Bitcoin Exchange-Traded Funds (ETFs) have recently witnessed unprecedented inflows, sparking excitement and speculation within the Bitcoin community.

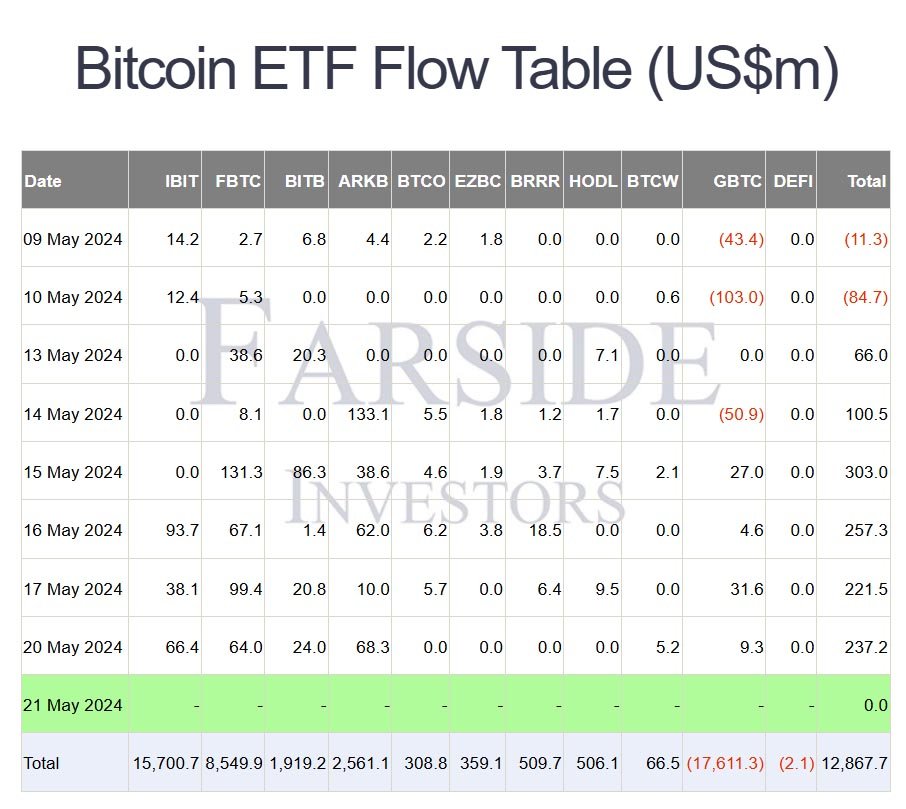

According to reports from Farside Investors, spot Bitcoin ETFs saw remarkable inflows totaling $237 million on May 20 alone.

This surge in investment marked the sixth consecutive day of net inflows for Bitcoin ETFs, with inflows exceeding daily mined BTC supply by approximately eight times.

This trend is indicative of growing institutional and retail investor appetite for exposure to Bitcoin.

Interestingly, despite experiencing net outflows in previous months, Grayscale’s ETF GBTC managed to attract inflows in the past few days, signaling a potential turnaround in investor sentiment.

The influx of investment into Bitcoin ETFs is attributed to various factors, including positive market sentiment, evolving macroeconomic conditions, and increasing institutional interest.

Analysts suggest that recent market consolidation and support bounce near the $60,000 mark have sparked renewed interest among investors.

The surge in Bitcoin ETF activity is accompanied by a bullish momentum in the broader digital asset market.

Bitcoin’s price rallied to $70,000 amidst a flurry of spot buying and ETF purchasing, signaling a potential run-up to $100,000. Analysts believe that bitcoin’s performance reflects investors’ anticipation of US monetary expansion and rising inflationary pressures.

Considering bitcoin’s impressive 51% gain so far this year alongside US monetary policy, the surge in available money supply suggests potential inflationary tendencies despite cautious spending by both businesses and individuals.

The Head of Research at the CoinShares, James Butterfill, penned a blog post on Monday, stating:

“The inflows were an immediate response to the lower-than-expected CPI report on Wednesday, with the latter three trading days of the week making up 89% of the total flows.”

Butterfill highlighted that the most significant bitcoin allocations are coming from hedge funds and private equity, with some notable investments from large pension funds, indicating a growing interest beyond niche markets.

Matt Hougan from Bitwise expressed optimism for Bitcoin ETFs, noting that although firms like Hightower Advisors have a small percentage of their assets in Bitcoin ETFs, the current low average portfolio size suggests potential for increased investment as confidence in the market grows.

Despite the positive trend in Bitcoin ETF inflows, challenges remain, including market volatility, regulatory hurdles, and macroeconomic factors. However, the overall trajectory looks promising, with growing institutional interest and anticipation of more favorable regulatory decisions.

Boosting optimism, CryptoQuant data reveals a dramatic drop in BTC reserves on exchanges to a seven-year low. Only 1,918,417 BTC are available on major platforms as of May 19, down substantially from last year.