred a significant portion of its bitcoin holdings, seized from Silk Road marketplace website, leading to speculation that it may be preparing to sell off the stash. This anticipation has the market on its toes, with discussions arising about the aftermath of this event. This move, possibly aimed at liquidating a significant stash of bitcoin, has sparked discussions among experts and investors alike.

Seizure of BTC from Silk Road Marketplace Website

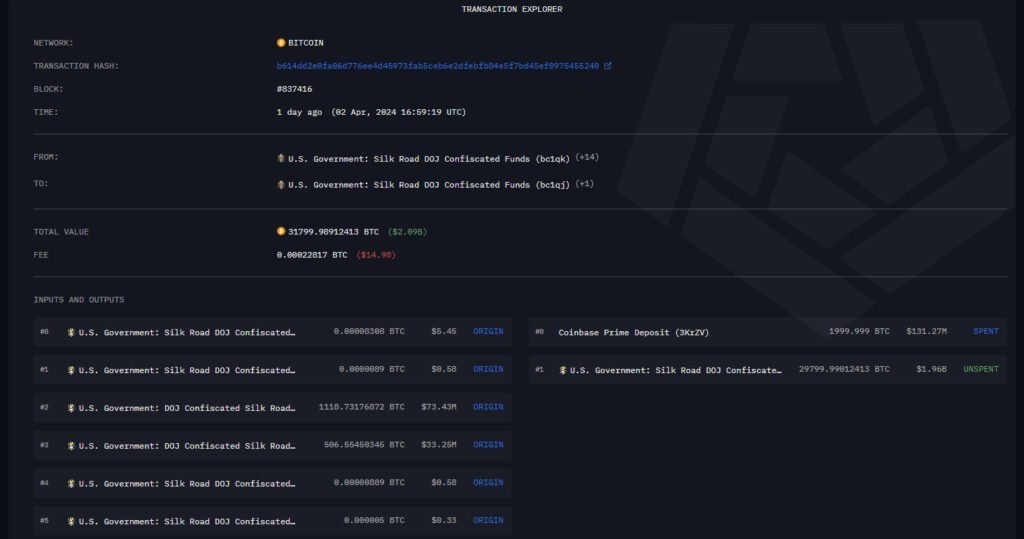

Silk Road, once a notorious digital black market facilitating illegal transactions, was shut down by the FBI. The government seized over 200,000 bitcoin, worth billions of dollars, from this illicit marketplace. The legal battle ensued, leading to the recent decision by the US Department of Justice (DOJ) to move forward with the sale of these seized assets. At present, the main address where the government stores its bitcoin from the Silk Road holds a total of 29,799 BTC, valued at approximately $1.96 billion.

The US government recently initiated transactions involving these seized bitcoin. On-chain data revealed several transactions indicating the transfer of significant amounts of bitcoin to exchanges like Coinbase. These transactions have raised speculation about the government’s intentions and their potential impact on the digital asset market.

Expert Insights

Blockchain analysts and industry leaders have offered their perspectives on the government’s actions. Blockstream CEO, Adam Back, sees the government’s bitcoin sales as an opportunity for holders, suggesting it could protect against future inflation. He remarked:

“hehe good point. should’ve hodled. but better for bitcoiners if they sell and then print more USD later. they know they want to. well basically have to at this point.”

Blockchain analyst Benjamin Skew shared his views on social media, shedding light on the Silk Road bitcoin’s movement to Coinbase. Skew explained that while chaos ensues, the bulk was transferred to an inactive wallet.

Ali Martinez chimed in on the price analysis of bitcoin for now, emphasizing the significance of the 200-period moving average (EMA) on Bitcoin’s 4-hour chart. Martinez notes its consistent support since February, crucial in halting declines.

Bloomberg analyst James Seyffart highlighted this event, suggesting that the government’s action was influenced by Judge Failla’s dismissal of SEC’s accusations against Coinbase regarding brokerage activity on Coinbase Wallet.

The U.S. Marshals Service, a major bitcoin seller, has facilitated the sale of 195,000 BTC up to now, as reported by researcher Jameson Lopp.

Government’s Strategy and Market Reaction

Following reports of the government’s possible bitcoin sales, the bitcoin market experienced fluctuations. Bitcoin prices dropped, reflecting the uncertainty surrounding the sale of such a large quantity. Market observers are closely monitoring the situation for further developments.

The US government’s decision to sell seized bitcoin is part of its ongoing efforts to handle assets obtained from criminal activities. Despite attempts by lawmakers to hold these funds as strategic assets, the government continues to follow its mandate of selling confiscated assets, including digital assets. In March, the US government auctioned 10,000 Silk Road-related bitcoin, selling about 9,861 BTC valued at $216 million, as reported in court documents.

The sale of such a significant amount of bitcoin could potentially affect market dynamics. Some experts believe that the government’s sales may create short-term volatility in the Bitcoin market. However, others argue that the long-term impact may be limited, as previous sales had little visible effect on bitcoin’s price movements.

Future Outlook

As the US government proceeds with the sale of Silk Road bitcoin, questions arise about its intentions and the broader implications for the bitcoin market. Investors and analysts are keenly observing how these developments unfold and their potential ramifications for bitcoin’s price and market dynamics.

The US government’s decision to sell seized Silk Road bitcoin marks a significant development in the space. With experts offering diverse perspectives and the market reacting to the news, the outcome of these sales remains uncertain. However, it underscores the increasing integration of Bitcoin into mainstream financial systems and the ongoing regulatory challenges they face. As the situation evolves, stakeholders will continue to monitor developments closely to gauge their impact on the broader digital asset market.