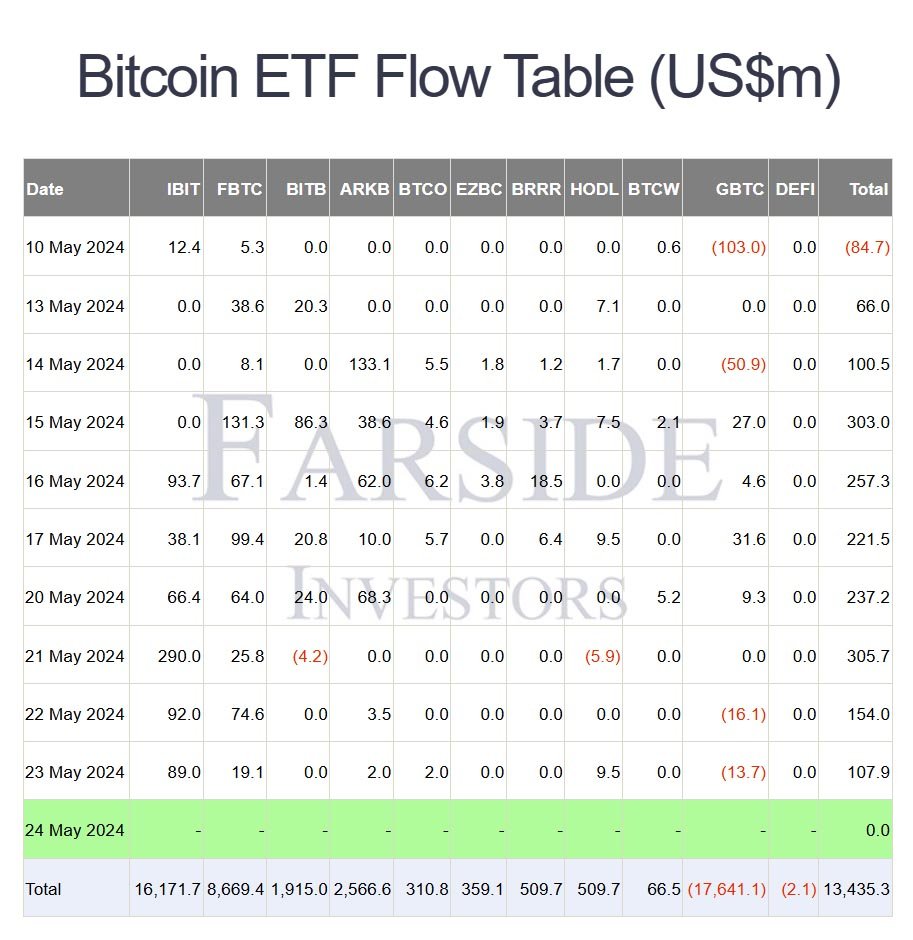

Signs of renewed interest in Bitcoin start to emerge in the market, as U.S. spot Bitcoin exchange-traded funds (ETFs) record net inflows for nine consecutive days.

This marks the longest streak of funds flowing in since mid-March, when bitcoin ETF inflows saw ten straight positive days. The recent surge reflects a growing interest and confidence in this investment product.

On Thursday alone, spot Bitcoin ETFs attracted $107.91 million. BlackRock’s iShares Bitcoin Trust (IBIT) led the way, contributing $89 million to the total inflows.

Fidelity’s Wise Origin Bitcoin Trust (FBTC) followed with $19 million, while VanEck’s Bitcoin fund added another $10 million. Smaller inflows were reported by funds from Ark Invest, 21Shares, Invesco, and Galaxy Digital.

Despite these impressive numbers, not all funds shared in the gains. Grayscale’s converted Bitcoin Trust (GBTC) experienced a net outflow of $13.7 million.

Other funds, including those from Bitwise, Valkyrie, Franklin Templeton, WisdomTree, and Hashdex, reported no significant changes in their flows.

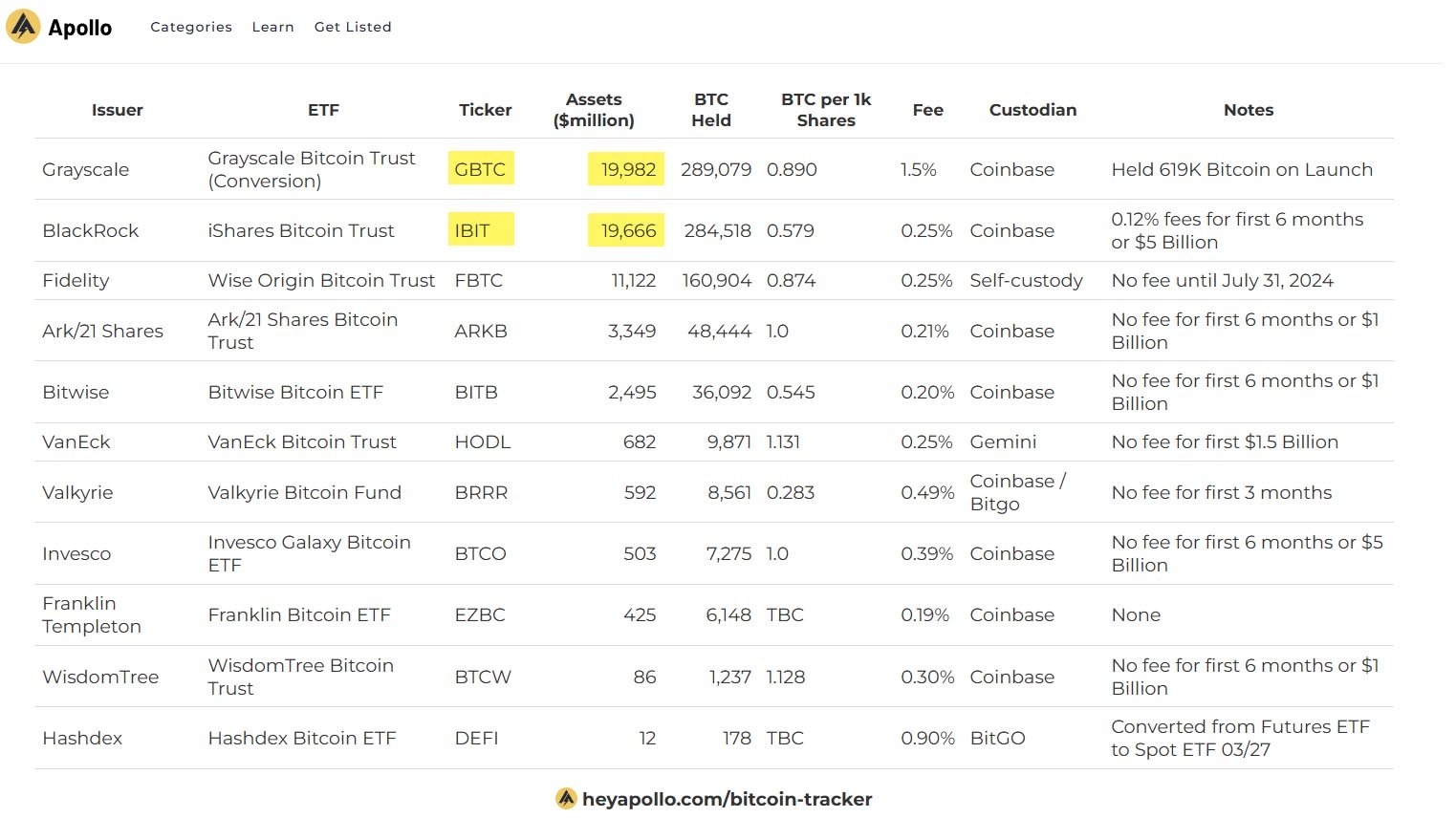

In just four months, IBIT has amassed nearly $20 billion in assets, a milestone that typically takes years for most ETFs to achieve. It is currently running close behind Grayscale’s GBTC in terms of Assets Under Management (AUM), according to data from Apollo.

As BlackRock prepares to take over GBTC, IBIT is now only $300 million behind GBTC in AUM, setting it on a path to become the largest spot Bitcoin ETF.

Since the approval of spot Bitcoin ETFs by the U.S. Securities and Exchange Commission (SEC) in January, these investment products have seen total net inflows of over $13.43 billion.

However, it’s worth noting that the current capital flowing into these ETFs is still significantly lower than the peaks observed in March.

These ETFs are designed to track the price of bitcoin, allowing investors to benefit from price movements without the complexities of buying and storing the digital asset themselves.

The recent inflows into spot Bitcoin ETFs come at a time when bitcoin’s price has been experiencing some volatility. Over the past 24 hours, the price of bitcoin rose by more than 2%, surpassing the $69,000 mark. As price surges, the demand for Bitcoin ETFs remains strong, as evidenced by the continuous inflows.

The approval and subsequent success of spot Bitcoin ETFs have also paved the way for similar products in other regions.

This week, the U.K. approved Bitcoin exchange-traded products (ETPs) to be listed in London, further validating Bitcoin as a credible institutional asset class. If the current momentum continues, bitcoin could be on track to finish May on a high note.